Dogecoin Longs Dominate Binance Futures: What Traders Need to Know

- Futures traders are going all-in on long positions for DOGE, signaling strong short-term bullish bets.

- Historically, big jumps in Daily Active Addresses haven’t reliably led to price increases, suggesting current activity might be more about speculation than genuine adoption.

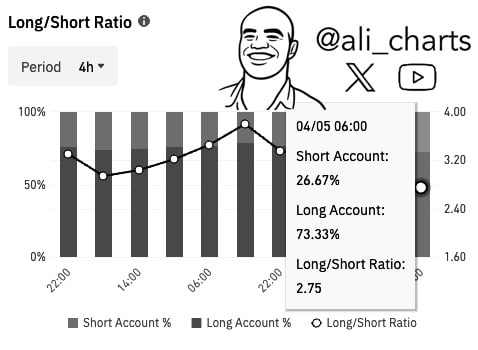

It seems like Binance Futures traders are feeling pretty bullish about Dogecoin [DOGE] right now. They’re piling into long positions more than shorts across the board.

According to a chart shared by Ali Martinez, this bullish sentiment peaked on April 5th, with long positions hitting 73.33% and a Long/Short Ratio of 2.75.

Source: X

Actually, if you look at earlier data, the bullishness was even stronger.

Take April 3rd, for example: long positions went through the roof to a staggering 80.23%! That pushed the Long/Short Ratio up to 4.06, while short positions practically vanished, dropping to just 19.77%.

Even by April 6th, although long interest had cooled off a bit, it was still dominating at 77.98% of all open positions.

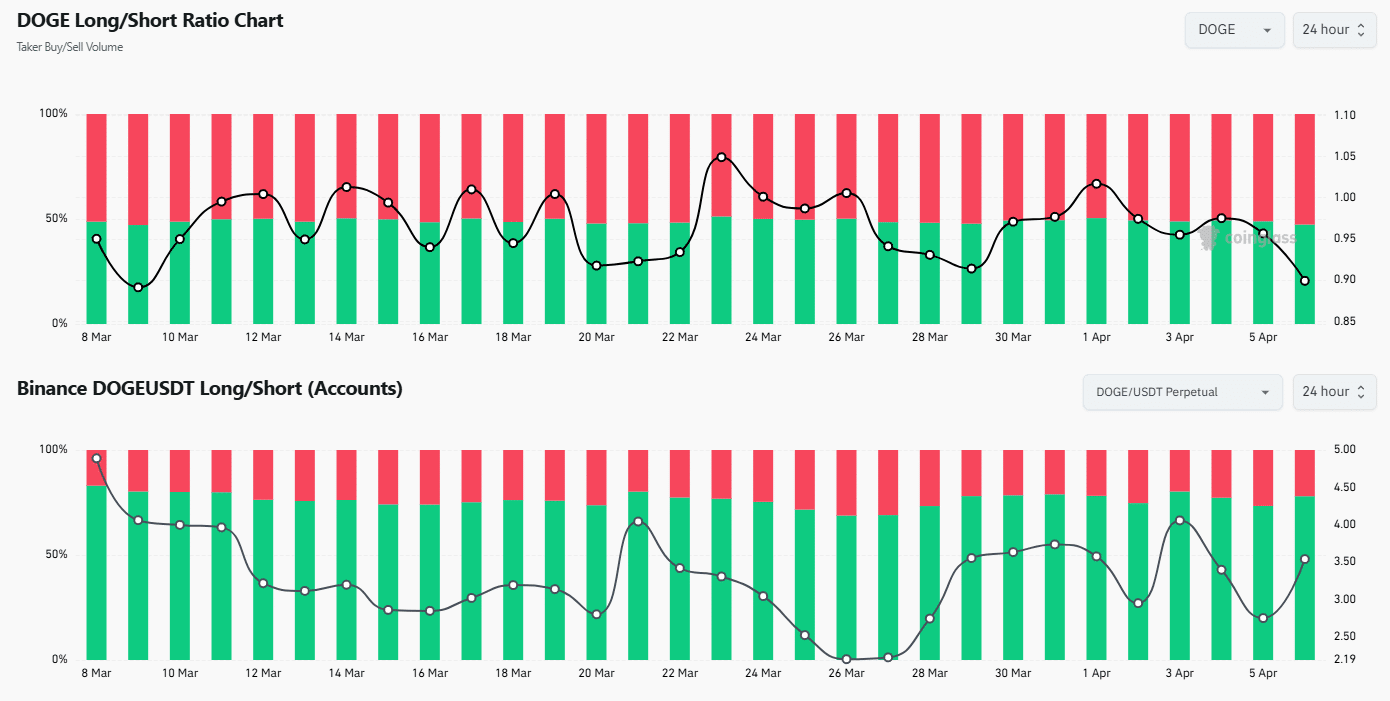

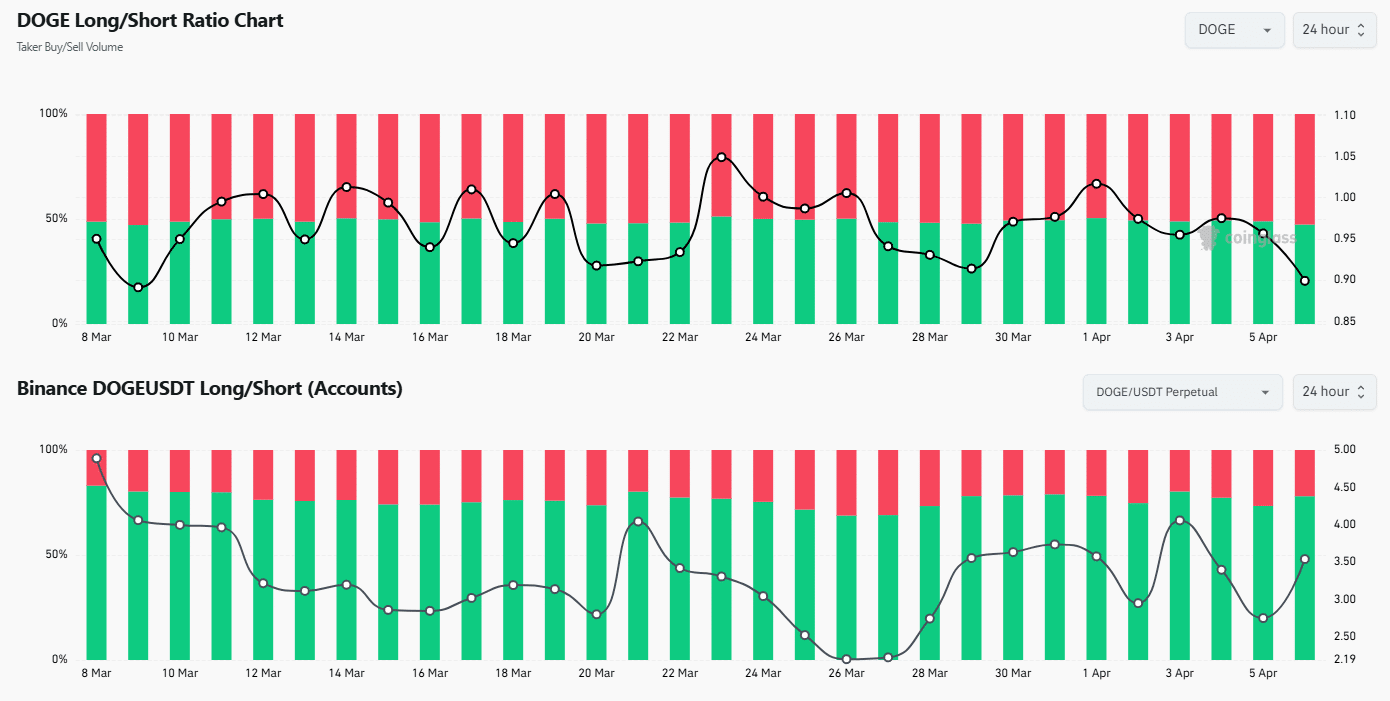

Source: CoinGlass

However, if we zoom out and look at the bigger picture – Binance Futures’ Long/Short Ratio from March 30th to April 6th – we start to see a change in the air.

While things started with longs in the lead, by April, the tables seemed to turn. Short positions climbed to 52.66%, and long interest dropped to 47.34%. This shift dragged the Long/Short Ratio down to 0.899, hitting its lowest point for the week.

The impact is even clearer in DOGE futures liquidations

But the real story unfolds when we look at DOGE futures liquidations.

And this divergence between futures optimism and reality becomes even sharper when we consider spot prices and liquidations.

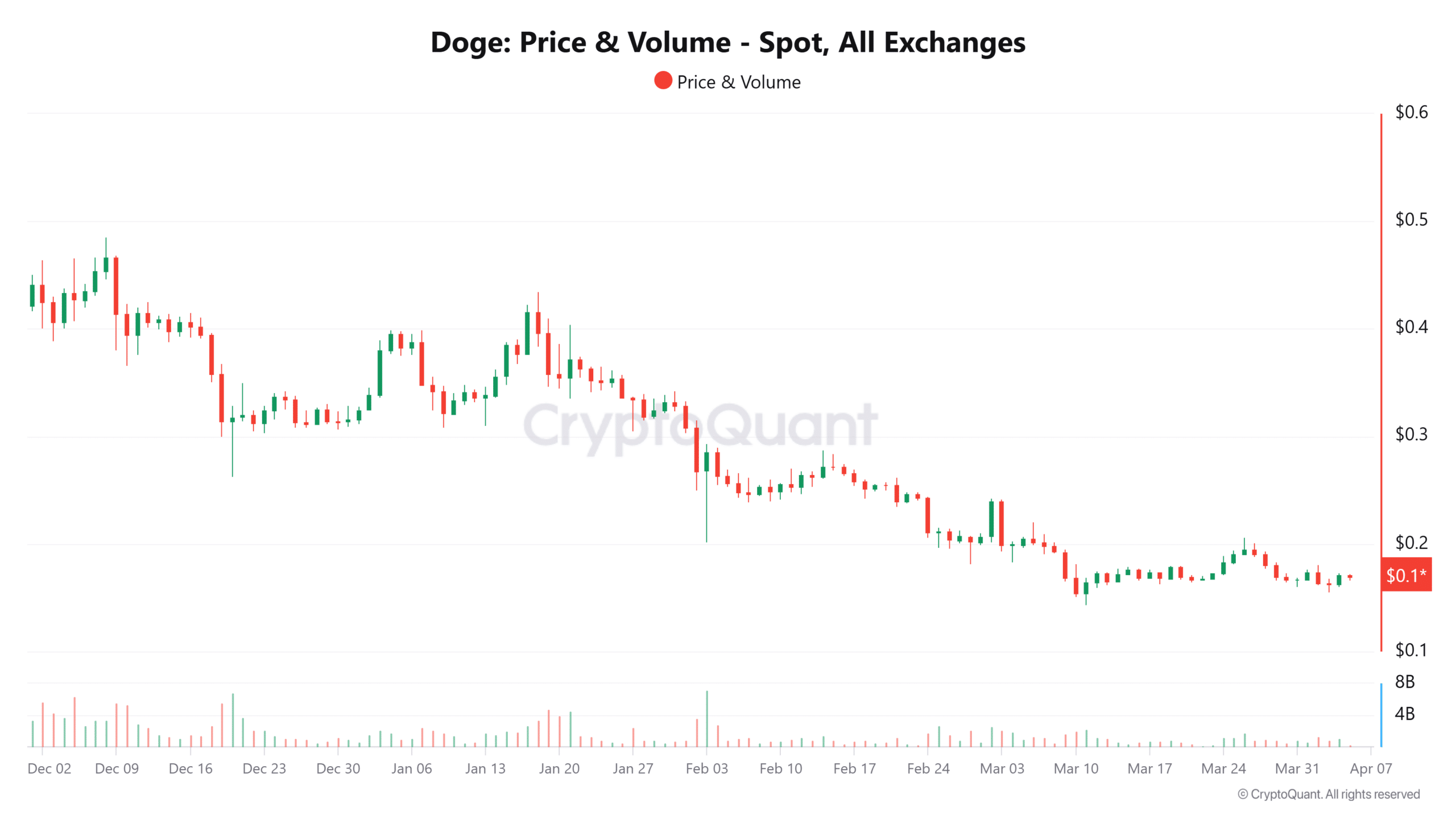

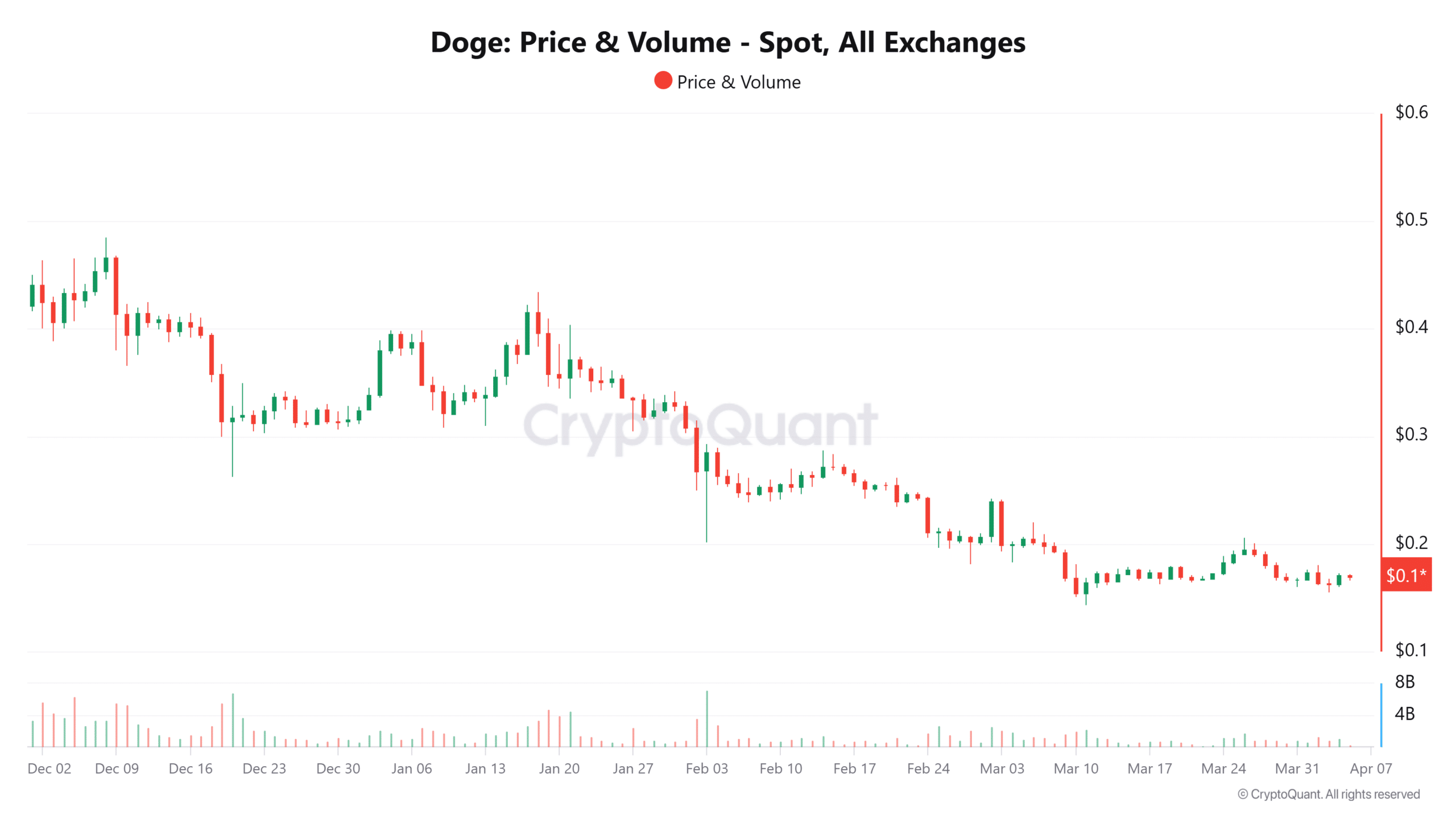

Between February and April, Dogecoin’s price took a nosedive, plunging nearly 32% from $0.248 to $0.169, according to aggregated spot data.

And to add insult to injury, trading volume completely collapsed, shrinking from a massive 7.18 billion tokens to a mere 353 million. That’s a staggering 95% drop, screaming that conviction in the spot market was seriously fading.

Source: CryptoQuant

Even more tellingly, whale activity also took a nosedive.

Back on January 21st, when DOGE was around $0.42, we saw a healthy 466 transactions exceeding $100,000. But by April 5th, even with the price still around $0.169, that number had cratered to just 19.

This massive drop in large trades strongly suggests that the big players – institutions or wealthy investors – were either selling off their DOGE or simply staying away as prices fell. And if you look at the on-chain data overall, it’s flashing warning signs.

Dogecoin metrics suggest network health is also deteriorating

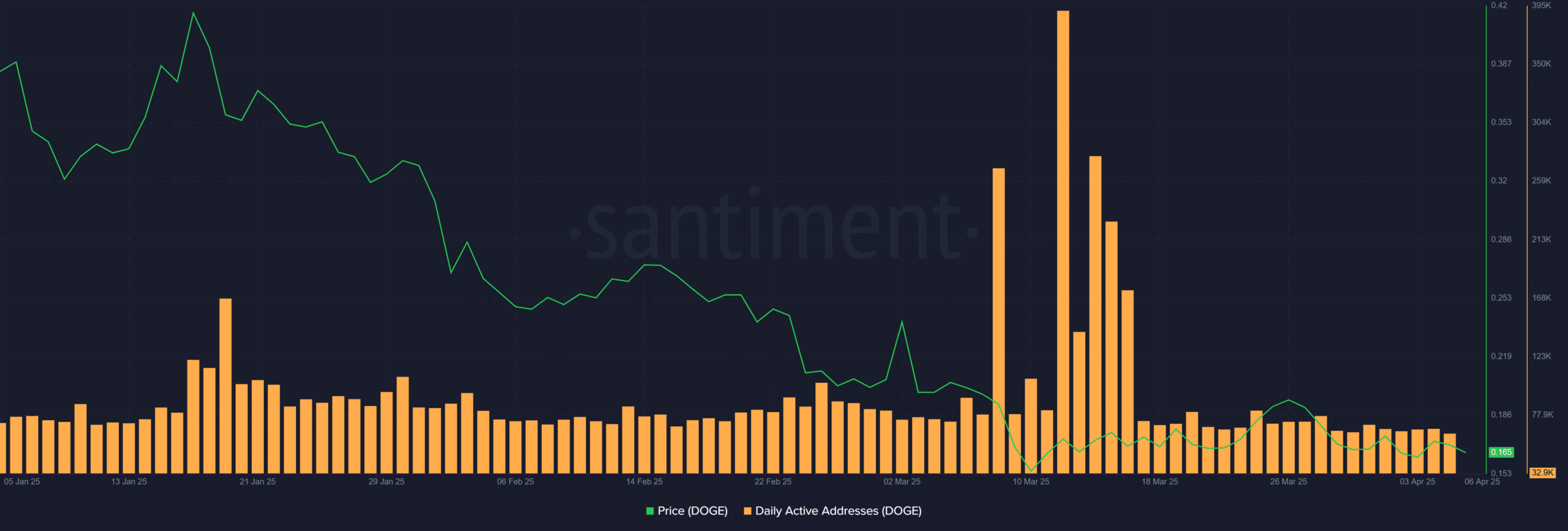

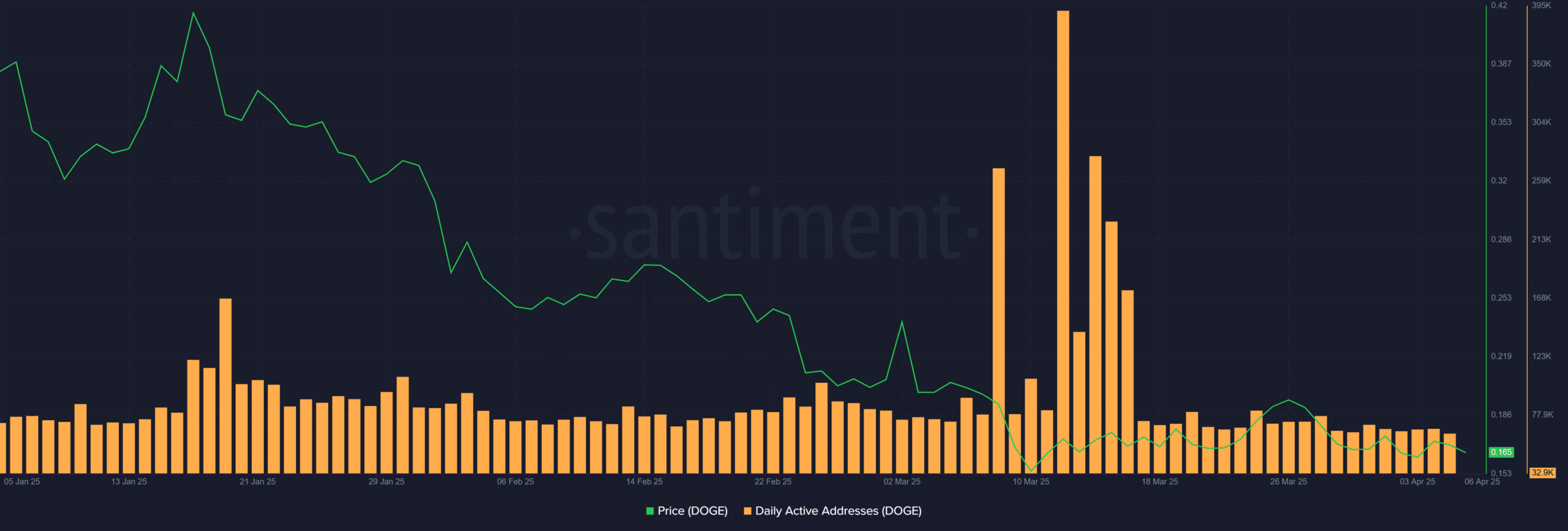

Let’s talk about network health. The number of Daily Active Addresses (DAA) – that’s essentially the number of unique people using the Dogecoin network each day – peaked at a robust 81,861 on March 11th. But fast forward to April 5th, and that number had dwindled to 63,736 – a concerning 22% decrease.

Source: Santiment

Interestingly, and perhaps worryingly, a high number of Daily Active Addresses hasn’t always translated into price pumps in the past.

So, what does all this mean? Well, even though futures traders were betting big on long positions in early April, pretty much every other indicator was telling a different story. Whale trades were down, spot volumes were shrinking, and the Dogecoin network itself looked less active.

This paints a clear picture: a disconnect between short-term hype in the futures market and a more cautious, hesitant broader market.

While this futures-driven bullishness might have given DOGE traders a temporary shot of optimism, it’s clear that this advantage is shaky at best. The spot market and on-chain data are sending strong signals of fading interest, reduced participation from key players, and continued price declines.

In short, the Dogecoin market is sending mixed signals. You’ve got this short burst of excitement in futures trading clashing head-on with a more cautious long-term perspective revealed by almost everything else.