Bull Market Verdict: Is Bitcoin Truly Back?

After Bitcoin took a tumble from over $100,000 down to below $80,000 in a few weeks of sharp selling, everyone’s asking the same question as prices bounce back: Is the Bitcoin bull market really back in action, or are we just seeing a temporary breather before things potentially head even higher?

Bitcoin’s Local Bottom or Bull Market Pause?

Bitcoin’s recent dip definitely shook things up a bit, but it wasn’t so deep that it broke the bigger picture uptrend. It looks like the price found a comfortable spot to settle around $76K–$77K. Now, some pretty reliable indicators are starting to confirm that this could be a low point and that we might be heading upwards again.

Think of the Net Unrealized Profit and Loss (NUPL) as a mood ring for the Bitcoin market. When prices dropped, the NUPL dipped into “Anxiety” mode. But with the recent price recovery, it’s climbed back into the “Belief” zone. This is a crucial shift in sentiment that we’ve often seen when Bitcoin makes higher lows in the bigger picture.

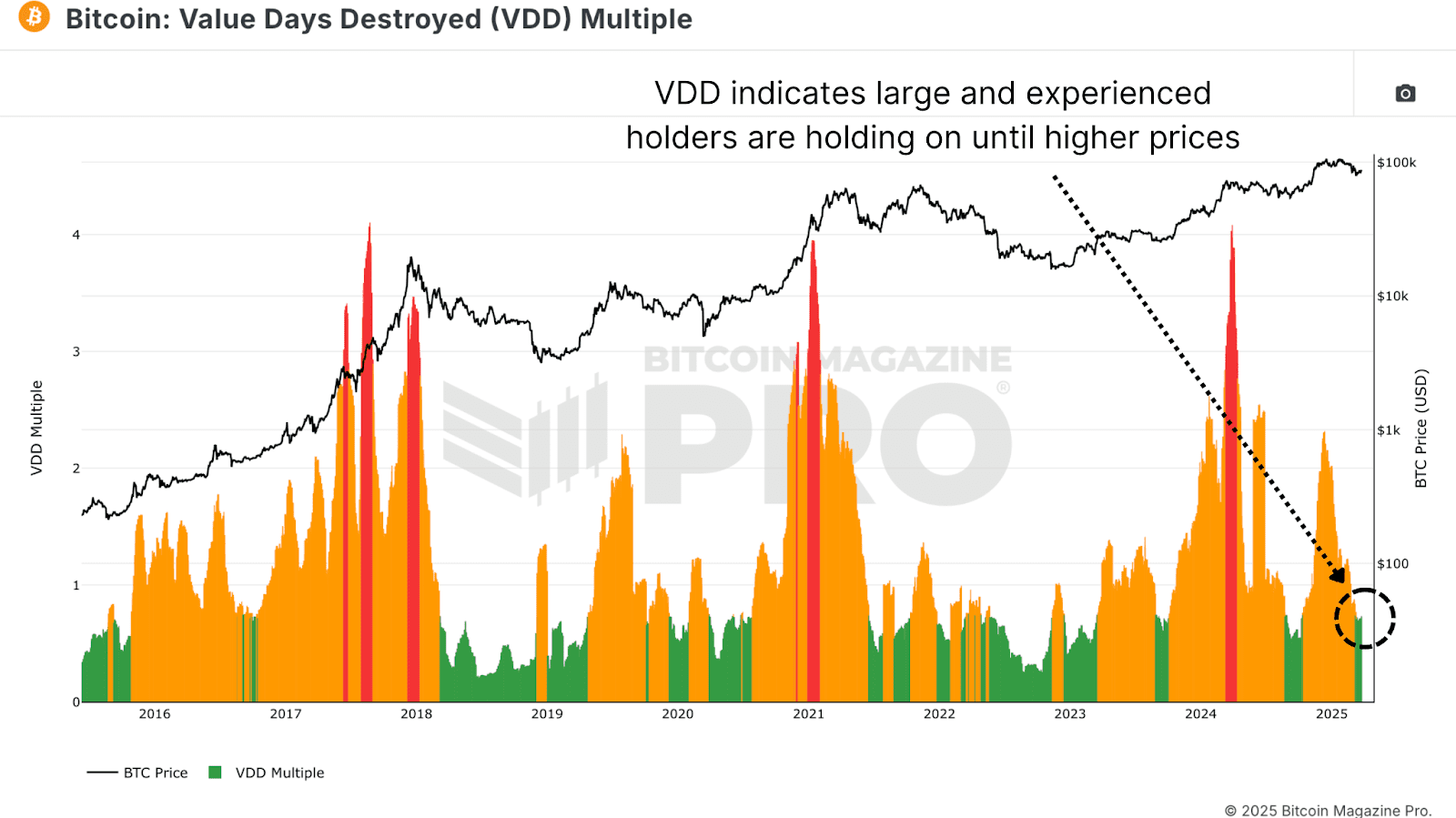

The Value Days Destroyed (VDD) Multiple is like peeking into the minds of long-term Bitcoin holders. It looks at how old and how large the coins being spent are, comparing it to the usual yearly activity. Right now, the VDD Multiple is low, which tells us that big, old Bitcoin wallets aren’t moving their coins much. This is often seen as a sign of strong belief from the “smart money” crowd. We saw similar things happen before those big price jumps in the 2016/17 and 2020/21 bull runs.

Bitcoin Long-Term Holders Boost Bull Market

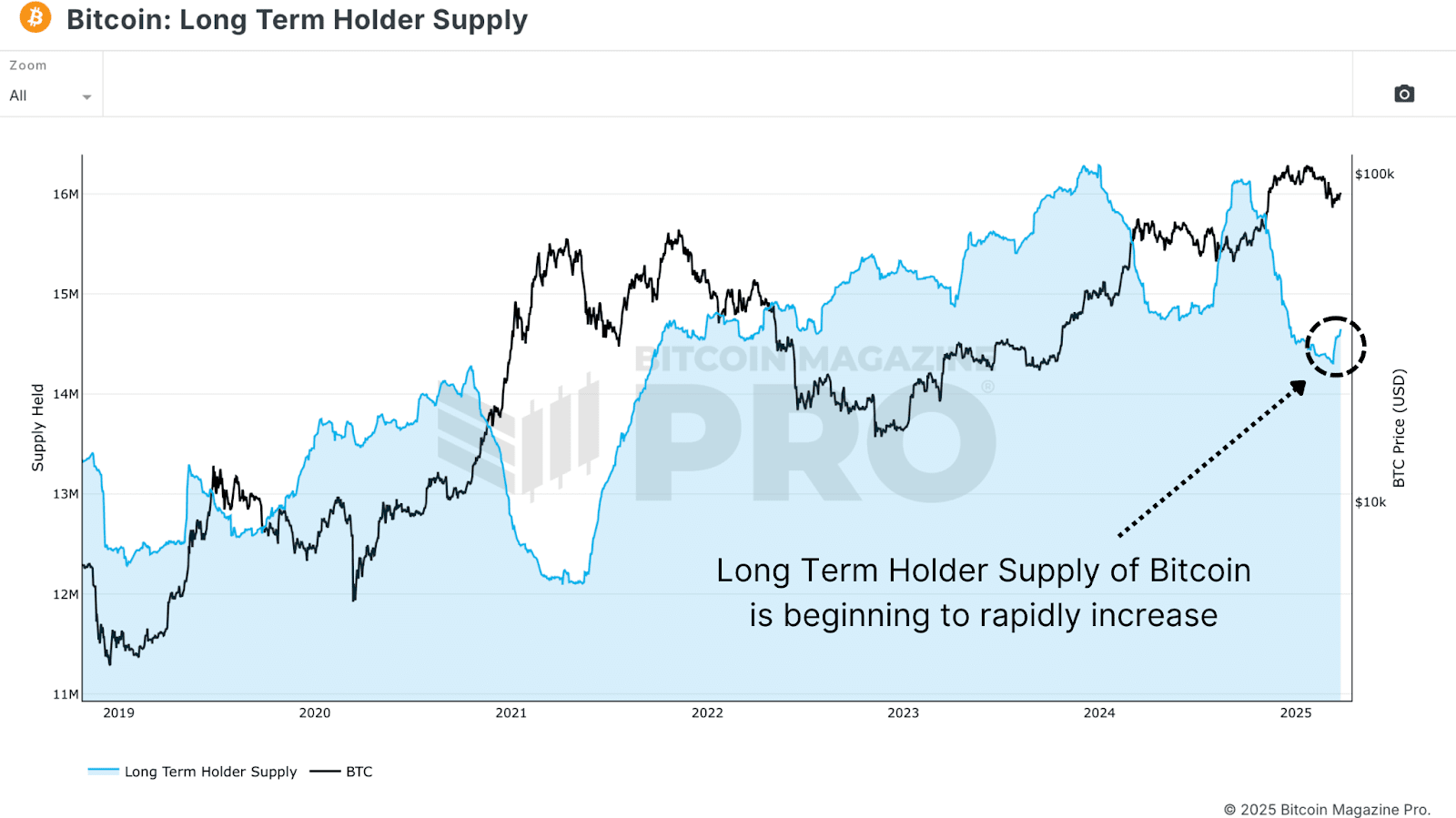

And there’s more good news! We’re also noticing that the amount of Bitcoin held by Long Term Holders is starting to increase again. After some folks took profits when Bitcoin was above $100K, these long-term believers are now buying back in at lower prices. Historically, these periods of accumulation have been key in creating supply shortages and setting the stage for those exciting, skyrocket-style price increases.

Bitcoin Hash Ribbons Signal Bull Market Cross

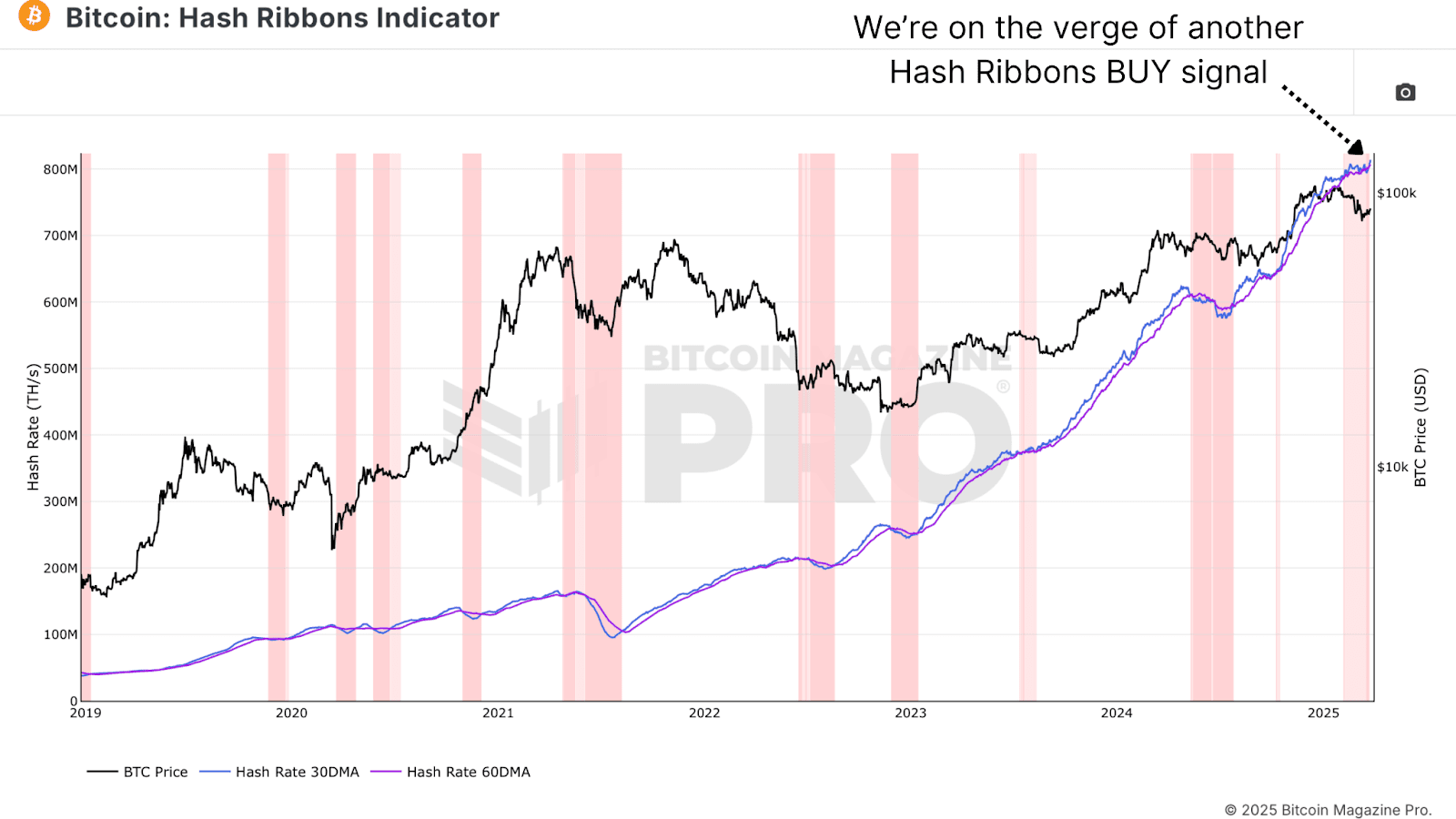

The Hash Ribbons Indicator just flashed a bullish sign! It’s called a bullish crossover, and it happens when the short-term trend of Bitcoin’s mining power (hash rate) climbs above the longer-term trend. In the past, this has often been a reliable signal that we’ve found a bottom and the trend is changing direction. Since miners tend to act based on how profitable they think Bitcoin will be, this crossover suggests they’re feeling confident about higher prices coming.

Bitcoin Bull Market Tied to Stocks

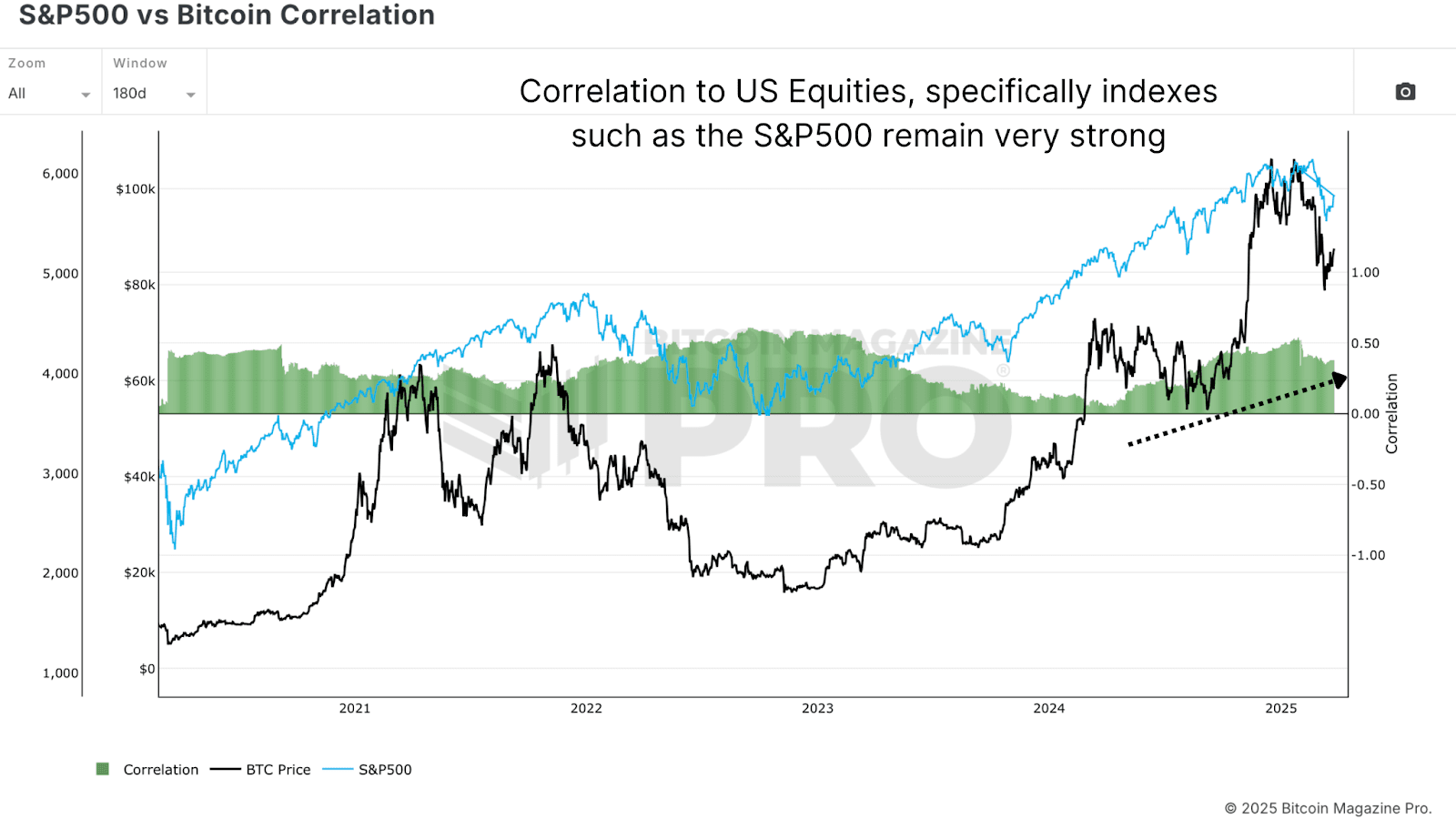

Even with all this positive on-chain data, it’s important to remember that Bitcoin’s price still has a strong connection to the broader financial world, especially the stock market, and specifically the S&P 500. As long as this link is strong, Bitcoin’s fate will be partly tied to things like global money policies, how people are generally feeling about risk, and where money is flowing. Hopes for interest rate cuts have helped boost risky assets recently, but any sudden change in that outlook could bring back some turbulence for Bitcoin.

Bitcoin Bull Market Outlook

Looking at the numbers and data, Bitcoin is increasingly looking like it’s in a good position to keep this bull run going for a while. On-chain data is really painting a convincing picture of Bitcoin’s bull market bouncing back strongly. The Net Unrealized Profit and Loss (NUPL) has swung from “Anxiety” during the recent price drop to “Belief” after the rebound—a kind of shift that we often see when Bitcoin is making higher lows in its long-term cycles. Similarly, the Value Days Destroyed (VDD) Multiple has dropped back to levels that suggest strong conviction among long-term holders, which is similar to what we saw before Bitcoin’s big rallies in 2016/17 and 2020/21. These indicators are pointing to real underlying strength, especially with long-term holders grabbing up more Bitcoin while the price was below $80,000.

Adding to this positive outlook, the Hash Ribbons indicator‘s recent bullish crossover shows that Bitcoin miners are increasingly confident in Bitcoin’s profitability, which has historically been a reliable sign of trend changes. This phase of people accumulating Bitcoin suggests that the bull market might be getting ready for a supply squeeze – a situation that has fueled those massive, parabolic price surges in the past. Overall, the data highlights strength and resilience, not weakness, with long-term holders seeing the dip as a buying opportunity. However, this strength is just one part of the story – what happens next will also depend a lot on factors outside the Bitcoin market itself.

However, we still need to be a bit cautious because of the bigger economic picture. The Bitcoin bull market doesn’t exist in its own bubble. Bull markets usually take time to build momentum, needing consistent buying and favorable conditions to kick off the next big upward move. While that low point around $76K–$77K seems to be holding for now, the journey forward probably won’t be a straight shot up in a frenzy of excitement just yet. Bitcoin’s link to the S&P 500 and overall global money trends means we could see some ups and downs if there are shifts in central bank policies or changes in how people feel about risk.

For example, while hopes for interest rate cuts have given a boost to risky assets, a sudden change in that expectation—maybe because of unexpected inflation or global events—could challenge Bitcoin’s stability. So, even though on-chain data is showing a strong setup, the next stage of the Bitcoin bull market will likely unfold at a more measured pace. Traders hoping for a quick return to those six-figure prices will need to be patient as the market builds a solid base.

If you’re looking for more detailed analysis and up-to-the-minute data, you might want to check out Bitcoin Magazine Pro for some really useful insights into the Bitcoin market.

Disclaimer: This article is just for informational purposes and shouldn’t be taken as financial advice. Always do your own homework before making any decisions about investing.