Hodler’s Digest: Weekly Crypto Roundup

Argentina finalizes rules for virtual asset providers

Argentina is setting the stage for crypto regulation! The country’s securities watchdog just dropped the final rules for virtual asset service providers (VASPs). Think crypto exchanges and other platforms dealing with digital assets – these rules are for them, covering everything from how they should behave to keeping your crypto safe.

The official announcement of these regulations came on March 13th, courtesy of the National Securities Commission, or CNV as they’re known, under General Resolution No. 1058.

According to a translated version of the official announcement, these new rules place “obligations regarding registration, cybersecurity, asset custody, money laundering prevention, and risk disclosure” on all VASPs operating within Argentina.

And the goal? Straight from the announcement: to ensure “transparency, stability, and user protection” within the ever-evolving crypto world.

Argentine tax lawyer Diego Fraga chimed in, noting that the final guidelines will require VASPs to keep company funds separate from client funds, conduct annual audits, and submit monthly reports to the CNV.

US Rep. Byron Donalds to introduce bill codifying Trump’s Bitcoin reserve

Could Bitcoin become a formal part of US financial strategy? US Representative Byron Donalds is pushing for a new bill that would make President Trump’s Bitcoin reserve idea official. This move aims to solidify Bitcoin’s place by turning Trump’s executive order into law.

You might recall that President Trump signed an executive order on March 7th, proposing a national reserve built from Bitcoin seized in government criminal cases.

Now, Congressman Donalds is stepping in with legislation to ensure this Bitcoin reserve becomes a permanent fixture, preventing future administrations from easily dismantling it with a simple executive action.

“For years, the Democrats waged war on crypto,” Donalds, a Florida Republican, stated plainly in a statement to Bloomberg. “Now is the time for Congressional Republicans to decisively end this war.”

FTX liquidated $1.5B in 3AC assets 2 weeks before hedge fund’s collapse

Did FTX play a bigger role in the 3AC collapse than we thought? Leaked court documents reveal that FTX quietly liquidated a massive $1.53 billion of Three Arrows Capital (3AC) assets just two weeks before the hedge fund imploded in 2022. This bombshell challenges the previous story that 3AC’s downfall was just a market thing.

Once a crypto giant valued at over $10 billion, 3AC crumbled in mid-2022 after some risky, leveraged trades went south. Turns out, the hedge fund had borrowed funds from over 20 major institutions leading up to the May 2022 crypto crash that saw Bitcoin’s price plummet to $16,000.

However, this newly unearthed evidence shows that the FTX exchange pulled the plug, liquidating a staggering $1.53 billion of 3AC’s holdings just two weeks prior to the fund’s dramatic fall.

According to Mbottjer, the pseudonymous co-founder of FTX Creditor (a group representing FTX creditors and bankruptcy claim buyers), 3AC “asked a bankruptcy court to let it increase its claim against FTX from $120 million to $1.53 billion,” as reported on X.

SEC delays decision on XRP, Solana, Litecoin, Dogecoin ETFs

Still waiting on those crypto ETFs! The SEC has just pumped the brakes on decisions for several ETFs hoping to track XRP, Solana, Litecoin, and Dogecoin.

In a flurry of filings released on March 11th, the agency stated they’ve “designated a longer period” to mull over the proposed rule changes necessary for these ETFs to move forward.

Among the ETF applications caught in this delay are Grayscale’s XRP trust and Cboe BZX Exchange’s spot Solana ETF filings. Decisions on these and others have been pushed back until May.

Russia using Bitcoin, USDt for oil trades with China and India: Report

Is Russia turning to crypto to bypass sanctions? A new Reuters report says Russian companies are using Bitcoin and USDt to keep trade flowing with China and India despite international pressure.

Specifically, Russian oil companies are reportedly leveraging crypto assets like Bitcoin and Tether’s USDt to conduct international trade, according to Reuters reported on March 14th, citing inside information from four sources.

One Russian oil trader is reportedly pulling off tens of millions of dollars in transactions monthly using digital assets, according to a source who preferred to remain anonymous due to a non-disclosure agreement.

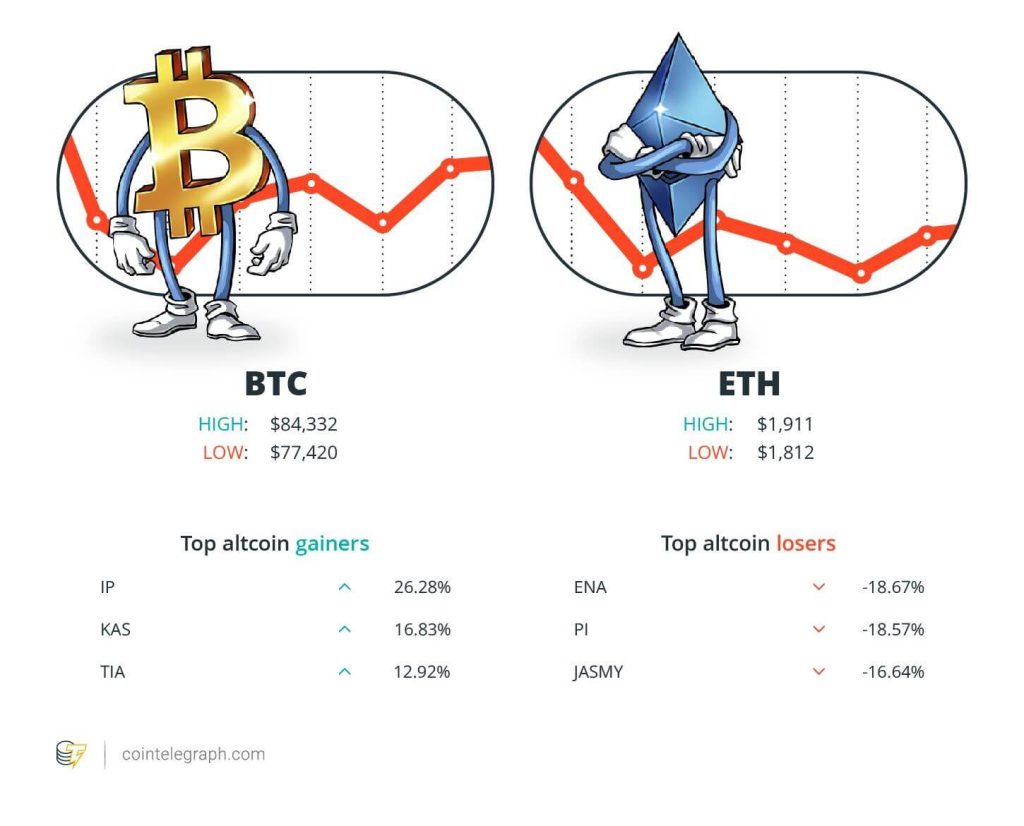

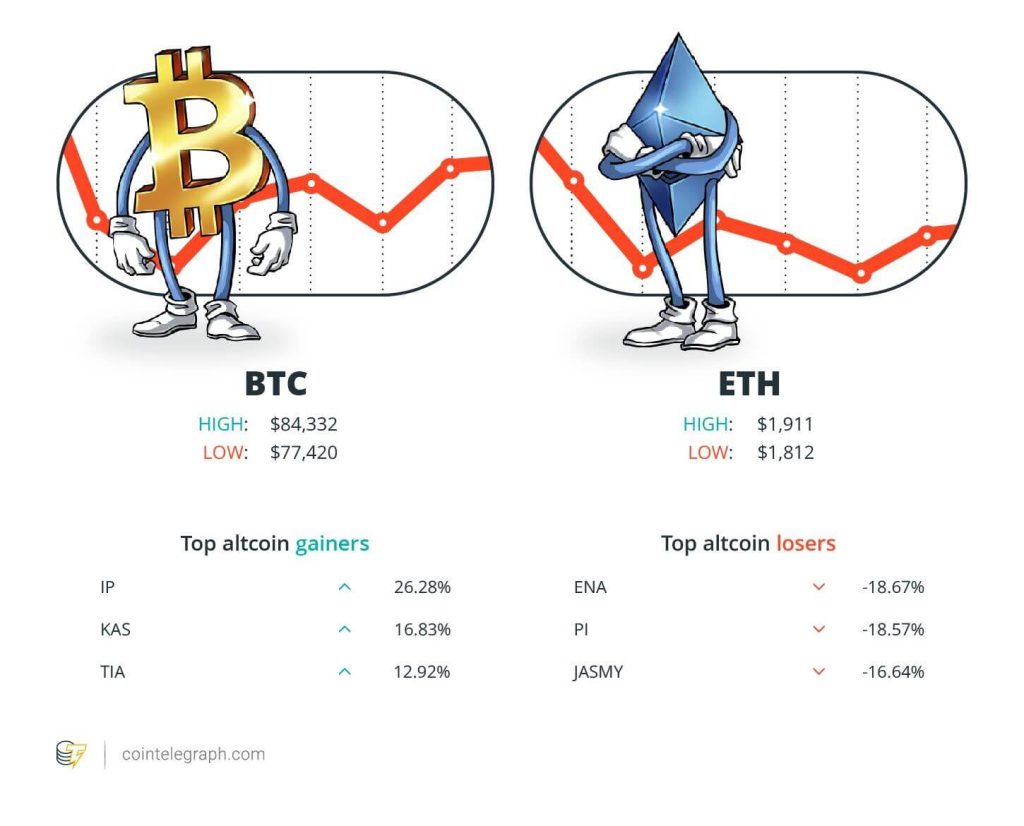

Winners and Losers

Let’s check the scoreboard! Here’s how the crypto markets landed this week. Bitcoin (BTC) closed at $84,322, Ether (ETH) at $1,911, and XRP at $2.39. Overall, the crypto market cap stands tall at $2.74 trillion, according to CoinMarketCap.

Zooming in on the top 100 cryptocurrencies, the three altcoins that enjoyed the biggest gains this week are Story (IP) with a 26.28% jump, Kaspa (KAS) up 16.83%, and Celestia (TIA) climbing 12.92%.

On the flip side, the toughest week belonged to Ethena (ENA), down 18.67%, Pi (PI) slipping 18.57%, and JasmyCoin (JASMY) retracting 16.64%. Want a deeper dive into crypto price movements? Make sure to check out Cointelegraph’s detailed market analysis.

Most Memorable Quotations

“As a long time Solana builder, the reason I stepped down is because I am far too trusting for how parasitic the memecoin space is.”

Ben Chow, co-founder of Meteora

“No felon would mind a pardon, especially being the only one in US history who was ever sentenced to prison for a single BSA [Bank Secrecy Act] charge.”

Changpeng “CZ” Zhao, former CEO of Binance

“With stablecoins under the government’s control, the result is the same, with the false veneer of decentralization added as a bonus.”

Jean Rausis, co-founder of Smardex

“The US administration is favorable toward cryptocurrencies and especially dollar-denominated stablecoins, which may raise certain concerns in Europe.”

Pierre Gramegna, managing director of European Stability Mechanism

“With Bitcoin dipping below $80,000, approximately 70% of all selling came from investors who bought within the last three months.”

Markus Thielen, CEO of 10x Research

“If Trump’s administration provides clearer regulations on stablecoins, ETFs and institutional adoption, altcoins could regain momentum.”

Alvin Kan, chief operating officer at Bitget

Top Prediction of The Week

Will Ethereum price bottom at $1.6K?

This week’s bold prediction: Will Ether’s price hit rock bottom at $1.6K? Ethereum’s Ether token took a tumble below $2,000 on March 10th and has been fighting to climb back above ever since.

Read also

Features

XRP win leaves Ripple and industry with no crypto legal precedent set

Features

UK cannabis millionaire’s legal ‘deals on wheels’ via crypto

After this dip, the altcoin touched a multi-year low of $1,752 on March 11th. But are things set to get even lower? Onchain data and technical analysis hint that the price could slide another 15% in the coming weeks.

This recent price drop below $2,000 has some significant onchain implications for Ether. Data from Glassnode, a leading analytics platform, reveals that ETH slumped below its realized price of $2,054 for the first time since way back in February 2023.

Top FUD of The Week

Bitcoin apparent demand reaches lowest point in 2025 — CryptoQuant

This week’s biggest FUD? Bitcoin demand slump! CryptoQuant data shows Bitcoin’s ‘apparent demand’ metric has plummeted to its lowest point in 2025, even dipping into negative territory. It seems traders and investors are getting cautious about risky assets amid all the economic uncertainty.

According to CryptoQuant’s Bitcoin Apparent Demand metric, demand for Bitcoin slid all the way down to a negative 142 on March 13th.

Read also

Features

Billions are spent marketing crypto to sports fans — Is it worth it?

Features

Crypto Is Alive and Well, Though Skeptics Say It’s ‘Not Money’

Bitcoin’s apparent demand had been on a positive streak since September 2024, reaching a peak around December 2024 before gradually starting to descend.

However, demand managed to stay in positive territory until the start of March 2025, after which it began a consistent decline.

Crypto founders report deluge of North Korean fake Zoom hacking attempts

Watch out for fake Zoom calls! At least three crypto founders have reported dodging sophisticated hacking attempts in recent days, allegedly from North Korean actors. The scammers are trying to swipe sensitive information through these bogus Zoom meetings.

Nick Bax, from the white hat hacker group Security Alliance, highlighted in a March 11th X post that this particular method used by North Korean scammers has already been used to steal millions from unsuspecting victims.

The typical tactic? Scammers reach out with a meeting invite or partnership proposal. Once the call is underway, they fake audio problems, display a generic stock video of a bored venture capitalist, and then send a link to a “new” call – watch out if you receive something similar, warns Bax.

Lazarus Group sends 400 ETH to Tornado Cash, deploys new malware

The notorious North Korean hacking group, Lazarus Group, is at it again. They’ve been busy moving crypto assets through mixers following a series of high-profile heists.

On March 13th, blockchain security firm CertiK alerted their X followers to a detected deposit of 400 ETH – roughly $750,000 – into the Tornado Cash mixing service.

“The fund trail leads back to the Lazarus group’s activities on the Bitcoin network,” CertiK noted in their alert.

This same North Korean cybercrime syndicate is believed to be behind the massive Bybit exchange hack on Feb. 21st, which resulted in a staggering $1.4 billion loss in crypto assets.

Top Magazine Stories of The Week

Crypto fans are obsessed with longevity and biohacking: Here’s why

Delve into the surprising (and perhaps a bit strange) connections between the crypto and longevity communities – it’s deeper and weirder than you might think!

Vitalik on AI apocalypse, LA Times both-sides KKK, LLM grooming: AI Eye

This week in AI: new evidence of AI deception surfaces, the LA Times’ AI gives a surprisingly sympathetic view of the KKK, and concerns rise over Russians seeding AI training data with propaganda.

Ridiculous ‘Chinese Mint’ crypto scam, Japan dives into stablecoins: Asia Express

Catch up on the latest from Asia: uncover a ridiculous “Chinese Mint” crypto scam, see how Cebu airlines in The Philippines are integrating blockchain, witness the Bithumb chair’s acquittal upheld, and explore Japan’s big bet on stablecoins.

Subscribe

The most engaging reads in blockchain. Delivered once a

week.

Editorial Staff

Cointelegraph Magazine writers and reporters contributed to this article.