Jackpot Miner: Tiny Rig, Huge Bitcoin Win

- Incredible luck! A Bitcoin solo miner just raked in $263K in rewards using a rig that fits in your pocket.

- Some good news for Bitcoin? Miner selling pressure seems to have eased up in March, potentially paving the way for BTC to bounce back.

Talk about a lucky strike! A solo Bitcoin [BTC] miner recently experienced an incredibly rare event, successfully finding a block and pocketing a sweet $263,000 reward using a surprisingly affordable mining rig.

According to Con Kolivas, a developer at solo.CKPool Bitcoin – the solo mining pool this miner used – this kind of success with such a small setup is a “1 in a million chance.”

“A miner with this level of equipment typically has less than a one-in-a-million chance of finding a block each day. To put it another way, on average, it would take about 3,500 years to find a block!”

Kolivas mentioned that the miner was using a Bitaxe machine, which runs at 480 Gigahash per second (GH/s), and was the 297th solo miner from that pool to strike Bitcoin block gold.

The lucky miner was rewarded with 3.15 BTC – valued at $263,000 – which includes both the block reward and transaction fees.

Miner flows

Source: CryptoQuant

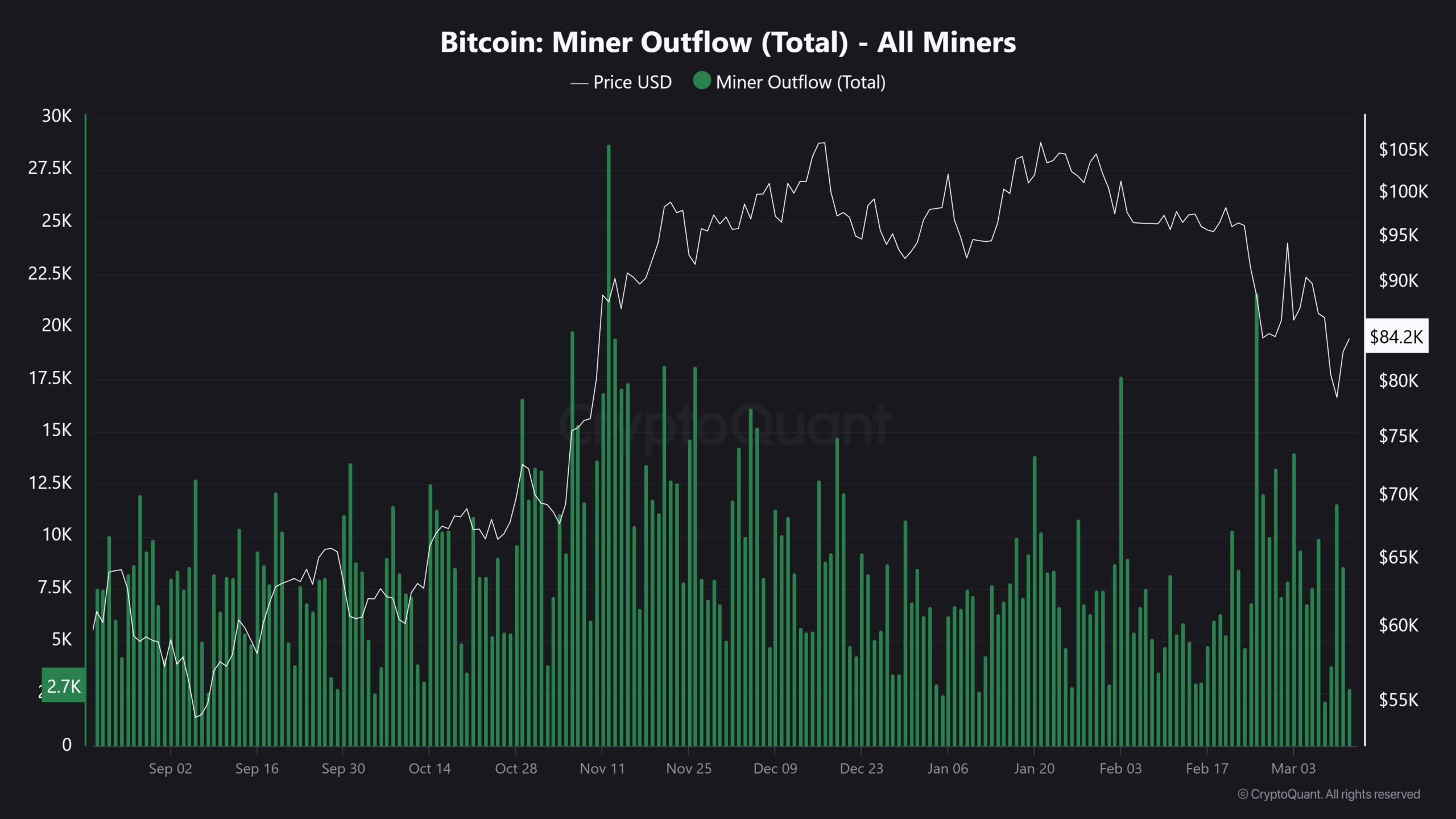

Moving on to miner activity overall, it seems the flow of BTC from miners – which can contribute to selling pressure – has decreased in March compared to what we saw at the end of February.

To illustrate, back on February 26th, a significant 21.6K BTC flowed out of miner wallets, a surge that coincided with Bitcoin’s price dipping below $90,000 for the first time recently.

The next notable miner sell-off occurred around March 10th, with 11.6K BTC being sold – about half the amount seen in late February.

Generally, it looks like miner selling pressure has lessened over the past couple of weeks, potentially giving Bitcoin more room to make a recovery.

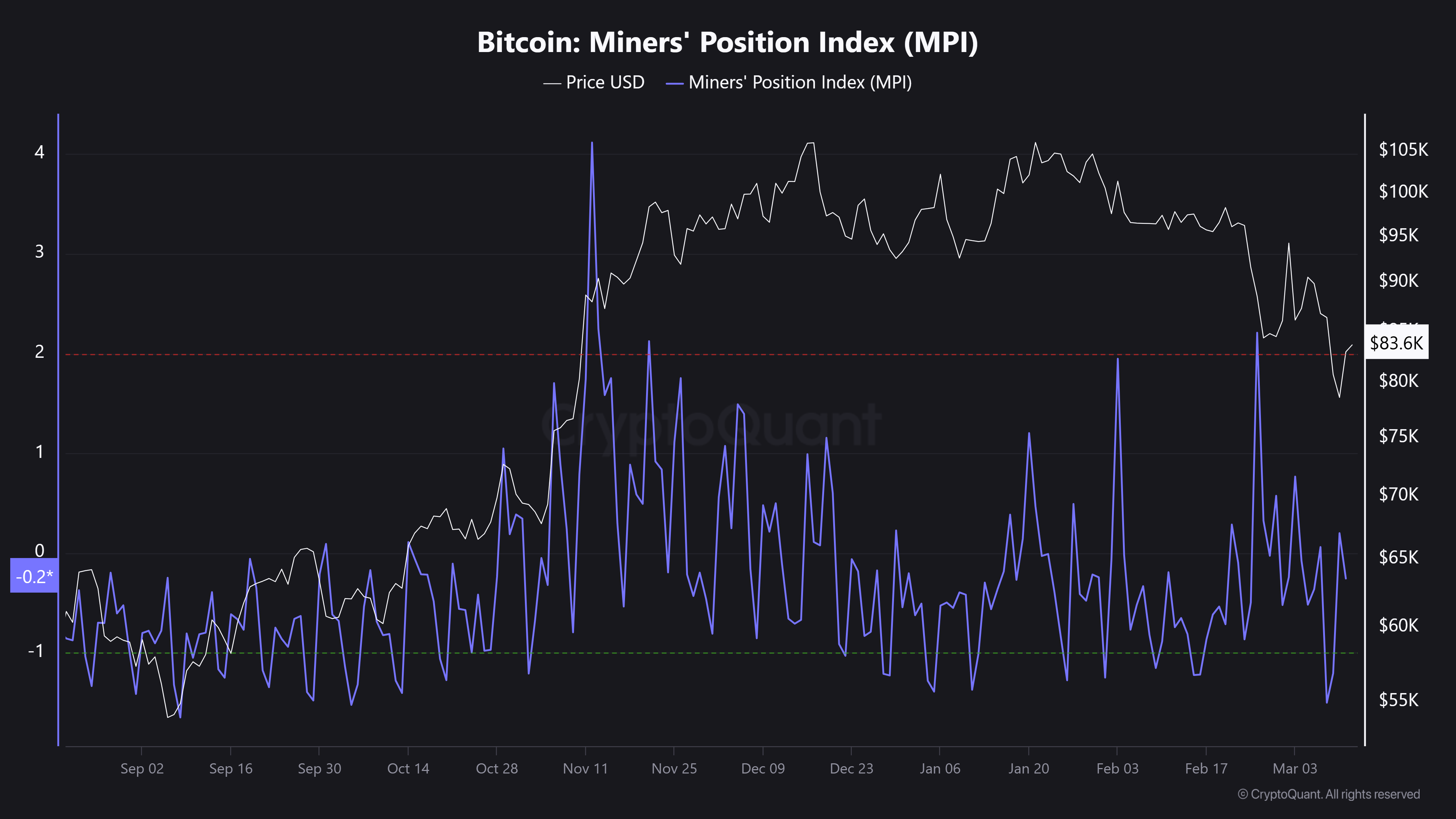

This idea is further supported by the Miners’ Position Index (MPI), which helps us understand if miners are selling their BTC and how it might affect the price.

The MPI jumped into an “overheated” zone above 2 in late February, confirming the increased selling pressure that contributed to Bitcoin falling below its previous range low of $92,000.

Source: CryptoQuant

Currently, the MPI has slightly come down, but if it were to climb above 2 again, it might put a lid on Bitcoin’s potential to rise further. Meanwhile, Bitcoin is trading around $84,000, a 10% increase from its recent lows of $76,000, but it’s currently facing some resistance around the $85,000 mark.