Liquidity Drain: Hyperliquid HLP Vault Hit by Risky Whale Trades

Hyperliquid protocol recently experienced a significant liquidity dip after a high-stakes move by a whale investor involving Ethereum (ETH). This bold bet on ETH forced Hyperliquid to step in and manage a massive 160,000 ETH position, tapping into its own liquidity to start the process of unwinding it.

A recent large and risky long position taken on Ethereum (ETH) put Hyperliquid’s system to the test. In a calculated move, a whale opened a substantial position, secured some profits by liquidating a portion, and then strategically allowed the remaining position to be liquidated.

This sequence of events meant Hyperliquid had to take control of the position at a price of $1,915 per ETH, facing the daunting task of liquidating the full 160,000 ETH. Market volatility at the time caused Hyperliquid to initially absorb a temporary loss of $4 million.

Hyperliquid protocol clarifies the liquidity drain is not an exploit

To address concerns, the protocol made it clear that this liquidity drawdown and liquidation were not the result of a hack or exploit. Rather, a trader employed a risky, albeit sophisticated, strategy that allowed them to be long on ETH for a short period—less than an hour—and successfully pocket some profits. After this brief window, the trader let the position expire, leaving the decentralized exchange (DEX) to deal with the resulting losses.

Regarding commentary and questions on the 0xf3f4 user's ETH long:

To be clear: There was no protocol exploit or hack.

This user had unrealized PNL, withdrew, which lowered their margin, and was liquidated. They ended with ~$1.8M in PNL. HLP lost ~$4M over the past 24h. HLP's…

— Hyperliquid (@HyperliquidX) March 12, 2025

In response to this incident, Hyperliquid is indicating a need to re-evaluate and potentially adjust its leverage limits for Bitcoin (BTC) and Ethereum (ETH). The aim is to discourage such high-risk strategies in the future. Ultimately, this whale trader reportedly walked away with a profit of $1.8 million, while simultaneously creating a $4 million unrealized loss for Hyperliquid and burdening them with unwinding the substantial position.

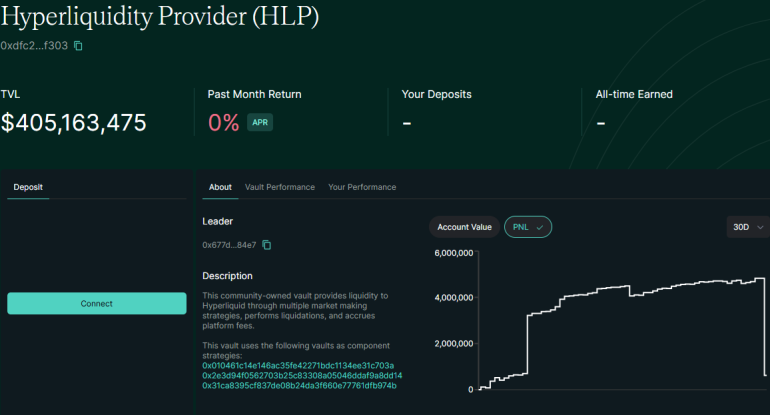

The funds used to manage this position were drawn from the HyperLiquidity Provider (HLP) community vault. This vault is designed to generate earnings by providing funding to traders on the platform. While the vault currently holds over $408 million in liquidity, this single whale’s maneuver wiped away more than $4.2 million in profit and loss (PnL).

Hyperliquid typically offers conservative leverage, even for volatile meme tokens, usually in the 3-5X range. It often sets itself apart from competitors by accommodating riskier trading strategies. The decentralized nature of the market, relying on community liquidity and decentralized vaults, often allows for less regulation and a less cautious approach to leverage.

HLP vault took on bad debt

The trader’s actions have been interpreted as more than just high-stakes risk-taking. The strategic timing of the margin collateral withdrawal, occurring after less than an hour of trading, suggests the whale deliberately aimed to secure profits while offloading the resulting “bad debt” onto the exchange.

Compounding the situation, copy traders also mirrored the whale’s positions, with mixed outcomes overall. The whale’s decision to go long on ETH was seen as a particularly risky and perhaps unconventional play, capitalizing on the market’s recent bounce back from local lows.

Hyperliquid has since reminded its users that participating in the HLP pool, while offering the potential for passive income from trading activity, is not without risk. It’s worth noting that the vault still holds over $60 million in total gains accumulated over its operational history.

A key concern for Hyperliquid is the possibility that the whale’s actions were pre-meditated, and the impact was amplified by the involvement of copy traders. Many analysts speculate that the liquidation of a 160,000 ETH position was a calculated move designed to force the HLP vault to absorb the toxic position. The initial withdrawal of margin collateral further contributed to triggering the liquidation, both for the primary whale trader and those who followed suit.

This large long liquidation essentially exploited the HLP vault mechanism. The liquidity pool’s design means that profits and losses are shared among all participants. As a consequence, liquidity providers are now faced with covering the substantial loss incurred by this large long position. Adding to the intrigue, there are suspicions that the whale may have also held a short position simultaneously to profit further from the resulting liquidation event, although no concrete evidence of corresponding large short positions in ETH at that precise time has surfaced.

Reports indicate the trader employed leverage ranging from 13X to 19X to maximize initial gains in this operation. The entire maneuver was executed with $23 million in underlying capital, although the final liquidation amount reached over $306 million.

Following the news of this significant liquidation and its impact on the HLP pool, Hyperliquid’s native HYPE token experienced a temporary price drop of up to 10%.

HYPE’s price dipped to around $12.80 before showing signs of recovery to $13.35. The high-profile liquidation event also had repercussions for Ethereum (ETH) itself, with the asset price briefly falling to $1,915.83 – levels coinciding with the liquidation of the whale’s large position. This recent risky trade on Hyperliquid may have broader implications for the crypto market, potentially hindering Ethereum’s recent rally beyond the $2,000 mark.

Cryptopolitan Academy: Coming Soon – A New Way to Earn Passive Income with DeFi in 2025. Learn More