FLOKI Price Drop: Will It Hit $0.00005?

- Interestingly, even as the MVRV ratio dipped slightly to 1.24, over half of FLOKI’s global investors are still seeing profits.

- Following a breakout from a parallel channel, FLOKI is potentially setting its sights on the $0.00005 price point.

The memecoin market isn’t having the easiest time right now, and digging into FLOKI’s data, we see its MVRV ratio at 1.24, according to IntoTheBlock. Basically, this number means that on average, people bought FLOKI for less than it’s currently worth.

This generally points to a profitable situation for most who have invested. Historically, when the MVRV goes above 1, it’s often a signal that holders might start thinking about taking some profits, especially if prices begin to decline, and this could lead to increased selling pressure.

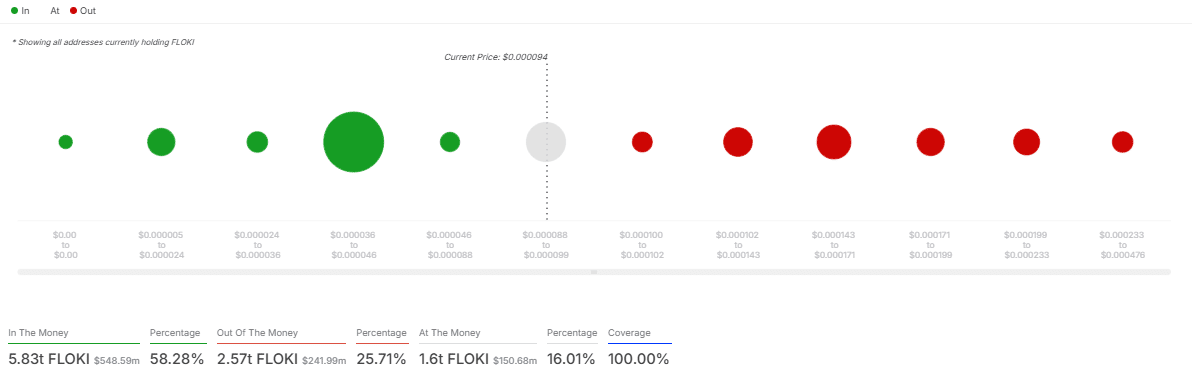

Looking closer at the “In/Out of the Money” metric, it turns out that a solid 58.28% of FLOKI holders are currently in profit. A significant chunk of investors are still holding onto coins they purchased at lower prices.

This level of profitability, even with the MVRV dipping a bit recently, suggests that holders are showing considerable resilience and confidence.

Source: IntoTheBlock

Now, things could quickly change. If the MVRV were to jump up unexpectedly, that could bring on FOMO (fear of missing out), potentially pushing prices up in a hurry. On the other hand, a significant drop could spark panic selling, sending FLOKI’s price down further.

So, while a large chunk of the market is currently “In the Money,” the MVRV ratio sitting at 1.24 — even though it’s not as high as it once was — still suggests a cautiously optimistic view for FLOKI moving forward.

What might be next for FLOKI’s price?

Recently, FLOKI broke out of what’s called a parallel channel. This breakout confirms a bearish trend, suggesting its price could be heading towards that $0.00005 mark.

This sideways channel had actually formed right around the peaks of its recent bullish run that we saw throughout the last quarter of 2024.

Currently, the memecoin is trading around $0.00009535 and hasn’t been able to climb back to its previous support level near $0.00011, which is now acting as resistance.

This price point is key because it’s the immediate hurdle FLOKI needs to overcome after the breakout.

If it can manage to push above this level and hold, it might just shake off the bearish outlook and pave the way for a move towards $0.00014 and potentially even higher.

However, looking at Fibonacci retracement levels, the 0.618 level at $0.0001055, just shy of $0.00011, has been tested and rejected. This reinforces the current bearish sentiment.

Source: Ali/X

If the selling pressure continues, FLOKI might just slide further down to the 0.5 Fibonacci level around $0.00007294, and then potentially even to the 0.382 level at $0.00005041 – which lines up with that expected bearish target we mentioned earlier.

Should it break below this zone, we could see FLOKI’s losses extend even further, maybe towards $0.00003192 at the 0.236 Retracement Level.

On the flip side, if FLOKI manages to bounce back above $0.00011, that bearish scenario could be off the table. Such a move could propel the price up towards $0.00017 before it even thinks about testing $0.00025.

However, right now, the momentum still seems weak, making further dips more probable unless buyers step in and regain control at those crucial support levels. Keep an eye on the next trading sessions – they’re going to be key in deciding where FLOKI heads next.