Cryptos and Africa: Strategic Beef Reserve.

At the 2025 World Economic Forum in Davos, the South African Reserve Bank (SARB) governor posed a question – “Why not a strategic beef reserve?” While seemingly rhetorical (or perhaps even a tad sarcastic, when followed by a mention of “strategic bitcoin reserves”), Lesetja Kganyago’s comment actually highlighted something important: Africa needs to really rethink its economic playbook as the global financial landscape shifts dramatically.

We’re living in a world being reshaped by digital transformation, and even the very idea of money and how we store value is changing fast. Africa, traditionally, has built its economies on commodities. Think oil, gold, beef, cocoa – the continent’s relied on these natural resources for a long time to keep things running. But here’s the thing: depending on commodities comes with a whole set of problems. Global commodity prices are incredibly sensitive – they bounce around because of market swings, global politics, and even climate change. Take beef, for example. Its price can jump or plummet because of things like disease outbreaks or sudden trade barriers. It’s not so different from how fiat currencies can be unpredictable when you compare them to digital assets like Bitcoin, thanks to regional money policies and currency losing value. The Food and Agriculture Organization (FAO) points out that beef prices have actually seen up to 30% volatility from year to year, thanks to things like foot-and-mouth disease and export bans.

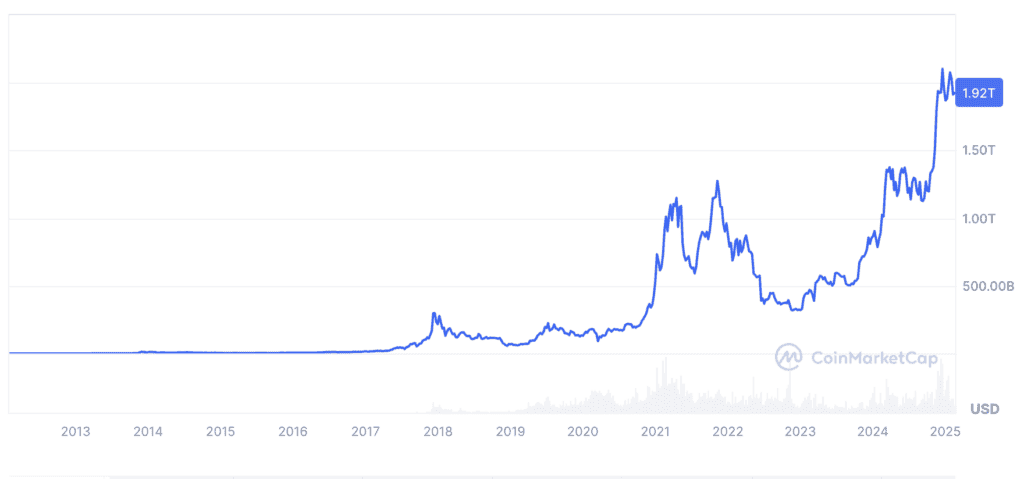

Image Source : CoinMarketCap

But Brian Armstrong, CEO of Coinbase, actually offered a really strong counter-argument to Kganyago’s point. He basically said, “Bitcoin isn’t just *better* money than gold – it’s also easier to move around, break down into smaller parts, and it actually has real-world uses.” And when you look at the numbers, Bitcoin’s done incredibly well over the last decade, outperforming every other major type of asset. It’s really solidified itself as a top-tier way to store value. For Africa especially, a continent that’s often been left out of the global financial system, a Strategic Bitcoin Reserve could be a game-changer. It could be the key to economic independence, spark new ideas, and build lasting wealth. The question is… how? Okay, let’s get real and look at the facts. Bitcoin is digital – it doesn’t need a warehouse to store it. Things like beef and mutton? They spoil, and keeping them safe and usable costs money. The World Bank even estimates that Africa loses about $48 billion *every year* just from agricultural products spoiling after harvest. That really shows how inefficient relying on commodity reserves can be. And sure, commodities have value, but what you can do with them is pretty limited – mostly just within specific industries. Bitcoin, though? It’s global, it crosses borders, and you can use it in finance, tech, and tons of other areas. That makes it a really strong contender for a strategic reserve. Plus, Bitcoin is designed to be limited – there will only ever be 21 million coins. That means it’s naturally deflationary, unlike regular currencies where governments can just print more and more, or even beef, which, well, you can always raise more cows. CoinMarketCap tells us that Bitcoin’s market value exploded from under $1 billion in 2013 to over $1 trillion by 2025. That’s not just adoption; it’s a massive jump in value.

WHY BITCOIN OVER BEEF ?

Think about it: Bitcoin can zip across borders in minutes, and you can break it down into tiny fractions called satoshis. That’s way more practical than trying to move gold or, you know, beef around. And get this – over the last ten years, Bitcoin has delivered an average yearly return of *over 200%*. It’s crushed gold, stocks, and even real estate. A study by Fidelity Investments even showed that Bitcoin’s returns, when you consider the risk, are *better* than traditional assets. That makes it a really compelling choice for keeping your wealth safe over the long haul. Around the world, countries are starting to wake up to Bitcoin’s potential as a reserve asset. El Salvador made headlines back in 2021 by making Bitcoin legal tender. And places like Switzerland and Singapore? They’ve already woven Bitcoin into their financial systems. We’re in 2025 now, and even the United States is considering a “Strategic Bitcoin Reserve” Bill! And here’s something else to consider: a 2023 Chainalysis report says Africa is actually one of the *hottest* crypto markets out there, with Nigeria, Kenya, and South Africa leading the charge.

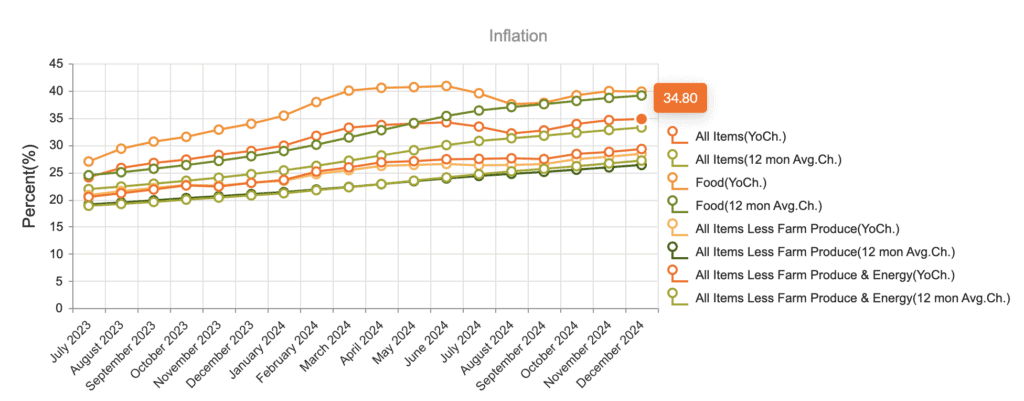

Because Bitcoin is deflationary, it’s a powerful weapon against inflation, which has been a *major* problem for many African economies. Look at Nigeria – their inflation rate spiked to almost 35% in 2024, just eating away at the value of their Naira. A Bitcoin reserve could be a shield, protecting national wealth from that kind of value loss. Think about this: if Africa put just 1% of its reserves into Bitcoin, it could unlock billions in value. Imagine if the continent’s combined foreign reserves of $500 billion included $5 billion in Bitcoin. If Bitcoin’s value just went up 10x, that’s a $50 billion return. And here’s another angle: raising beef contributes to deforestation and those nasty greenhouse gas emissions. Bitcoin mining, on the other hand, *can* be powered by clean energy. In fact, the Cambridge Bitcoin Electricity Consumption Index says that over half of global Bitcoin mining was already using renewable energy back in 2021! Africa has huge potential for solar and hydro power, making it a perfect place for *sustainable* Bitcoin mining. Plus, storing and managing Bitcoin reserves is just plain cheaper and easier than dealing with commodities. No storage fees, nothing to spoil, and no crazy logistics to worry about.

Image Source : Central Bank of Nigeria.

El Salvador going all-in on Bitcoin as legal tender? That’s a real case study that Africa can learn from. Even with all the initial doubts, Bitcoin actually gave tourism and foreign investment a boost in El Salvador. Their Central Bank said tourism revenue jumped 30% in just the first year after adopting Bitcoin. And here’s a huge point: before Bitcoin, over 70% of people in El Salvador didn’t even have bank accounts. Bitcoin has opened up the global economy to millions of people there. By cutting down their dependence on the US dollar, El Salvador made a bold move towards controlling their own financial destiny. Lots of African countries lean heavily on the U.S. dollar for trade and reserves, which makes them really sensitive to economic decisions made outside of Africa. Bitcoin offers a way out of that system. It’s decentralized, meaning it’s not controlled by any single government or bank. It’s a way to reduce reliance on those old financial structures. So, by creating a Strategic Bitcoin Reserve, Africa can really secure its economic future, shield itself from inflation, and become a leader in the digital economy. It’s time for Africa to break free from old-fashioned economic thinking and jump into the future of money. Like Brian Armstrong said, Bitcoin isn’t just *better* money – it’s the foundation of a whole new way of doing finance. For Africa, the choice is clear: Bitcoin, not beef, is the path to a thriving future. Bitcoin is a revolutionary asset that’s simply in a different league compared to traditional commodities like beef or mutton.

This is a guest post by Heritage Falodun. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.