Chainlink Recovery Hinges on $13 Support – Analyst Optimistic

Reason to trust

We have a strict editorial policy focused on being accurate, relevant, and unbiased.

Our content is created by industry experts and thoroughly reviewed by our team.

We adhere to the highest standards in both reporting and publishing.

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

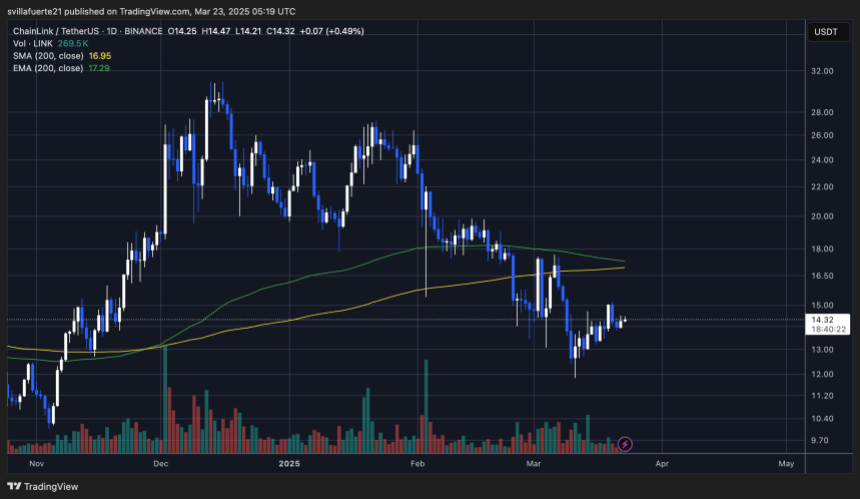

Chainlink (LINK) is looking stronger lately, trading 27% up from its low on March 11, and it looks like it could potentially bounce back if the wider market improves. Even with the recent ups and downs and the ongoing uncertainty in the economy, LINK has managed to stay steadier than many other altcoins, giving a bit of hope to investors who are thinking the worst might be behind us. Some analysts are still playing it safe, warning that prices could still go lower, but others see this period of holding steady as a good reset before the next potential climb.

Related Reading

Top analyst Ali Martinez shared some thoughts on X, pointing out that Chainlink is currently testing a key support level around $13, which lines up with the bottom of a long-term price channel. Martinez suggests that if LINK can hold this level, history shows us that a solid rebound could be coming.

With market opinions still divided, all eyes are on whether LINK can maintain this support. If it can hold strong, Chainlink could be one of the leading altcoins in the next market rally. For now, traders are keeping a close watch, waiting to see if this price action signals the start of a new uptrend.

Chainlink Holds Strong Support as Buyers Aim for a Breakout

After losing the important $17–$18 support area, buyers have been struggling to regain control. Chainlink is trading at a critical point as it tries to get back to higher prices amidst ongoing market uncertainty and volatility. LINK has dropped over 61% since hitting its mid-December peak of around $30, mirroring the overall bearish feeling in the market driven by economic instability and investors playing it safe.

However, there’s growing optimism that LINK might be gearing up for a recovery. Martinez’s insights highlight that Chainlink is now sitting on a key support level at $13, which marks the lower boundary of a well-established trading channel.

Martinez suggests that holding onto this zone could set the stage for a significant rally. If LINK confirms it can stay above $13, past price movements indicate that a move towards the mid-range target of $25 is likely, and possibly even up to $50 if the buying momentum really takes off.

Related Reading

The next few days are going to be crucial as buyers need to defend the $13 level to prevent further drops. A bounce back from this level could bring back investor interest and speed up momentum, potentially making Chainlink a leader in a broader market recovery for altcoins. For now, everyone’s watching to see if LINK can hold the line and get its bullish trend going again.

LINK Price Fights Key Resistance

Chainlink is currently trading at $14.30, just under a crucial resistance area that will likely decide its direction in the short term. The $15 level has become a key battleground for buyers and sellers. If LINK can break through this resistance with force, analysts are expecting a quick move towards the $17 region—another important level that previously acted as strong support before the recent downturn.

Recent price activity shows that buyers are starting to get some momentum back, especially after the bounce from the $13 zone. However, the market is still sensitive due to wider economic uncertainties and a cautious mood among investors. If there’s a confirmed break above $15, it would likely draw in more buying interest, setting the stage for a short-term price increase.

On the other hand, if LINK can’t reclaim $15 and gets pushed back at this resistance, it could slide back down to lower support levels. A drop below $13 would weaken the bullish outlook and open the door for further declines, with the $12 mark being a possible next support area.

Related Reading

The next few trading sessions will be critical for LINK. Traders are watching closely to see if buyers can build enough momentum to break out—or if sellers regain control and push the price lower.

Image from Dall-E, charts via TradingView