Gold outperformed the S&P 500

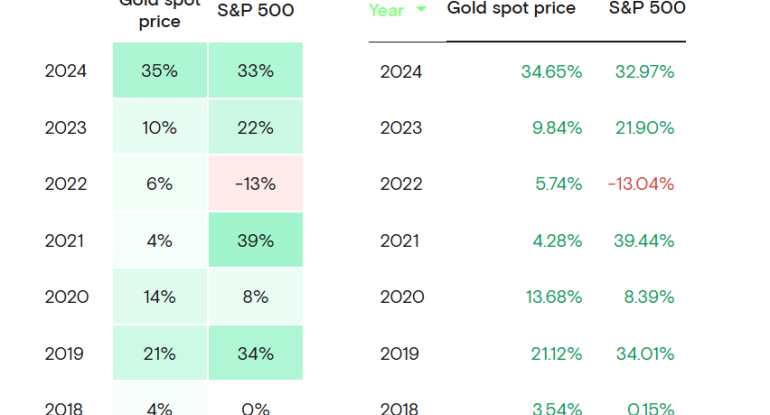

For much of the recent past, gold has been a shining investment. In fact, since 2018, gold has outperformed the US stock market benchmark, the S&P 500, in four out of the last seven years. Data from Curvo even shows that this precious metal delivered an impressive average annualized return of over 40% in 2024 – a full 10% higher than the S&P 500.

Looking at 2024 more closely, gold’s price in US dollars rose by an impressive 25.5%. That’s just a hair above the S&P 500’s total return of 25%, which already factors in dividends. And this upward trend has continued into 2025. Just in January, gold prices surged by 6.4%, hitting new peaks, while the S&P 500 saw a more modest gain of 2.8%.

Gold outperformed the S&P 500 in years of economic uncertainty

According to data from Curvo.eu, while the S&P 500 did achieve higher gains in 2021 and 2019, gold really shone during years marked by economic jitters, like 2022 and 2020. Looking back further, over the past two decades, gold’s spot price has impressively climbed by 735.5%, although the S&P 500 still edges it out with an even greater increase of 848.1%.

However, it’s worth noting that when we look at metrics like compound annual growth rate over the last year (gold at 7.14% versus the S&P 500 at 11.29%) and the Sharpe ratio (gold at 0.46 versus the S&P 500 at 0.69), it indicates that historically, the S&P 500 has offered better returns when you consider the level of risk involved.

Taking a deeper dive, in early February, prominent gold advocate Peter Schiff pointed out an interesting perspective: according to Schiff, if you measure the S&P 500’s value in gold terms, it’s actually worth less than 2.1 ounces. He further highlighted that this decline is even more striking when compared to the start of the century, when the S&P 500 was valued at a much higher 4.85 ounces of gold.

Summarizing his point, the Europac chair, Schiff, concluded, “So in real terms, the S&P is down 57% over the past 24 years. The nominal gain is all due to inflation.”

Adding to this perspective, Jordan Roy-Byrne, another well-known gold enthusiast, observed on Wednesday that gold had just closed at its second-highest level against the S&P 500 in four years. He also noted it had reached a 22-month peak against the Nasdaq.

Gold is Making Progress Against Stocks

vs. S&P 500, 2nd highest close in 4 years

vs. Nasdaq, highest close in 22 months

vs. Equal Weight S&P 500, backtest of breakout

If this is the start of Gold outperforming the S&P 500 for a while…look out above over next 12-24 months. pic.twitter.com/AHtSeihF0X— Jordan Roy-Byrne CMT, MFTA ⛏⛏ (@TheDailyGold) March 5, 2025

In his post, Byrne also included a chart illustrating how gold recently retested a breakout point against the equal-weighted S&P 500. This, he suggested, could signal a continuation of gold outperforming the broader stock market.

Prices peaked in February; trade war concerns may boost prices further

As of Thursday, gold prices were hovering near record highs at $2,920 per ounce, supported by a weakening US dollar. Adding to the market dynamics, President Donald Trump announced a temporary one-month reprieve for US automakers from his recently introduced 25% tariffs on goods from Canada and Mexico. This move could be interpreted as creating a window of opportunity for investors to increase their gold holdings.

Furthermore, Trump hinted at possible revisions to these trade measures, and a US official even indicated that the 10% tariff on Canadian energy imports might be lifted for specific products that meet the requirements of trade agreements.

These US tariffs on trade partners are already sparking retaliatory measures. China, for instance, has filed a revised consultation request with the World Trade Organization regarding these tariffs. This ongoing trade friction is injecting uncertainty into the markets, prompting traders to seek the safe haven of gold, shifting capital away from the potentially more volatile stock market.

While lower interest rates generally support gold prices by making non-yielding assets like gold more attractive compared to interest-bearing investments, it appears that factors like geopolitical uncertainty and trade disruptions are currently playing an even more significant role in driving up demand for the precious metal.

Adding to the trade tensions, just this past Tuesday, President Trump imposed new tariffs targeting the United States’ top three trading partners: Canada, Mexico, and China. These new duties – 25% on imports from Canada and Mexico, and 10% on Chinese goods – have triggered concerns about the potential for increased inflation and slower overall economic growth.

Looking ahead, Lukman Otunuga, a senior research analyst at FXTM, shared his perspective with Reuters, stating, “Unless there is a fresh direction catalyst, the current bearish price action may drag gold lower. Should prices break below $2,900, this may signal further downside toward $2,880.”