Hodler’s Digest: March 16-22

Top Stories of The Week

SEC to Drop Ripple Appeal, Says CEO Garlinghouse

Looks like the long saga is reaching its finale! Ripple CEO Garlinghouse has announced that the US Securities and Exchange Commission’s years-long enforcement action against Ripple is finally wrapping up.

“And just like that – it’s over. Get ready for this: the SEC is dropping their appeal! This is a huge win for Ripple, for crypto, in every possible way,” Brad Garlinghouse, Ripple’s CEO, shared excitedly on X on March 19.

In a video accompanying his X post, Garlinghouse declared, “I can finally say the case is over; it’s truly finished.”

This marks the end of a protracted legal battle that began four years ago when the SEC initially sued Ripple in December 2020. The regulator alleged a $1.3 billion unregistered securities offering was at play.

Trump Breaks Ground as First Sitting US President to Address Crypto Conference

Donald Trump is making his stance on crypto clearer than ever, seemingly aligning his administration directly with the crypto industry. On March 20th, he made history by becoming the first sitting US president to speak at a crypto community conference.

In a pre-recorded message broadcast at Blockworks’ Digital Asset Summit on March 20th, Trump reaffirmed his commitment to ensuring the US becomes “the crypto capital of the world.”

Highlighting the recent shift in crypto regulation compared to the previous administration, the President added a forward-looking perspective:

“Innovators like yourselves are poised to revolutionize our banking and payment systems, championing enhanced privacy, safety, security, and prosperity for American consumers and businesses alike. Get ready for an explosion of economic growth.”

Bybit Hack: Vast Majority of $1.4B Stolen Crypto Still Trackable

Even after suffering one of crypto’s biggest heists, there’s a silver lining! It turns out the vast majority of the $1.4 billion pilfered from Bybit remains traceable, thanks to ongoing efforts by blockchain investigators to freeze and recover the funds.

Remember the seismic shock to the crypto world on Feb. 21? Bybit was hit by a historic hack, losing over $1.4 billion in assets, including liquid-staked Ether and Mantle Staked ETH.

Leading blockchain security experts, including Arkham Intelligence, are pointing fingers at North Korea’s Lazarus Group as the likely culprits. The attackers are reportedly actively trying to swap the stolen funds, hoping to obscure their trail.

But here’s the encouraging update: despite the Lazarus Group’s methods, Bybit exchange co-founder and CEO Ben Zhou reveals that over 88% of the massive $1.4 billion haul is still traceable.

Coinbase Crowned Ethereum’s Top Node Operator, Commanding 11% Stake

Coinbase is making waves in the Ethereum ecosystem! A recent Coinbase report has revealed that the exchange has become the largest node operator on the Ethereum network, now wielding a significant 11.42% of all staked Ether.

According to their performance report, Coinbase holds a staggering 3.84 million Ether staked to its validators, valued at roughly $6.8 billion. As of March 3rd, this impressive amount represents 11.42% of the total staked ETH network-wide.

Crypto commentator Anthony Sassano, host of The Daily Gwei, highlighted the significance, stating that Coinbase’s stake makes them the undisputed “single largest node operator” in the Ethereum network.

Sassano further clarified that while Lido collectively outranks Coinbase in total stake when considering all its operators combined, Coinbase stands out due to its concentrated single operator share.

Binance CEO Refutes Trump Family Deal Rumors Again

Setting the record straight – again! Binance CEO Richard Teng has once more denied reports alleging that Binance.US was engaged in deal discussions with entities linked to former US President Donald Trump. Teng addressed these rumors directly during a panel at Blockworks’ 2025 Digital Asset Summit in New York on March 18th.

Teng’s statement echoes previous denials from Binance co-founder Changpeng “CZ” Zhao and Trump himself, who both dismissed the story the week prior.

Read also

Features

Gen Z and the NFT: Redefining Ownership for Digital Natives

Features

Beyond In-Game Assets: Blockchain Gaming, DAOs, Guilds, and Ragequitting

The initial report, published by The Wall Street Journal on March 13th, claimed that Binance.US, operating independently as a US cryptocurrency exchange, was exploring selling an equity stake to Trump-affiliated business ventures. This included a potential agreement with World Liberty Financial, the Trump family’s DeFi project.

“I believe both World Liberty Financial and CZ have already tweeted and denied these reports, haven’t they? So, really, there’s nothing more I can add,” Teng stated at the summit, which Cointelegraph attended.

Winners and Losers

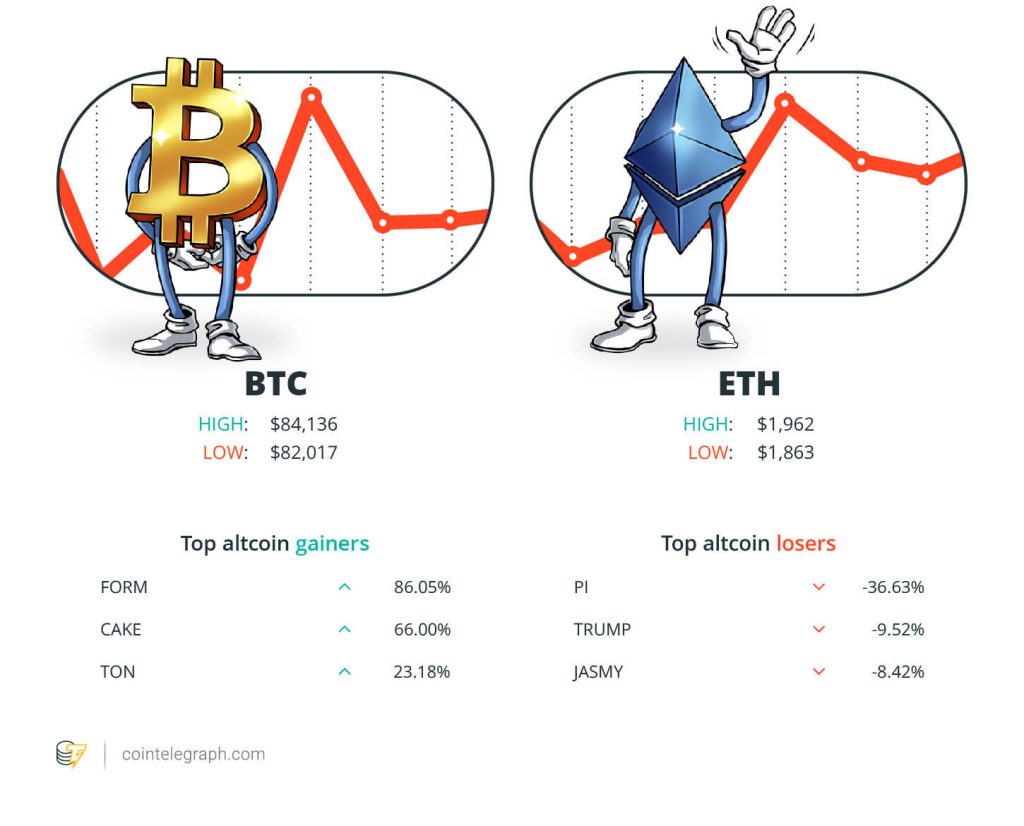

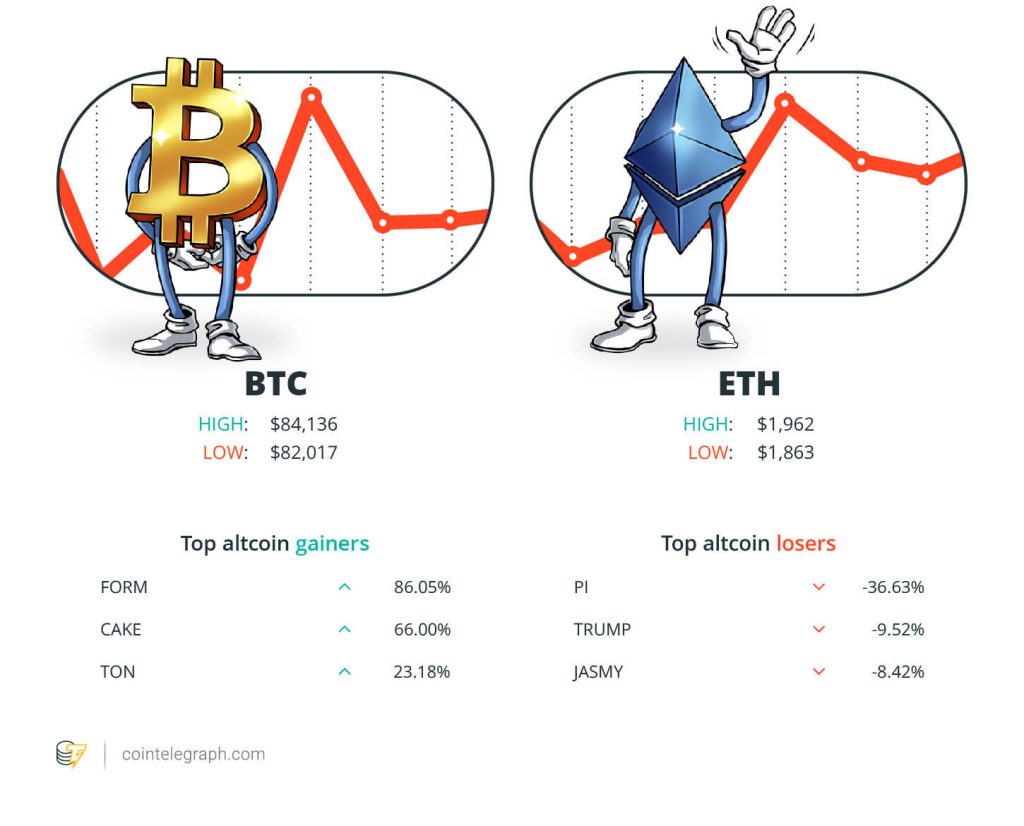

Let’s take a quick market snapshot! As the week wraps up, Bitcoin (BTC) is holding strong at $84,136, while Ether (ETH) stands at $1,962 and XRP at $2.38. The total crypto market cap is currently at a massive $2.75 trillion, according to CoinMarketCap.

Looking at the top 100 cryptocurrencies, we’ve got some serious altcoin movers. This week’s biggest gainers are Four (FORM) soaring by 86.05%, Pancake Swap (CAKE) up a tasty 66.00%, and Toncoin (TON) climbing 23.18%.

On the flip side, the top three altcoin dips this week were experienced by Pi (PI) down 36.63%, Official Trump (TRUMP) slipping 9.52%, and JasmyCoin (JASMY) decreasing by 8.42%. For a deeper dive into crypto market prices, don’t miss Cointelegraph’s detailed market analysis.

Most Memorable Quotations

“I’m genuinely ashamed that I initially downplayed it instead of calling it what it truly is – mean-spirited and targeting a vulnerable group.”

Anatoly Yakovenko, co-founder and CEO of Solana Labs

“I think it’s pretty clear both World Liberty Financial and CZ have already issued denials, right? So, from my perspective, there really isn’t anything further to discuss.”

Richard Teng, CEO of Binance

“Could $77k BTC have been the market bottom? Probably.”

Arthur Hayes, co-founder and former CEO of BitMEX

“I believe the Bitcoin bull cycle is now over, and we should anticipate a period of bearish or sideways price movement for the next 6-12 months.”

Ki Young Ju, CryptoQuant founder and CEO

“My sense is that if we do experience a recession, with declining GDP, it will actually give the President and the Fed more flexibility to maneuver in terms of tax cuts and monetary policy.”

Cathie Wood, CEO of Ark Invest

“While crypto can act as the currency for AI, not every AI agent needs its own token. Agents can leverage existing cryptocurrencies as payment for services.”

Changpeng “CZ” Zhao, co-founder and former CEO of Binance

Prediction of The Week

XRP Price Chart Hints at Potential 75% Surge as SEC Lawsuit Nears End

XRP is showing some serious momentum! The price has bounced back almost 30% in the last couple of weeks, riding the wave of a broader crypto market recovery and fueled by the nearing conclusion of Ripple’s long-standing legal battle with the US Securities and Exchange Commission.

As of March 21st, XRP rebounded after testing the lower boundary of a triangle pattern, now eyeing a potential climb towards the upper trendline. This target sits around the apex point at $2.35, with a timeframe set around April. Looking further ahead, the ultimate breakout goal is projected at $4.35 by June – a significant 75% jump from current price levels.

However, it’s not all bullish. A drop below the lower trendline could invalidate this optimistic outlook, potentially sending XRP down towards $1.28. This bearish price target is calculated by subtracting the triangle’s maximum height from the potential breakdown point at $2.35.

Top FUD of The Week

Bitcoin Bulls Beware: Retail Investors Are Already Here, Says CryptoQuant

Bitcoin bulls still banking on a cycle peak driven by a wave of retail investors might want to rethink their strategy. A crypto market expert suggests that the “retail hasn’t arrived yet” narrative might be outdated.

“The idea that the cycle isn’t topping out due to the absence of on-chain retail activity? Time to reconsider that,” CryptoQuant founder and CEO Ki Young Ju posted on X on March 19th.

Ju argues that solely relying on on-chain metrics for tracking retail participation will give you an incomplete picture.

“It’s likely that retail investors are entering through ETFs — the paper Bitcoin layer— and that activity simply isn’t reflected on-chain,” Ju explained.

Russian Gotbit Founder Reportedly Seals $23M Plea Deal with US Prosecutors

Aleksei Andriunin, a Russian national facing charges of cryptocurrency manipulation through the Gotbit market maker platform, has reportedly reached a plea agreement with US prosecutors.

According to legal news service Law360 on March 19th, Andriunin, founder and CEO of Gotbit, has agreed to forfeit approximately $23 million in Tether’s USDt and Circle’s USDC as part of the plea deal with Massachusetts federal prosecutors.

The plea agreement entails Andriunin pleading guilty to three counts of conspiracy to commit wire fraud and market manipulation, details indicate in a letter signed by the defendant on March 19th.

Heads Up: ‘Cracked’ TradingView Version Packs Crypto-Stealing Trojan

Cybersecurity firm Malwarebytes is sounding the alarm about a sneaky new crypto-stealing malware threat. It’s hiding within “cracked” versions of TradingView Premium – software popular for financial charting tools.

Scammers are reportedly lurking in crypto-focused subreddits, posting links to Windows and Mac installers for “TradingView Premium Cracked.” Unbeknownst to users, these downloads are loaded with malware designed to siphon personal data and empty crypto wallets, Jerome Segura, a senior security researcher at Malwarebytes, warned in a March 18th blog post.

“We’ve already heard from victims whose crypto wallets were drained dry, and worse, the criminals then impersonated them to send out phishing links to their contacts,” he added, highlighting the cascading impact of this scam.

Read also

Features

You can now clone NFTs as ‘Mimics’: Here’s what that means

Features

Bitcoin ETFs make Coinbase a ‘honeypot’ for hackers and governments: Trezor CEO

Top Magazine Stories of The Week

Native Rollups: A Dummies Guide to L2s as Secure as Ethereum Itself

Imagine the peace of mind – users could potentially entrust $10 million in life savings to a Native Rollup with the same confidence they’d place it directly on Ethereum.

Meebits and CryptoPunks: Adult Hot Wheels Says New MeebCo Owner Sergito

“It was my very first crypto purchase, and my timing was incredibly fortunate. It happened that week when Bitcoin dipped to $3,000 and Ethereum plummeted to around $110,” recalls MeebCo’s Sergito.

Are Memecoins Done For? Solana ‘100x Better’ Despite Revenue Dip

The memecoin frenzy might be fading, impacting Solana’s network activity, transaction fees, and token price. However, proponents argue that the Solana network’s underlying health is stronger than ever.

Subscribe

Get the most engaging reads in blockchain, delivered to your inbox once a

week.

Editorial Staff

Cointelegraph Magazine writers and reporters contributed to this article.