Impact Zone: BTC & ETH Options Expiry – Market Implications

BTC and ETH Options Expiry: Get Ready for a $2.25B Market Jolt!

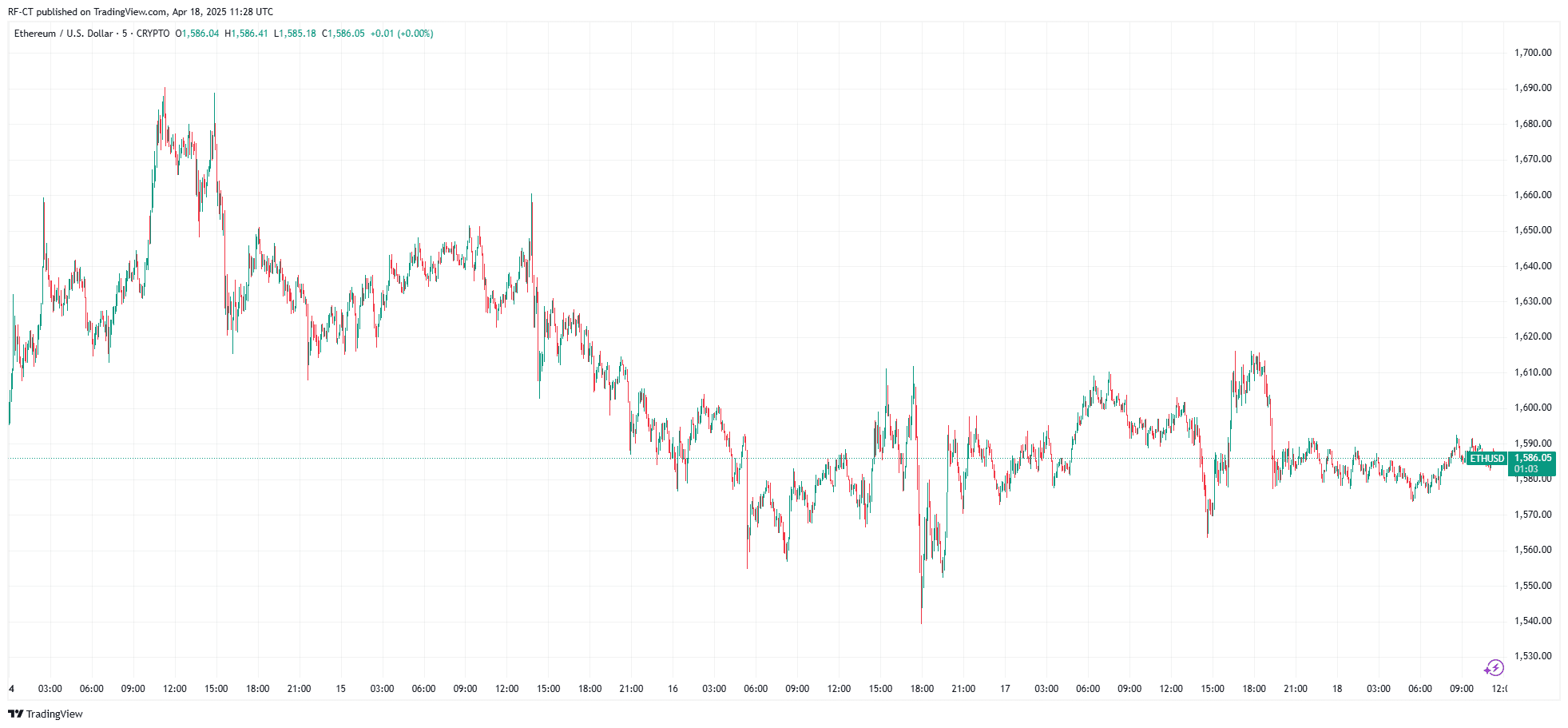

Hold onto your hats, crypto traders! Today, April 18, 2025, the market is geared up for some serious excitement. A whopping $2.25 billion in Bitcoin (BTC) and Ethereum (ETH) options are coming to an expiry. Specifically, we’re looking at $1.97 billion in BTC contracts and $280 million in ETH contracts all hitting their deadlines. With prices dancing around crucial levels, everyone’s eyes are glued to the charts to see what happens next.

This isn’t just another day in crypto; this options expiry event is a major pressure point that could send BTC and ETH on a wild ride, especially in the hours right after expiry. Buckle up!

Options Expiry Explained: Why All the Fuss?

Okay, let’s break down options. They’re basically financial tools that give you the choice (but not the demand!) to buy or sell assets, like BTC or ETH, at a price set in advance. Now, on expiry day, these options either get used (exercised) or simply vanish (expire worthless).

But here’s where it gets interesting – it’s not just about the numbers ticking over.

Let’s talk about the “max pain” theory. Think of it as the price point where the most options turn out to be worthless, causing the maximum collective pain for option holders. Rumor has it that big players—market makers and whales—often try to maneuver prices towards this “max pain” zone to maximize their own profit. Sneaky, right?

Here’s the lowdown for today:

- BTC Max Pain: $82,000

- ETH Max Pain: $1,600

Guess what? As of this morning, Bitcoin is trading at $81,500, and Ethereum is chilling around $1,580. That’s almost touching distance from their respective max pain levels. Coincidence? Maybe not!

Technical Charts: A Tug-of-War in the Crypto Sea

Looking at the technical side of things, it’s a bit of a mixed bag, which only adds to the day’s intrigue:

Bitcoin (BTC) Outlook:

- The Relative Strength Index (RSI) is hanging around 58, hinting at a bit of overbought conditions.

- The $82,000 mark is currently acting like a stubborn wall of resistance in the short term.

- Smash through that, and we could see a surge up towards $84,000–$85,000.

- But if $82K remains unbroken, we might see a dip back down to around $79,000.

Ethereum (ETH) Outlook:

- On the daily chart, ETH is showing a bullish engulfing pattern – a possible signal that the winds are changing direction and momentum might be picking up.

- Resistance is looming near $1,620, but support seems solid down at $1,550.

- Interestingly, trading volume on Uniswap has jumped by 15%, showing a real buzz of activity.

Investor Mood and Market Moves

Right now, the crypto crowd is split down the middle. Some think the big money players will try to pin Bitcoin and Ethereum right around those max pain levels, aiming to make a ton of call options expire uselessly. On the flip side, others are betting on a post-expiry surge, believing the market will finally be “free” from the constraints of these derivatives.

And just to spice things up further:

Liquidity is tight, and excitement is high. In this environment, even a small burst of trading volume could set off a chain reaction of price swings. Things could get very interesting, very quickly!

So, What Happens Next?

Often, expiry days lead to quiet trading or minor corrections. But today feels different. With BTC practically breathing down the neck of its max pain level, just $500 away, and ETH a mere $20 off, even a gentle nudge in buying or selling could cause some significant price movement.

Keep a close watch on:

- The big moment: the 4 PM UTC close, when most of these options contracts officially expire.

- Funding rates and any sudden volume spikes across major exchanges – these can be early indicators of big moves.

- Possible relief rallies or maybe even price drops after expiry, depending on whether the market manages to break through those key levels or gets pushed back down.

With a massive $2.25 billion in crypto options expiring today, get ready for potential shake-ups. Whether you’re a day trader looking for quick wins or a long-term investor playing the bigger game, today’s market action could very well set the stage for the next major swing in the crypto bull or bear saga. Stay alert!