ETH ETF Outflow: Will It Hit $20M?

Ethereum grabbed headlines this Saturday as its price surged upwards, even briefly breaking past the $2,000 mark. Interestingly, this price jump occurred despite continued outflows from Ethereum ETFs over the past few days, injecting a dose of optimism into the market regarding future price potential.

To give you some background, Ethereum ETFs have been experiencing daily outflows, raising eyebrows across the market. While these outflows have consistently stayed under $20 million daily, market analysts are keeping a close watch on what this could mean as the market situation evolves.

Ethereum Price Jumps Even as ETH ETFs See Outflows

The price of ETH saw a boost, climbing nearly 2% in the last 24 hours to settle at $1,995 by the time of writing. The cryptocurrency bounced back from a low of $1,937 during the day and briefly touched $2,005 this Saturday.

This positive price movement caused quite a buzz in the market, going against the grain of typical investor feelings given the ongoing outflows from ETF products. Data from Sosovalue reveals that Ethereum experienced a significant $102.89 million in outflows from its ETFs between March 14th and 21st, which is definitely a point of concern for investors.

Breaking down these outflows, we saw $11.72 million leave on March 19th, $12.41 million on the 20th, and $18.63 million on the 21st. Market participants are now wondering if these daily outflows will exceed the $20 million threshold soon, which could put further downward pressure on the price.

Interestingly, the price of Ethereum has actually climbed nearly 5% since the last time ETF outflows surpassed $20 million, which was back on March 18th. Since then, the price has risen from around $1800 to $1,985. This upward movement has sparked discussions about whether the ETF outflows might be starting to slow down, a theory supported by other market factors.

Could an ETH Supply Shock Be on the Horizon?

Adding to the positive vibes, recent on-chain data is reinforcing a strongly bullish outlook for Ethereum. Well-known market analyst ‘Merlijn The Trader’ has pointed out that large investors, or “whales,” have snapped up a whopping $236 million worth of ETH in the last 72 hours. This significant buying activity suggests a positive trajectory for future price movements, hinting at a possible rebound for ETH back to previous highs.

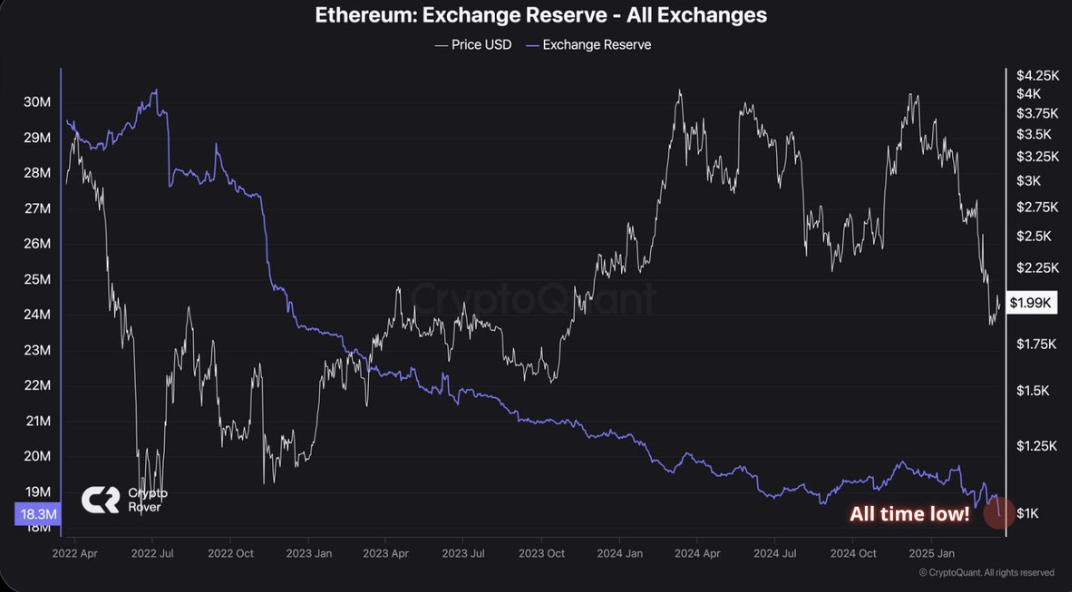

And that’s not all – market analyst Crypto Rover shared on X (formerly Twitter) that Ethereum reserves on crypto exchanges have plummeted to an all-time low. Essentially, dwindling exchange reserves usually mean more people are withdrawing crypto, which signals growing market interest. This data suggests we might be looking at a potential supply shock, which could further bolster the price.

So, even with those persistent ETF outflows, these positive indicators suggest that Ethereum’s price might be gearing up for further gains. If this trend continues, the growing interest could even lead to renewed inflows into ETH ETFs down the line.

Leading Analyst Predicts Potential 100% Surge for Ethereum Price

Adding fuel to the fire, market expert ‘Patron’ also shared insights on X, noting that ETH price has broken through a crucial support level around $1,978. According to Patron, if this level holds, bolstered by the bullish factors we’ve already discussed, we could see a significant 100% price jump. The analyst lays out potential targets at $2,296, $2,913, and even $4,000 – a near doubling from the current price.

However, it’s important to keep things in perspective. The Fear and Greed Index for ETH is currently at 37, which suggests investors are still feeling cautious despite these positive signals. This caution might stem from broader economic trends and a perceived dip in institutional interest. Looking ahead, some Ethereum price predictions suggest ETH could potentially reach $2,100.57 by 2025.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.