Crypto Vote: Trump’s Plan Faces Congress, Rally Risk

Crypto Vote: Trump’s Plan Faces Congress, Rally Risk

Crypto markets experienced a significant surge after former US President Donald Trump hinted at establishing a strategic crypto reserve. However, experts have warned that this excitement might not last.

According to a Cointelegraph report, on March 2nd, Trump stated that his Working Group on Digital Assets was instructed to consider adding three altcoins – XRP , Solana and Cardano’s ADA – to the proposed US crypto reserve. In another post on Truth Social, he clarified that the reserve would “obviously” also include the leading cryptocurrencies, Bitcoin and Ether .

This announcement immediately sparked a broad market recovery. The total value of the cryptocurrency market jumped almost 7%, reaching $3.04 trillion. Bitcoin also saw a significant intraday rally of 7.7%, breaking through the $95,000 barrier that many traders were watching.

However, some experts suggest that the celebratory mood might be premature. Aurelie Barthere, a principal research analyst at blockchain analytics firm Nansen, pointed out that setting up a US crypto reserve is not a simple task and could take considerable time due to regulatory hurdles:

“I think constituting a reserve by buying new tokens is a complex process that will need Congress’s vote, so it will take time. I would be a bit wary of the sustainability of today’s move.”

Adding another layer to the market analysis, some experts believe we might be approaching a market bottom. Crypto intelligence platform IntoTheBlock noted that Bitcoin’s active addresses recently hit a near three-month high on February 28th. This could signal that the market is at a “crucial turning point,” potentially indicating a “capitulation moment” where selling pressure might exhaust.

Analysts Predict Short-Term Market Swings

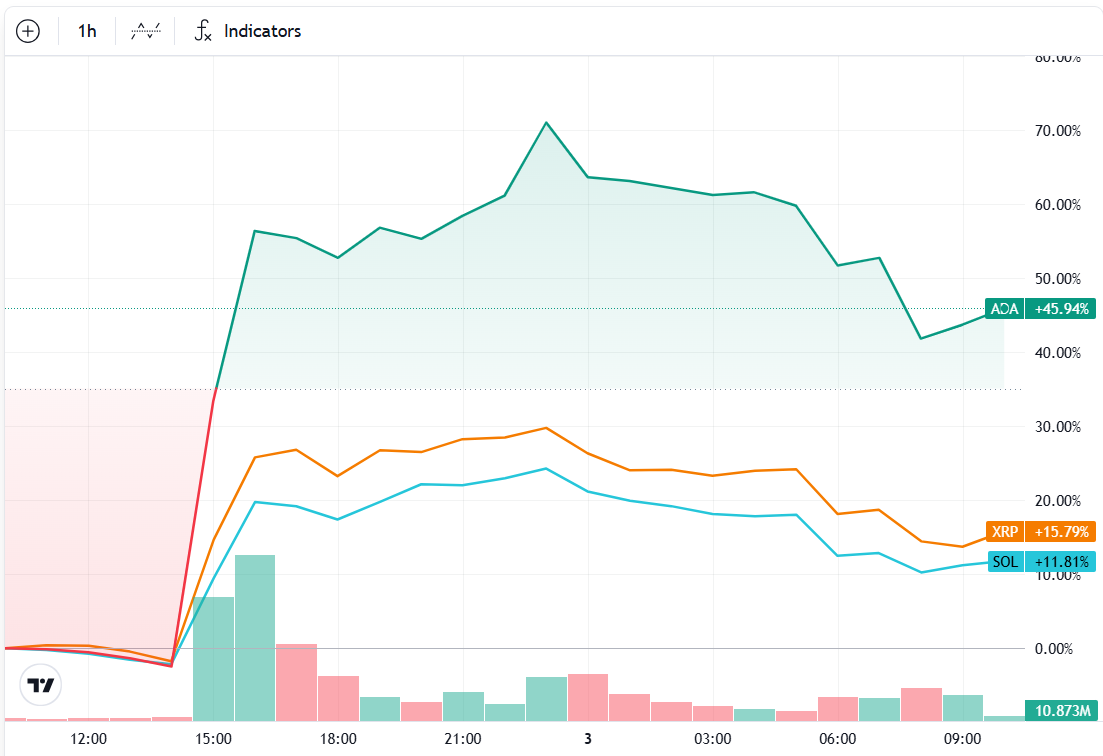

Following Trump’s announcement about considering them for the US strategic reserve, ADA, SOL, and XRP have outperformed the broader crypto market.

Despite the positive reaction, Nicolai Sondergaard, also a research analyst at Nansen, suggests that the crypto market’s potential for further gains might be limited. He also anticipates significant price fluctuations in the near future.

Speaking to Cointelegraph, Sondergaard elaborated:

“As Aurelie mentions it likely will not be that easy and I expect volatility in these tokens today especially (already seen in ADA nearly touching $1.17 and now sitting at $0.94).”

He further commented, “Regardless of whether these gains are sustainable, it’s a welcome boost for the market in the short term. However, the real question is whether these plans will actually materialize. If they don’t, it could become a negative development for the crypto space.”

Looking beyond immediate market reactions, crypto investors are also keeping an eye on other potential positive developments within the industry. One such event is the first White House Crypto Summit, scheduled to be hosted by Trump on March 7th.

Details about the Summit’s agenda are still scarce, but key topics like stablecoin regulation and laws concerning a strategic crypto reserve have been prominent in recent US regulatory discussions.