Gold Price Prediction: ChatGPT’s March 2025 Target

Even as volatility rocked most markets amid global economic uncertainty, gold continued its upward trajectory without missing a beat. The world’s top commodity by market capitalization soared to a new all-time high (ATH) this week and is currently up 10% year-to-date (YTD), trading at $2,900 at the time of writing.

Trade tensions continue to be a major driver behind gold’s recent surge, but a range of broader macroeconomic factors are also playing a significant role in shaping its direction. These include Federal Reserve policy, inflation expectations, and a softening in U.S. consumer sentiment.

Given the widespread analyst predictions pointing to a potential $3,000 price tag, Finbold decided to tap into the insights of ChatGPT to gain a better understanding of gold’s possible direction by March 2025.

ChatGPT identifies the major Gold price drivers

When asked about the current situation, the AI model analyzed gold’s recent performance and the various factors fueling its upward movement. It pinpointed the key elements that could potentially influence prices in the near future.

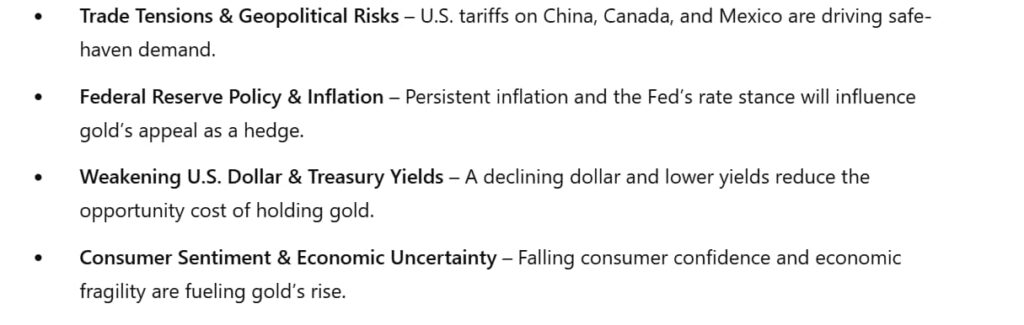

According to the AI model, a significant factor propelling gold’s rally is the escalating issue of trade tensions. Specifically, it noted U.S. President Donald Trump’s move to implement tariffs on imports from Canada and Mexico.

Another crucial element influencing gold’s path is the Federal Reserve’s approach to interest rates. Even with inflation remaining elevated, the market is closely watching the central bank’s forthcoming decisions. These decisions, especially in light of the Personal Consumption Expenditures (PCE) inflation report, are expected to significantly shape market sentiment.

Furthermore, the AI model highlighted the weakening U.S. dollar as another factor bolstering gold’s appeal. The dollar has recently dipped to its lowest point since December 10th, adding to gold’s attractiveness.

Adding to the positive environment for gold, U.S. Treasury yields have also declined. The 10-year yield is currently at 4.28%, and the 2-year yield stands at 4.08%. This is significant because when yields are lower, it reduces the ‘opportunity cost’ of holding assets like gold that don’t generate yield, making the precious metal a more appealing investment option.

ChatGPT sets Gold price target for March 2025

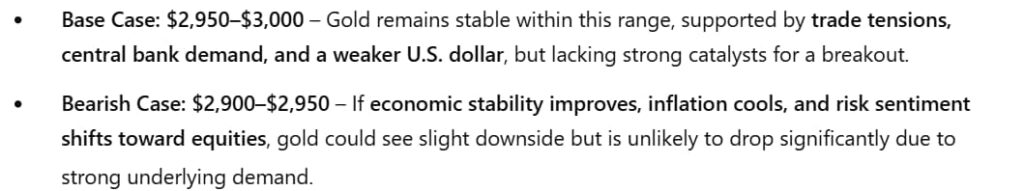

Taking these factors into account, ChatGPT forecasts a likely price target of $3,000 for gold by the close of the first quarter of 2025. This projection aligns with many existing long-term forecasts for the precious metal.

Looking at a base case scenario, the AI model anticipates that gold will likely trade in the range of $2,950 to $3,000. This expectation is primarily fueled by the continuing trade tensions and the softened U.S. dollar. Interestingly, this forecast implies a modest upside of only around 3.5% from the current trading level. However, in the context of the current macroeconomic climate, this level of growth is quite achievable as the broader economic factors are providing strong support to gold prices.

Looking ahead, the AI model suggests that breaking decisively above the $3,000 mark might be challenging without the emergence of new driving forces. In a less optimistic scenario, should economic conditions stabilize, inflation ease, and investors shift their focus towards higher-risk assets like stocks, gold could potentially remain within a narrower trading range of $2,900 to $2,950.