Cardano: Decoding today’s ADA price rise

Cardano

is currently flexing its muscles, showcasing a robust recovery as it bounced up 30% from a low of $0.7570 on March 4th. This impressive surge propelled ADA to an intraday peak of $0.9792, all in anticipation of this week’s groundbreaking White House Crypto Summit.

This leading altcoin, consistently ranked among the top ten, has climbed another 13% in the last 24 hours and is currently trading at $0.9384 as you read this.

ADA/USD daily chart. Source: Cointelegraph/TradingView

So, what’s fueling this rally? Let’s take a closer look at the primary factors propelling Cardano’s price upwards today.

Anticipation Builds for the White House Crypto Summit

The crypto world is buzzing with excitement for the inaugural White House Crypto Summit, scheduled for March 7, 2025, and Cardano is definitely feeling the positive vibes.

Here’s what you need to know about this pivotal event:

-

Set for March 7th, the summit, hosted by US President Donald Trump, marks a first-of-its-kind event focused on cryptocurrency.

-

The summit’s main goal is to gather industry leaders and key policymakers to discuss the future of crypto regulation, stablecoin oversight, and how digital currencies could fit into the U.S. financial system.

-

Expect to see industry heavyweights in attendance, potentially including Cardano’s own founder, Charles Hoskinson, along with prominent members from the President’s Working Group on Digital Assets.

-

Oversight of the summit will be led by Sacks, with Bo Hines, the executive director of the Working Group, managing the event.

-

Adding fuel to the fire, Trump recently announced the creation of a US Strategic Crypto Reserve, and Cardano was specifically name-dropped alongside crypto giants like Bitcoin

, Ether

, XRP , and Solana.

-

Naturally, this sparked speculation about a potential shift towards crypto-friendly regulations, with many hoping the summit will offer clarity on the administration’s digital asset strategy.

-

The fact that ADA is in the mix for this proposed reserve is a major confidence booster for investors.

-

It’s a common market trend: anticipation of positive policy changes often fuels price rallies. Today’s price surge likely reflects traders positioning themselves ahead of potential announcements that could solidify Cardano’s role in a national blockchain strategy.

-

Even though details about the summit are still emerging, the promise of clearer regulatory guidelines is a powerful catalyst driving ADA’s current momentum.

Cardano TVL Jumps 52% as DeFi Scene Heats Up

It’s not *just* summit hype driving ADA. The Cardano network’s DeFi scene is also heating up, which is another key factor boosting investor sentiment.

-

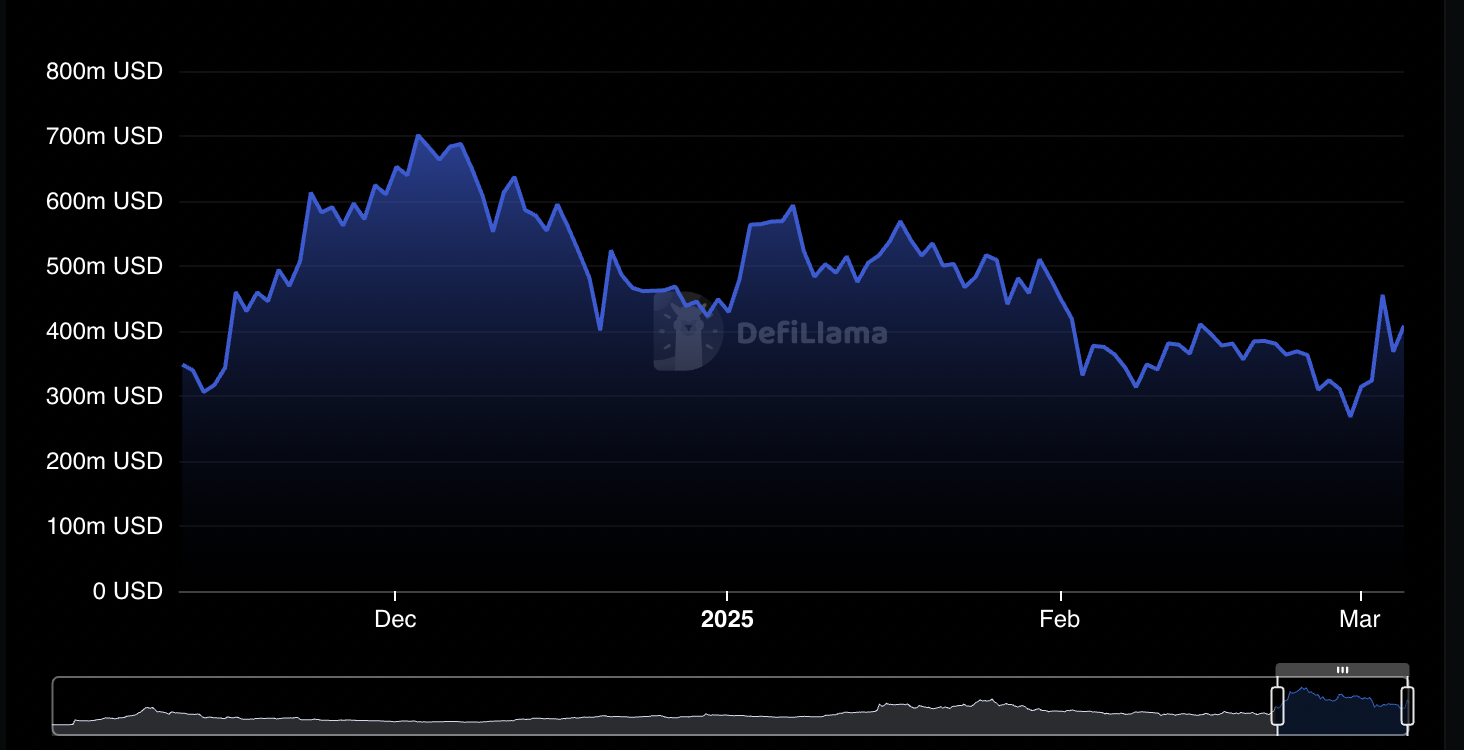

Cardano’s Total Value Locked (TVL) has jumped from $268 million to $408 million in a mere six days, marking a whopping 52% weekly increase!

Cardano’s TVL chart. Source: DefiLlama

-

Leading the charge in this TVL surge are protocols like Indigo (synthetics), Liqwidi (Lending), and MinSwap (DEX), each posting impressive gains of 32%, 30%, and 29% respectively in locked value over the past week.

Related: Traders longing ADA futures spike after Trump’s crypto reserve reveal: Bitrue

-

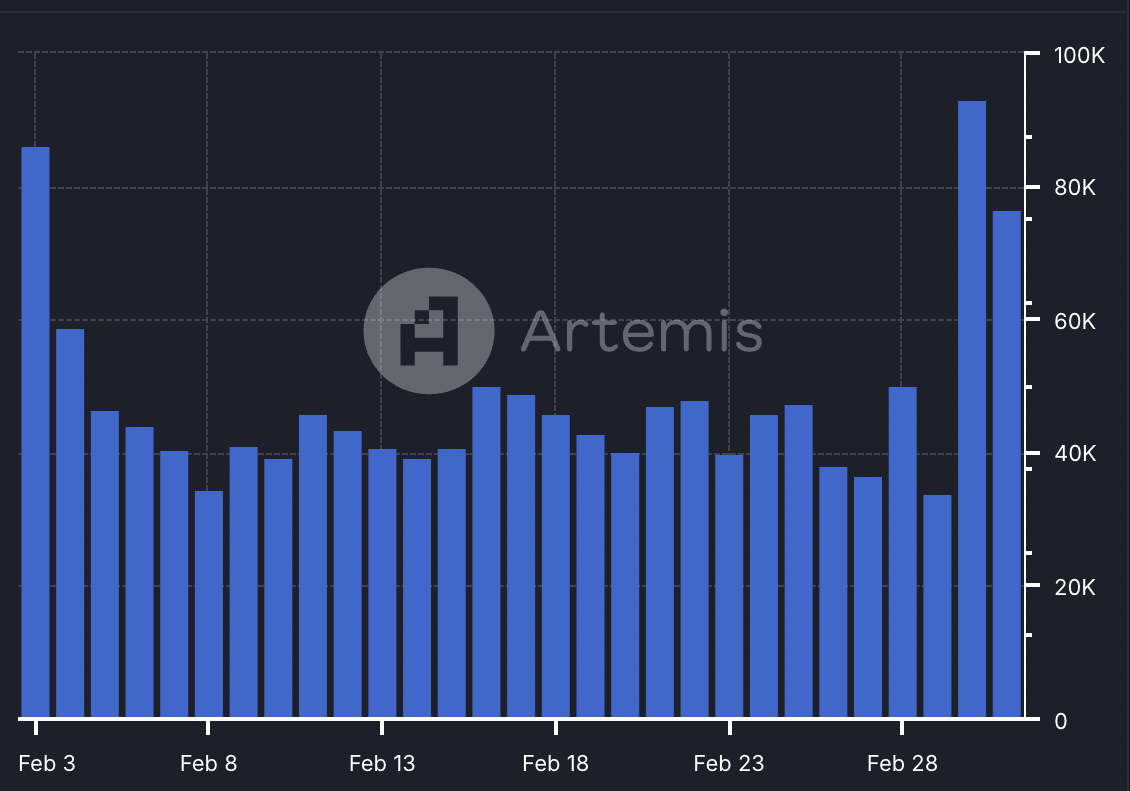

And it’s not just TVL – Cardano is buzzing with on-chain activity too! Daily transactions have been climbing since March 1st, according to data from Artemis.

Cardano: Number of daily transactions. Source: Artemis

-

Adding another layer of bullishness, Open Interest (OI) in Cardano has surged by $325 million in the same period, reaching $874.4 million by March 5th.

-

Interestingly, the funding rate is still negative. This suggests that many traders are still betting *against* ADA, anticipating a price drop.

-

Here’s where it gets interesting: if this bullish energy keeps building, we could see a short squeeze! Bears might get forced to close their positions, potentially sending ADA even higher.

Bull Flag Pattern Reinforces ADA’s Upward Trajectory

Beyond the fundamentals, technical analysis is also giving bullish signals for Cardano. ADA officially confirmed a bull flag pattern on March 2nd when it broke through the upper trendline around $0.80 on the weekly chart.

Here’s the technical breakdown:

-

ADA is currently bumping up against resistance around the $1.20 psychological level, as you can see in the chart below.

-

If we see a surge in trading volume and a break above $1.20, this bull flag pattern suggests a potential rocket shot all the way up to $3.20!

-

That’s a potential 238% gain from where we are right now!

ADA/USD weekly chart. Source: Cointelegraph/TradingView

-

The Relative Strength Index (RSI) is also backing up this bullish outlook. It’s currently above the midpoint and trending upwards, climbing from 47 to 58 in the past month alone, signaling strengthening bullish momentum.

-

An RSI reading of 58 suggests there’s still plenty of room to climb before hitting overbought territory, indicating further upside potential.

-

However, it’s not all sunshine and rainbows. A weekly candlestick close below the bull flag’s upper boundary at $0.80 would throw a wrench in the bullish scenario.

-

In that case, ADA might just keep ranging within the flag pattern for a while longer, consolidating before its next major move.

Adding further color to the bullish picture, crypto analyst Kwantxbt noted the ADA price is “showing strong recovery at $0.95, up 21.87%,” in a March 5 post on X, adding:

“Volume surge and tight consolidation suggest the potential for a run up into the $1.05-1.10 range. Support at $0.92.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.