Crypto: EU Watchdog Demands 100% Coverage for Insurer Holdings

Imagine a new rule for insurance companies in Europe: if they hold any cryptocurrency, they’d have to keep aside the exact same amount in cash as a safety net. That’s essentially what the European Union’s insurance authority is suggesting, aiming to protect policyholders from potential crypto-related risks.

This proposal is hot off the press, released by the European Insurance and Occupational Pensions Authority (EIOPA) in a report to the European Commission on March 27th. Get this – it’s way stricter than what’s required for traditional assets like stocks and real estate. Those guys don’t even need to be backed up at half the rate!

“For crypto, EIOPA thinks a ‘100% haircut’ in the standard rules makes sense – it’s the cautious and right approach given the built-in risks and how wildly crypto values can jump around,” they explained in a separate announcement, using industry jargon for setting aside the full value as capital.

Why this heavy-handed approach? EIOPA says it’s about closing a regulatory loophole. Currently, EU rules for insurers don’t specifically address crypto, so this measure would bridge the gap between standard capital requirements and the newer crypto regulations (MiCA for those in the know).

You might recall Circle arguing back in January that a blanket 100% stress on crypto assets wasn’t fair to lower-risk stablecoins. Source: Circle

Now, EIOPA laid out four options for the European Commission to think about. Option one? Do nothing. Options two and three? Mandate an 80% or a 100% “stress level” for crypto assets, respectively. Think of “stress level” as the percentage of capital they need to hold.

Essentially, these stress levels dictate how much backup cash firms must have to stay afloat.

The fourth option was a bit broader, asking the Commission to consider the risks of digital assets that are tokenized – think of representing real-world assets on a blockchain.

But EIOPA made their preference clear: option three, the 100% stress level, is the way to go.

They reasoned that “an 80% stress level for crypto just doesn’t seem careful enough,” while “100% is more appropriate and lines up with how crypto is being handled temporarily under other regulations.”

This “100% stress” is based on the idea that crypto prices could, in theory, drop to zero, and spreading investments around (diversification) wouldn’t necessarily cushion the blow. EIOPA even pointed out that Bitcoin (BTC) and Ether (ETH) have seen massive drops of 82% and 91% in the past, respectively, to illustrate the point.

To put it in perspective, this 100% capital charge is a world away from stocks (39% to 49% capital charge) and real estate (just 25%), according to existing EU rules on solvency.

EIOPA believes a 100% capital charge for insurers dealing with crypto shouldn’t be “too much of a burden” and wouldn’t really cost policyholders anything extra.

“These capital rules would fully capture the potential risk of crypto-assets, which is good news for protecting policyholders if crypto becomes a bigger part of insurance holdings in the future.”

Zoom Out: Speaking of insurance and crypto, Tabit is offering USD policies backed by Bitcoin regulatory capital

Interestingly, EIOPA admitted that currently, crypto assets held by insurers are relatively small – only around 655 million euros, or a tiny 0.0068% of all assets in Europe. They even called it “insignificant.”

“But,” EIOPA stressed, “crypto assets are still high-risk investments that could completely lose their value.” That’s why they’re pushing for option three – better safe than sorry.

Luxembourg and Sweden Could Feel the Pinch Most From the Proposed Rule

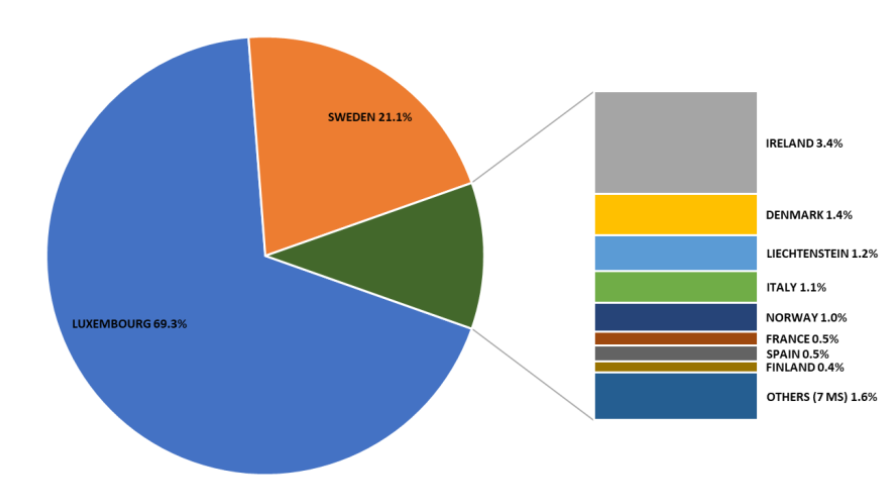

It seems insurers in Luxembourg and Sweden might be most impacted by this potential rule. According to a report from Q4 2023 cited by EIOPA, these two countries account for a whopping 69% and 21% of all crypto-related holdings among European insurers.

Ireland, Denmark, and Liechtenstein also have some exposure, but much smaller, at 3.4%, 1.4%, and 1.2% respectively.

EIOPA pointed out that many of these crypto holdings are tucked away in funds, like exchange-traded funds, and are held for policyholders who have unit-linked policies – investment-based insurance products.

Where’s the crypto? Breakdown of crypto-asset exposure across European countries in Q4 2023. Source: EIOPA

However, EIOPA did acknowledge that if crypto becomes more mainstream in the future, they might need to think about a more “nuanced approach” to these capital rules.

Dive Deeper: Ever wondered why crypto folks are so into living longer and biohacking? Here’s the scoop