Crypto: Ethereum Price Bear Market Extends, Expert Predicts Duration

Why You Can Trust Our News

We adhere to a strict editorial policy focused on delivering news that is accurate, relevant, and unbiased.

Our content is created by seasoned industry professionals and undergoes thorough review for quality and accuracy.

We are committed to upholding the highest standards in both our reporting and publishing practices.

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

Ethereum’s price hasn’t managed to climb back above $2,000 over the last week, and it seems likely to stay around this level for at least the next few days, with no strong signs of a rebound just yet. The second-biggest crypto by market value has been facing selling pressure since early March, as sellers have been in control of the broader crypto market.

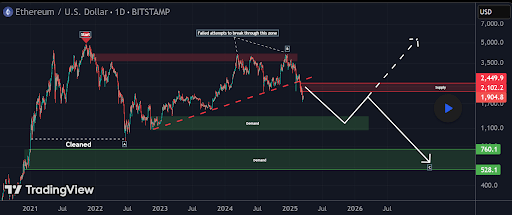

Interestingly, recent technical analysis using Elliott Wave theory suggests that this bearish trend for Ethereum could continue for a while. According to an analysis posted on TradingView, an ABC correction pattern has formed, and this could determine Ethereum’s next big price swing.

Ethereum’s Price Structure Suggests Further Correction

According to behdark, a crypto analyst on TradingView, several factors point towards an ongoing correction for Ethereum, including recent price pivots, shifts in momentum, and wave degrees. This intriguing prediction is based on behdark’s Elliott Wave count, which indicates Ethereum is currently forming an ABC correction pattern.

Related Reading

This ABC correction pattern has been developing since November 2021, stretching across the past three and a half years. In Elliott Wave theory, the ABC correction is a three-wave pattern that signals a major correction. Wave A is the initial drop, wave B is a temporary rise or move against the trend, and wave C is the final push downwards, often going lower than wave A.

It appears that wave B, the pattern’s middle wave, might be complete or close to it now that Ethereum has fallen below a trendline around $2,500 in late February. This suggests that wave C is next, which is expected to extend the current downtrend. The analyst mentioned that wave C is likely to last a bit longer than wave A, indicating a potentially prolonged decline down to a significant demand area between $760 and $530.

Two Potential Bottom Zones for ETH

The analyst has identified two possible price levels where Ethereum might bottom out, calling them “Demand 1” and “Demand 2.” The first demand zone is located between $1,350 and $1,080. This is where Ethereum could find enough buyers to potentially halt the wave C decline.

Related Reading

However, if this first demand zone doesn’t hold, Ethereum’s price could drop even further before stabilizing. In that case, the next level of potential support lies between $760 and $530. A drop to this lower range would undoubtedly push market sentiment around Ethereum to a new low. However, it could also present a buying opportunity for bullish traders to accumulate, as this zone is expected to precede the start of the next five impulse waves upwards.

Going against this bearish outlook, the analyst also highlighted a point of invalidation at $2,941. If Ethereum can close a daily trading session above this price, the bearish scenario would no longer be valid.

Currently, Ethereum is trading around $1,930. Considering the current price trends, it seems unlikely that Ethereum will break above $2,941 anytime soon.

Featured image from Unsplash, chart from Tradingview.com