Crypto Profits: Trader Nets $6.8M from BTC, ETH Before Trump Post

Get this: a crypto whale, someone with serious digital asset pockets, made a bold move—placing hundreds of 50x leverage long position bets on Bitcoin and Ether. This happened just before former US President Donald Trump’s announcement regarding a Crypto Strategic Reserve, and guess what? It paid off big time, netting them nearly $7 million in profit from these trades.

Imagine dropping $5.9 million in USD Coin. That’s exactly what this whale did on March 1st, depositing it on Hyperliquid, a decentralized derivatives exchange. According to HyperDash, a crypto analytics platform, this deposit was to establish those hefty long positions.

The whale initiated their first long position in Ether

on March 2nd at 2:49 pm UTC. Then, just 35 minutes later, boom! Trump drops the Crypto Strategic Reserve announcement. Market prices? They practically exploded almost instantly.

Around $4 million of that initial deposit was leveraged 50x, ballooning into positions worth a staggering $200 million. The whale, operating from Ethereum wallet address ”0xe4d…02c62”, started closing out their Ether positions a mere 16 minutes after Trump’s announcement. This timing has raised eyebrows, with some wondering if insider trading might be at play.

The whale wasted no time closing several Ether long positions after Trump’s announcement. Source: HyperDash

Interestingly, the whale’s Bitcoin

long positions were actually initiated earlier, on March 1st at 10:44 pm UTC, when Bitcoin was hovering around $86,033. Many of these positions were then closed, with prices ranging from $87,512 to a high of $91,399.

Notably, some of these Bitcoin positions were exited *before* Trump even made his announcement.

As it stands now, HyperDash reports that the whale has closed out the majority of their positions, locking in profits exceeding $6.8 million. Quite the haul!

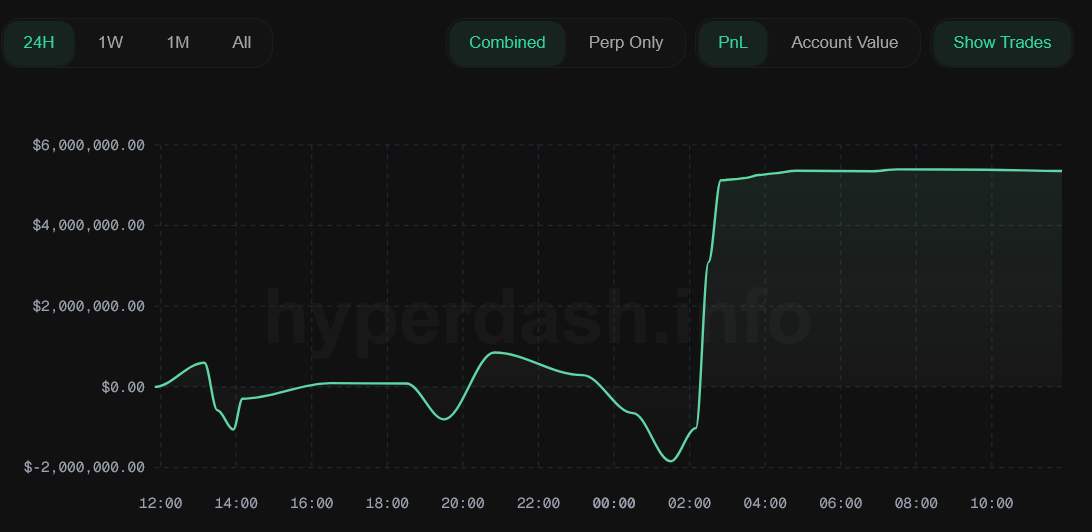

Profit and loss position overview for the crypto whale behind wallet address “0xe4d…02c62” over the last day. Source: HyperDash

However, it’s important to remember this detail: Trump’s initial post about the Crypto Strategic Reserve only mentioned XRP, Solana, and Cardano’s

inclusion.

It wasn’t until almost two hours later that Trump clarified Bitcoin and Ether would not just be included, but would form the “heart of the reserve.”

Between these two announcements, Bitcoin and Ether prices were indeed climbing, but not with the same explosive force seen in the initially mentioned tokens.

Insider trading? The speculation is rife.

Given the 50x leverage, a mere 2% dip in Bitcoin or Ether’s price could have triggered liquidation. This high-stakes situation has led industry experts and commentators to openly wonder whether insider information played a role.

Carl Runefelt, founder and host of The Moon Show, didn’t mince words, saying: “This $200 million long position on Bitcoin and Ethereum *before* the Bitcoin strategic reserve announcement… this could be the biggest INSIDER TRADE I’ve ever seen.”

“Smells illegal.”

One X user posited that if the trader *knew* about Trump’s announcement beforehand, they likely would have also taken long positions on the other tokens initially mentioned. Crypto researcher “FatMan” responded, adding nuance to the discussion:

“I don’t know if it was an insider or not, but it’s also possible for an insider to know the tweet is coming but not know the *exact contents* of the tweet.”

Related: Bitcoin price metric hits ‘optimal DCA’ zone not seen since BTC traded in $50K to $70K range

It’s worth noting that the Crypto Strategic Reserve announcement followed weeks of deliberation by the President’s newly established Working Group on Digital Assets. This group is spearheaded by executive director Bo Hines and David Sacks, the White House’s point person on AI and crypto.

Trump is scheduled to host the inaugural White House Crypto Summit on March 7th, inviting key industry figures to meet with Bo Hines and David Sacks. The agenda? Discussions around regulatory frameworks and stablecoin oversight, among other critical topics.

Magazine: Elon Musk’s plan to run government on blockchain faces uphill battle