Funding Rate Swings Signal BTC Market Uncertainty

The bitcoin (BTC) perpetual futures funding rate is like a seesaw right now, swinging between positive and negative, and that’s a clear sign of uncertainty in the market. With Bitcoin’s price dipping and currently trading near $80,000, traders are really trying to figure out what’s next, especially after it slipped below its 200-day moving average.

Think of the funding rate, which crypto exchanges use for perpetual futures contracts, as a mechanism that basically dictates who pays whom between traders holding ‘long’ positions (betting on price increases) and ‘short’ positions (betting on price decreases). A positive rate? That means those betting long are paying those betting short. A negative rate? Flip it – the short positions are paying the longs.

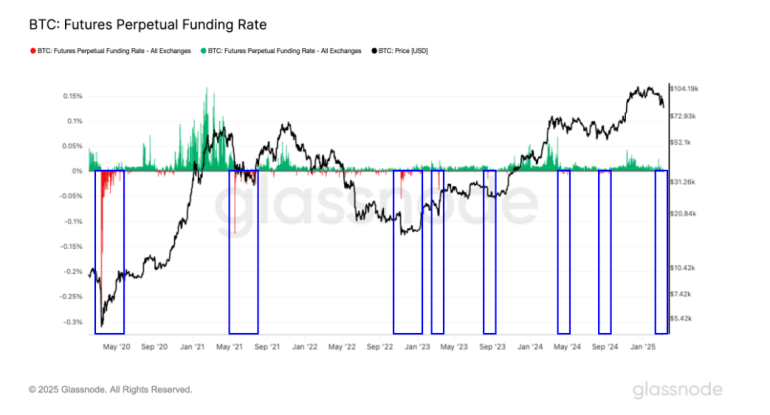

For the last couple of weeks, this funding rate has been bouncing back and forth between positive and negative territory, really showing how unsure everyone is about where Bitcoin’s price is headed next. Typically in a bull market, when prices are generally rising, you expect this rate to stay consistently positive. But just recently, though, we saw the daily funding rate dip into negative territory, hitting -0.006%. That might sound small, but it works out to an annualized rate of -2%, according to data from Glassnode.

Historically, when Bitcoin’s price hits rock bottom, it’s often been linked to periods where the funding rate stays negative for a while, and that usually happens when market sentiment is really bearish. Think back to events like the Covid-19 crash, the FTX collapse, and the China mining ban in 2021 – all times of sustained negative funding rates. But here’s the twist: over the past couple of weeks, every time Bitcoin has tried to rally a bit recently, traders have jumped back into long positions. However, when the price reverses again, those long positions get wiped out (liquidated), and that’s been stopping the funding rate from staying negative for any real length of time.

Important note: We used AI tools to help create parts of this article, but our editorial team reviewed everything to make sure it’s accurate and meets our quality standards. You can read more about how we use AI in our full AI Policy on CoinDesk.