Crypto: EU Mandates 100% Asset Backing

- Crypto insurers might need to hold a full 100% capital reserve, as suggested by a European Union agency concerned about the high ups and downs of crypto.

- But, Circle is pushing back, asking the EU agency to think about a more flexible approach, since not all cryptocurrencies are risky in the same way.

Here’s the deal: The European Insurance and Occupational Pensions Authority, or EIOPA for short – that’s the EU’s insurance watchdog – is suggesting that insurance companies dealing with crypto should back those assets with capital reserves on a 1:1 basis.

Why? Well, according to EIOPA, it’s because crypto is super volatile, hence the need for a full 100% capital cushion. They even mentioned it in a statement, which you can see for yourself, saying:

“EIOPA believes that setting aside capital equal to 100% of the crypto asset value is the smart and sensible move given the risks involved and how wildly crypto prices can swing.”

Room for flexibility

The agency explained that this move is intended to plug a gap in the current crypto regulations (MiCA), which doesn’t cover crypto insurers.

They even pointed out that in the past, big names like Bitcoin [BTC] and Ethereum [ETH] have seen drops of 82% and 91%. That’s why they think using a 100% “stress test” – basically planning for the worst-case scenario where an asset loses all its value – is necessary.

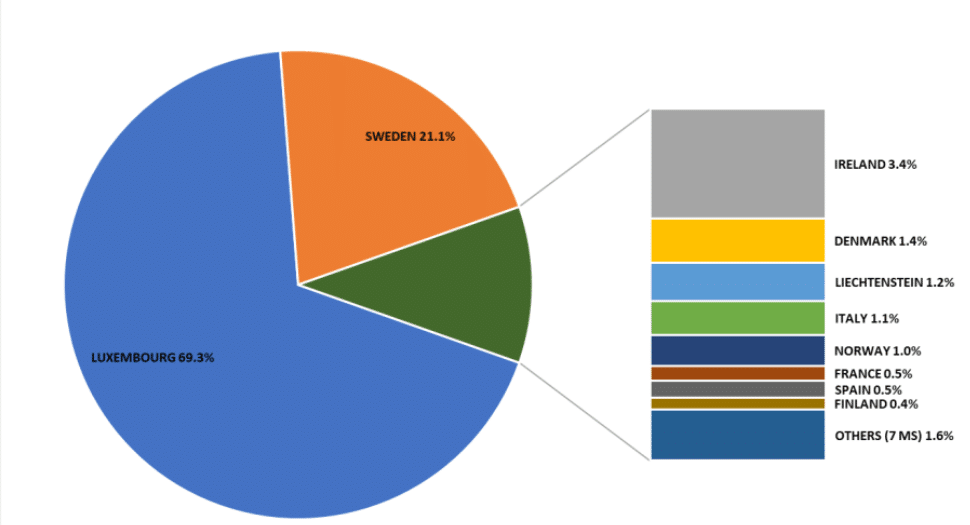

EIOPA also highlighted that Luxembourg and Sweden would feel this change the most if the European Commission gives it the thumbs up. These countries have a lot riding on crypto, with over 90% exposure, making them particularly vulnerable to these new rules.

Source: EIOPA

However, the agency also recognized that this one-size-fits-all 100% capital rule might not be the best long-term solution if crypto really takes off. They hinted that in a future where crypto is more mainstream,

“If more and more people start using crypto, we might need to think about a more tailored approach later on.”

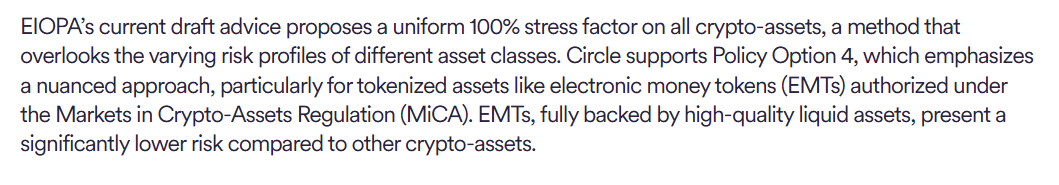

In response, Circle, the company behind the stablecoin, pushed back against this idea. They argued that it’s unfair to treat all cryptos the same, as some are riskier than others, and shouldn’t all be lumped under this 100% rule. Instead, Circle suggested a ‘nuanced approach’ to figuring out capital backing.

Source: Circle