Ethereum’s Growth: Multi-Year Bullish Structure

This article is also available in Spanish.

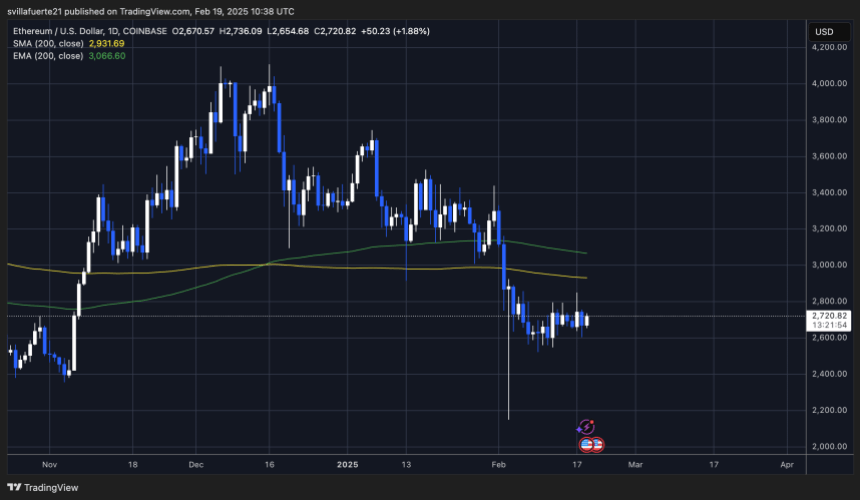

Ethereum’s price has fluctuated between $2,650 and $2,750 over the past week, leading to short-term market uncertainty. This price indecision is evident as bulls struggle to push past the $2,800 resistance level, a critical zone that will likely dictate Ethereum’s next price movement. While the broader long-term trend remains unclear, Ethereum is currently trading at significant demand levels, facing persistent selling pressure that has dampened price action.

Related Reading

Despite efforts to remain composed amid market swings, investors are increasingly anxious as Ethereum demonstrates relative weakness compared to Bitcoin. Some analysts caution that failure to maintain a price above $2,600 could trigger a more substantial downward correction. Conversely, some analysts maintain a positive outlook, suggesting that Ethereum could potentially be establishing a long-term bullish pattern.

Crypto analyst Jelle shared a technical analysis on X, highlighting Ethereum’s continued presence within a multi-year ascending triangle. This pattern is historically recognized as a strong indicator of potential breakout opportunities. If Ethereum can sustain its position above current price levels and successfully overcome the $2,800 resistance, this could initiate a recovery towards the significant $3,000 resistance point. Currently, the market’s focus is intently on Ethereum’s upcoming movements, as the next few days could be crucial in defining its short-term trajectory.

Ethereum Testing Crucial Liquidity Levels

Ethereum is currently navigating between critical short-term demand and supply liquidity zones, resulting in its price action being confined within a narrow range. Throughout the past week, ETH has closed trading days between $2,650 and $2,750, causing uncertainty regarding its immediate direction. Investor sentiment is split, with some anticipating further price corrections and an extended period of consolidation, while others foresee an imminent recovery rally. The market is awaiting a definitive breakout or breakdown to signal the next prevailing trend.

Related Reading

Ethereum is making attempts to break through the $2,700 level and establish it as a support base, which would serve as an initial sign of growing bullish momentum. However, to confirm a sustained recovery, ETH must overcome and hold above both the $2,800 and $3,000 price points. These key resistance zones have historically acted as substantial supply areas and are likely to determine Ethereum’s next significant move. Should ETH fail to reclaim these levels, a deeper correction towards lower demand regions around $2,500 may occur.

Analyst Jelle’s insights on X point out that ETH remains within a large ascending triangle, a bullish pattern spanning multiple years. He observed instances of false breakouts in both directions, which cleared out liquidity on both sides. With downside liquidity now addressed, Jelle anticipates a forthcoming rebound, suggesting ETH might soon attempt to recover lost ground.

Should Ethereum successfully break through the $2,800 barrier and maintain upward momentum, the next target would be a move towards the $3,000 level. However, if selling pressure continues to dominate the market, ETH may remain within a consolidation phase or potentially experience further price declines. The coming days will be pivotal in determining whether ETH can regain bullish traction or if a more significant correction looms.

Price Action Lacks Short-Term Direction

Ethereum is currently priced at $2,720, following several days of sideways movement below the $2,800 mark, indicating a struggle to build momentum for a breakout. Bulls need to actively intervene and drive the price above this level promptly to alter market sentiment and regain control over price action. The $2,800 level has been acting as a strong area of supply, and successfully breaching it would pave the way for a move towards the $3,000 target.

Conversely, defending the $2,700 and even the $2,600 price levels is critical for sustaining any bullish momentum. If ETH can hold these levels consistently, it would signal robust demand and reinforce the potential for a recovery rally. Climbing and maintaining above $2,700 would encourage buying activity, thereby increasing the likelihood of ETH retesting higher resistance zones.

Related Reading

However, failure to remain above $2,700 could leave Ethereum vulnerable to intensified selling pressure. Should ETH fall below the $2,600 mark, a deeper correction into lower demand areas around $2,500 might follow. The next few days will be decisive in revealing if Ethereum can establish a firm foundation for a bullish reversal or if bearish forces will continue to dominate the price action.

Featured image from Dall-E, chart from TradingView