Crypto Outflows Surge: $2.9B ETP Exit, Bitcoin Hardest Hit

Cryptocurrency investment products known as exchange-traded products (ETPs) just went through a really rough week, seeing a record-breaking $2.9 billion pulled out by investors – the largest weekly sell-off ever recorded.

This marks the third week in a row of investors pulling money out, and it’s added up to a staggering $3.8 billion leaving global crypto ETPs, according to a report from CoinShares, a European crypto investment firm, on March 3rd.

James Butterfill, head of research at CoinShares, pointed to a few things that likely triggered this “bloodbath” for crypto ETPs. He mentioned the hefty $1.5 billion hack of Bybit, tougher talk from the U.S. Federal Reserve about monetary policy, and the fact that this sell-off followed a long 19-week run where $29 billion had flowed into these products.

Butterfill explained that these combined factors probably led to investors taking profits off the table, while also making the overall feeling around crypto investments less enthusiastic.

Weekly crypto ETP flows since late 2024. Source: CoinShares

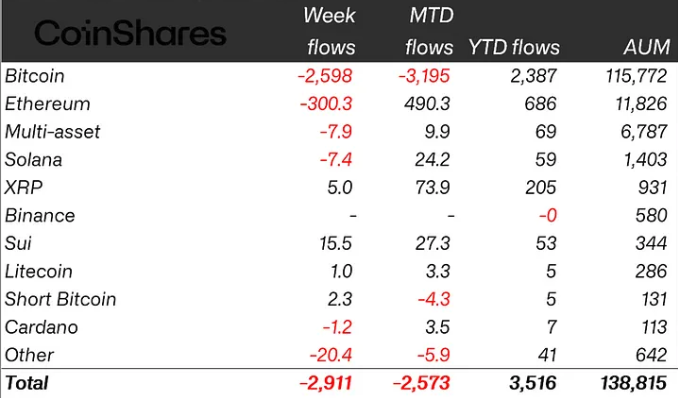

Bitcoin bleeds the most, while Sui is the biggest winner

Bitcoin

, being the biggest crypto asset in these ETPs, took the biggest hit from this negative mood. A massive $2.6 billion flowed out of Bitcoin ETPs alone last week, according to Butterfill’s report. Looking at the month so far (month-to-date or MTD), Bitcoin outflows are down $3.2 billion. Interestingly, ETPs that bet against Bitcoin (short Bitcoin ETPs) saw a tiny influx of $2.3 million.

However, it wasn’t all bad news. Sui

ETPs actually performed the best last week, attracting $15.5 million in new investments. ETPs linked to XRP also saw positive flows, bringing in $5 million.

Flows by asset (in millions of US dollars). Source: CoinShares

Ether

, the second biggest cryptocurrency by market value, also felt the pressure, with $300 million flowing out of its ETPs last week. However, if you look at the month as a whole, Ether ETPs are still in positive territory with $490.3 million in inflows so far this month.

Related: BlackRock Bitcoin fund sheds $420M as ETF losing streak hits day 7

As a result of this latest wave of selling, the total value of assets managed in crypto ETPs (known as Assets Under Management or AUM) has fallen to $138.8 billion. This is down from the record high of $173 billion reached back in January.

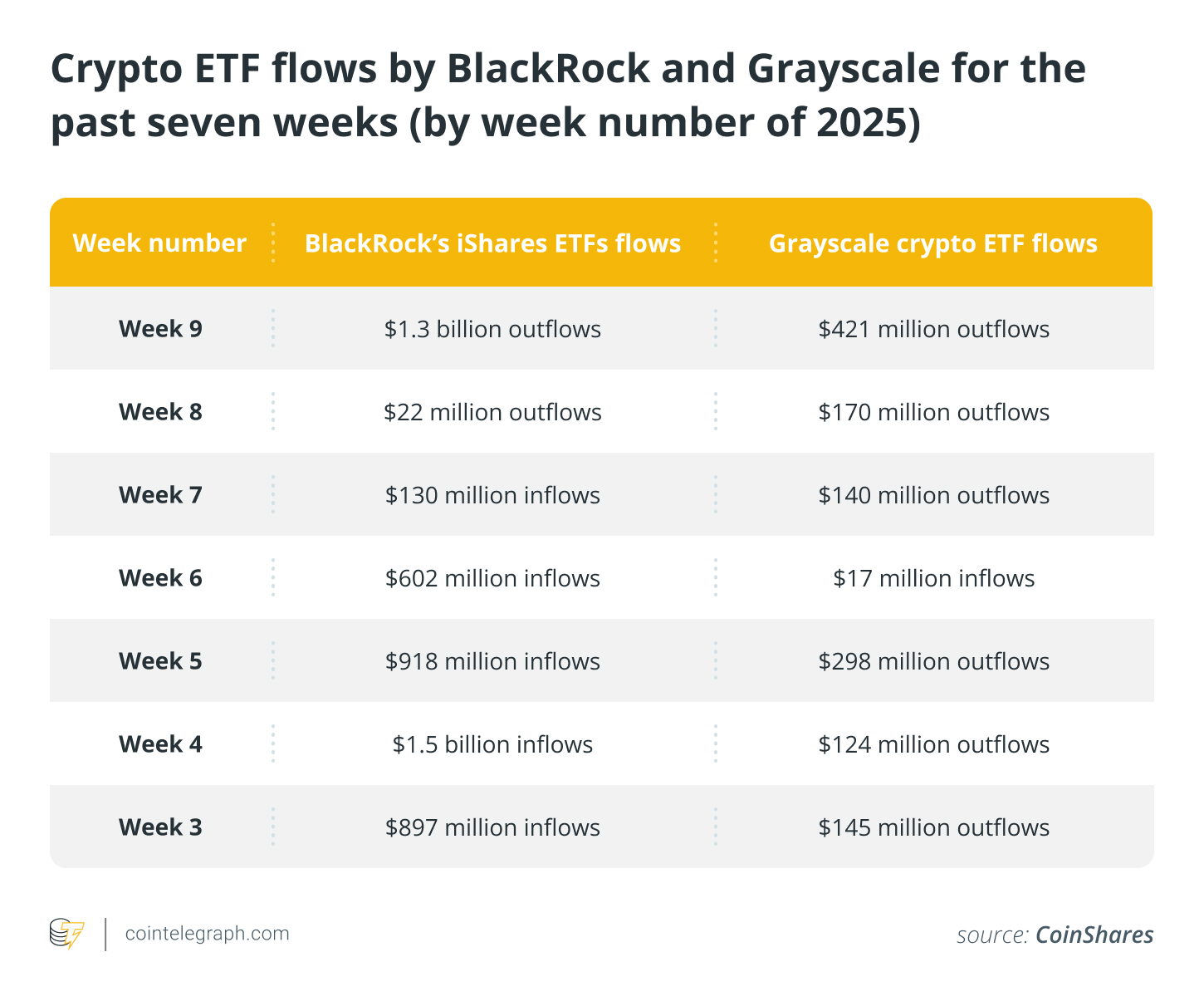

BlackRock’s iShares ETFs see largest outflows at $1.3 billion

Looking at specific ETF providers, BlackRock’s iShares ETFs experienced their biggest weekly outflow ever, with a substantial $1.3 billion leaving these funds. This came right after a smaller $22 million outflow the week before, which was their first negative week in 2025.

While this sell-off is the first significant instance of investors pulling funds from BlackRock’s iShares ETFs, it’s worth noting that these ETFs are still up for the year, with a net inflow of $3.2 billion since the start of 2025 and a total of $51 billion in assets being managed.

Grayscale Investments’ ETFs also saw investors heading for the exits, but at a lower level of $421 million last week. However, in contrast to BlackRock’s iShares ETFs, Grayscale’s crypto ETFs haven’t really seen much new money coming in during 2025. In fact, they’ve experienced net outflows of $1 billion year-to-date, according to CoinShares.

On a brighter note, ProShares ETFs stood out as the only ETF provider that didn’t see outflows last week. They actually attracted $76 million in new investments. ProShares is now the second-largest ETF issuer, after BlackRock, and has seen $349 million in inflows since the beginning of the year.

Magazine: SCB tips $500K BTC, SEC delays Ether ETF options, and more: Hodler’s Digest, Feb. 23 – March 1