Dominance falls: Bitcoin below 50% as Trump touts crypto reserve plan

Bitcoin’s grip on the crypto market loosened, dropping from 55.4% to under 50% shortly after Donald Trump, the US President, first revealed plans to include XRP, Solana, and Cardano in the nation’s “Crypto Strategic Reserve.”

Trump later clarified on Truth Social that Bitcoin

— and also Ether

— would be “central to the reserve.” However, his decision to include other cryptocurrencies didn’t sit well with many Bitcoin enthusiasts, and even some Bitcoin skeptics.

Consequently, Bitcoin’s dominance dipped further to 49.6% as Cardano

and XRP surged by 60.3% and 34.7% respectively in the past 24 hours.

Solana

and Ether also saw gains, rising 25.5% and 13.1% over the same period. Even altcoins Trump didn’t name experienced growth, while Bitcoin itself only climbed 10% to $94,220.

Bitcoin dominance percentage as compared to other large-value cryptocurrencies. Source: CoinGecko

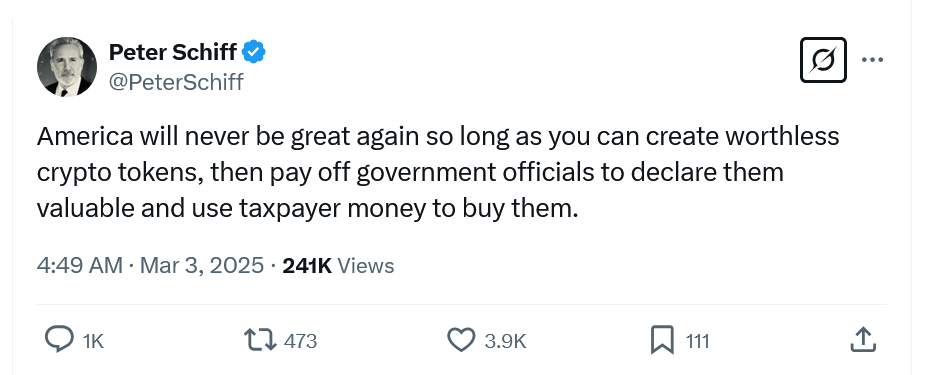

This decision by the Trump administration to not limit the reserve to Bitcoin alone raised eyebrows, surprising figures like Bitcoin critic Peter Schiff, who struggled to understand the rationale behind including altcoins.

Schiff articulated his confusion, stating, “I understand the logic behind a Bitcoin reserve. While I disagree with it, I grasp the comparison to our gold reserve—Bitcoin as digital gold, arguably superior to physical gold. So, a Bitcoin reserve isn’t completely illogical.”

“But what’s the rationale for an XRP reserve? Why on earth would we need that?”

Source: Peter Schiff

In the meantime, Jeff Park, Head of Alpha Strategies at Bitwise, suggested this move was a “major political misstep” by the Trump administration. Park believes Trump underestimated how vital it was for the Strategic Reserve to be exclusively focused on Bitcoin.

Echoing this sentiment, Nick Neuman, CEO of Bitcoin custody solution Casa, declared, “Bitcoin is the only cryptocurrency that logically fits as part of a national strategic reserve.”

“Infinite supply digital assets — especially ones with zero utility — do not fit the bill.”

Neuman elaborated further, stating, “Digital assets with unlimited supply—particularly those lacking real-world utility—simply don’t qualify.”

Adding to the chorus of Bitcoin-centric views, Pierre Rochard, VP of Research at Bitcoin mining company Riot Platforms, posited that the Crypto Strategic Reserve would “inevitably become Bitcoin-only” as altcoins lose value relative to Bitcoin.

Related: Bitcoin isn’t a worthy reserve asset, Swiss National Bank president says: Report

This Crypto Strategic Reserve initiative follows weeks of analysis by the President’s newly established Working Group on Digital Assets. This group is spearheaded by executive director Bo Hines and David Sacks, the White House’s expert on AI and crypto policy.

Looking ahead, Trump is set to host the inaugural White House Crypto Summit on March 7th. This event will gather industry leaders to discuss crypto regulations and stablecoin oversight, with Sacks chairing and Hines administering the summit.

Magazine: Elon Musk’s plan to run government on blockchain faces uphill battle