Liquidity Drives Bitcoin Prices

Ever wonder what *really* moves the Bitcoin price? We often look at on-chain metrics, technical charts, and the big picture economy. But there’s a powerful force that’s often missed: Global Liquidity. It’s a bit of a hidden gem, and understanding how it works could seriously change how you see Bitcoin’s ups and downs.

Impact on Bitcoin

Lately, Global Liquidity is the talk of the town, popping up in Twitter (X) feeds and analyst discussions. Everyone’s digging into these liquidity charts. And for good reason! Figuring out the relationship between Global Liquidity and Bitcoin? That’s key for anyone trading or holding for the long haul. But here’s the thing: recent trends are a little…different. The old rules might not fully apply anymore, and we need to look a bit deeper.

Okay, so what is Global M2 money supply, exactly? Think of it as all the readily available cash out there – physical money, checking accounts, stuff you can easily turn into cash. Historically, when this total money pot grows, that extra cash tends to look for better returns. Where does it go? Often into things like Bitcoin, stocks, and commodities. On the flip side, when the money pot shrinks, those “riskier” assets can take a hit as things get tighter.

In the past, Bitcoin has pretty much danced to the tune of Global M2. More liquidity, price goes up. Less liquidity, price feels the squeeze. But in this cycle, things look a bit…off. Even though Global M2 has been climbing, Bitcoin’s price hasn’t always followed suit. Interesting, right?

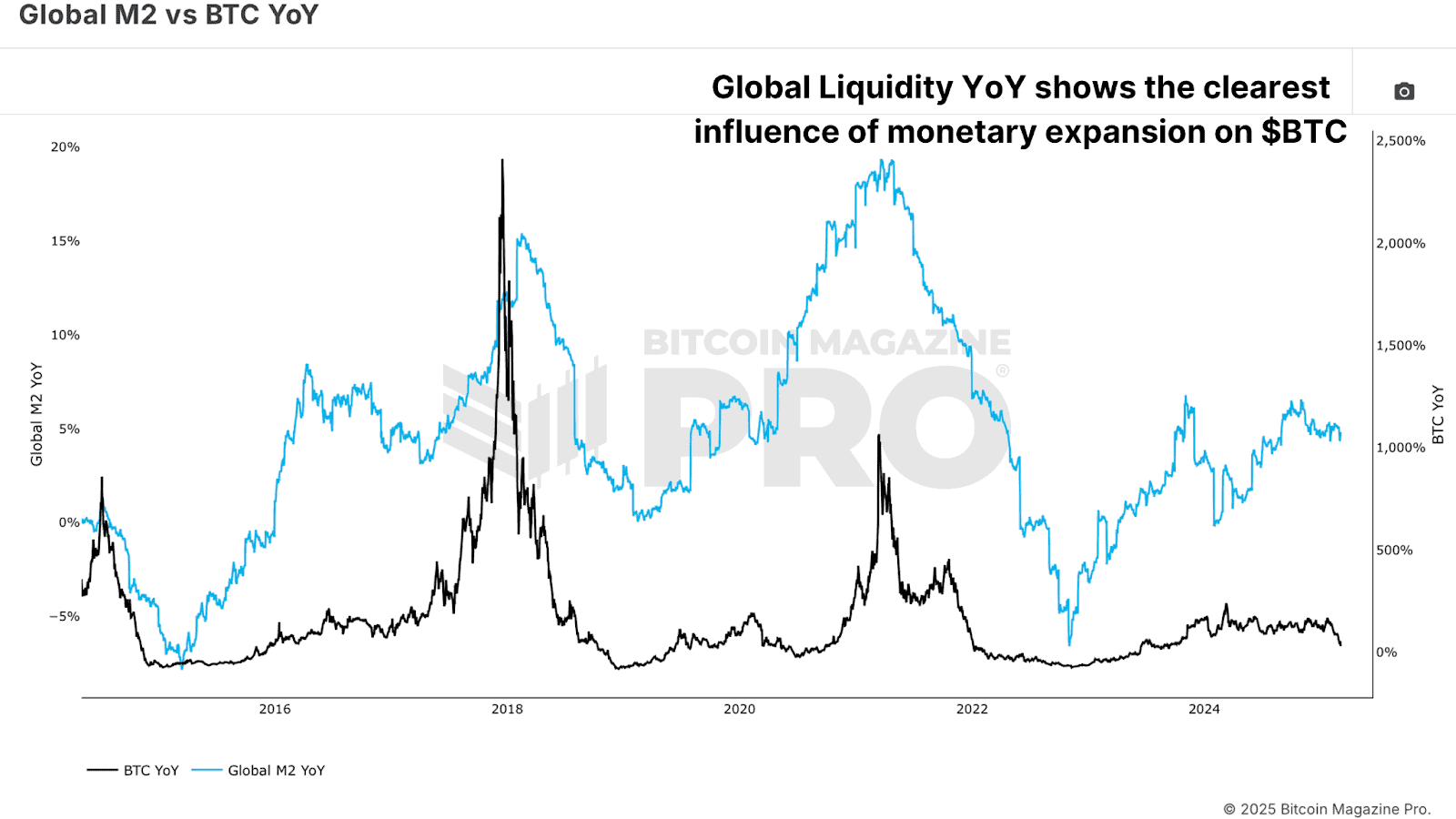

Year-on-Year Change

Instead of just looking at the raw number for Global M2, there’s a smarter way to see what’s going on: look at how much it’s changing each year. This yearly change tells us if liquidity is speeding up or slowing down. And *that* seems to really line up with how Bitcoin behaves.

Take a look at the Bitcoin Year-on-Year Return (YoY) compared to Global M2 YoY Change. Suddenly, things make a lot more sense! Bitcoin’s epic bull runs? They happen when liquidity is growing fast. Price dips or sideways trading? Often come after liquidity growth slows or even shrinks.

Think back to early 2025, when Bitcoin was in that consolidation phase. Global M2 was still inching up, but the *speed* of that growth was flatlining. Bitcoin only really took off again when M2 started expanding at a faster pace.

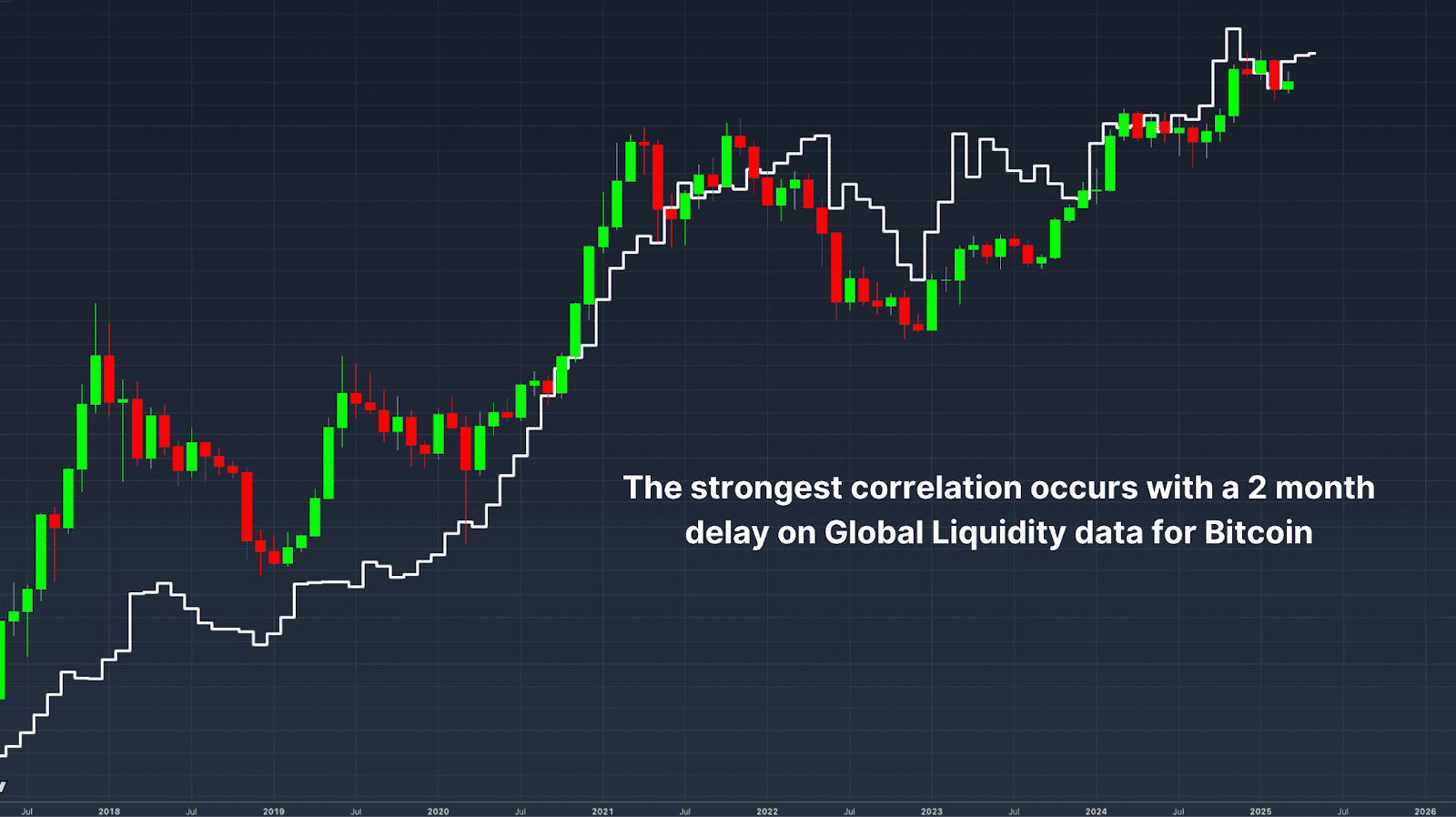

Liquidity Lag

Here’s another interesting wrinkle: Global Liquidity doesn’t hit Bitcoin’s price instantly. Research points to about a 10-week delay. If you push the Global Liquidity chart forward by 10 weeks, the link with Bitcoin gets much stronger. But, if you really fine-tune it, it looks like the sweet spot is actually closer to 56 to 60 days, or around two months.

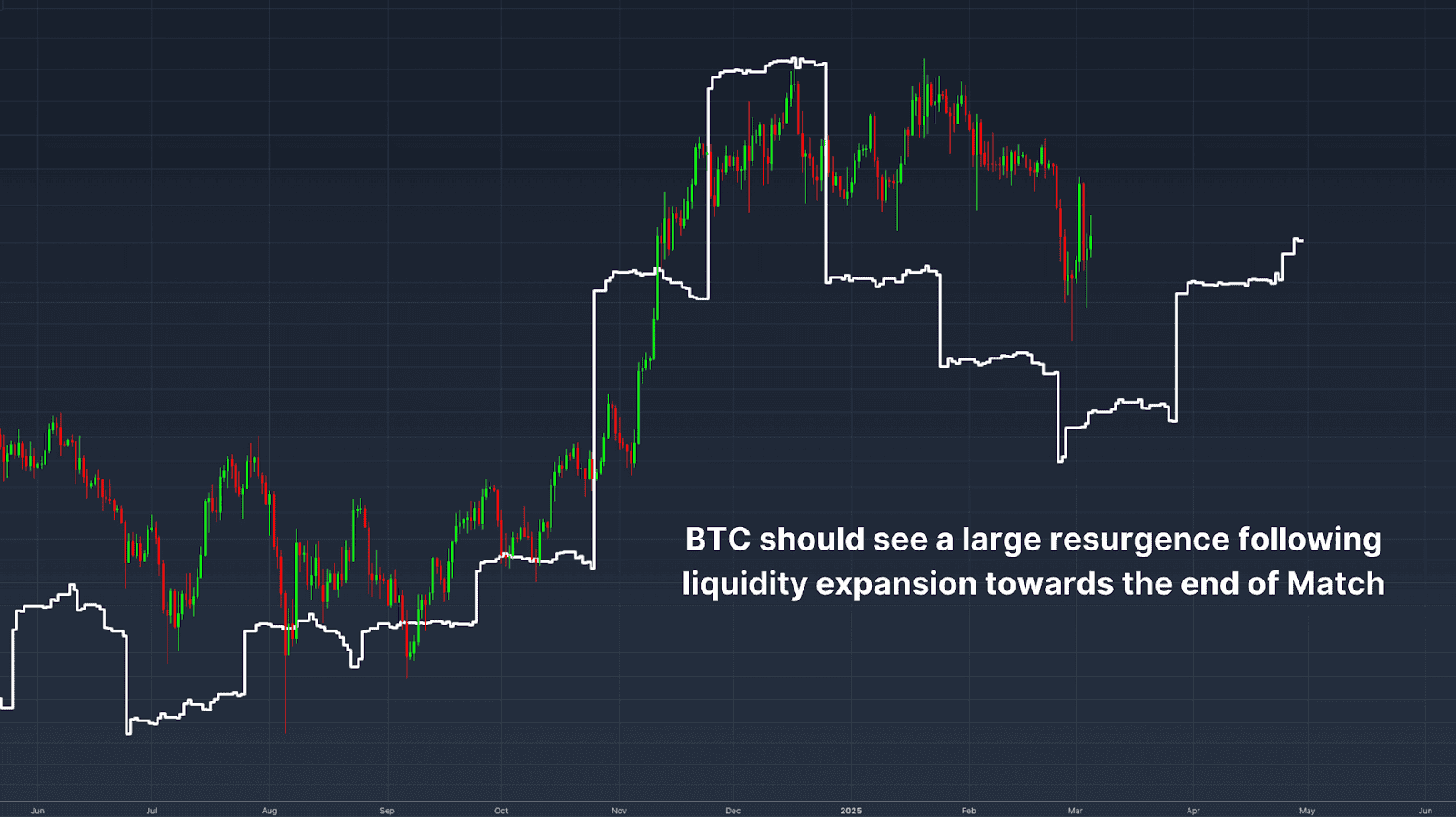

Bitcoin Outlook

For most of 2025, Global Liquidity has been kind of flat after that big surge in late 2024 that sent Bitcoin soaring. This pause in liquidity growth lines up with Bitcoin chilling out around $80,000. But, if history is any guide, this recent pickup in liquidity growth should mean we’ll see Bitcoin make another upward move sometime around late March.

Conclusion

Bottom line? Keeping an eye on Global Liquidity is crucial if you’re trying to figure out where Bitcoin’s headed. But instead of just looking at the overall M2 number, you’ll get a much clearer picture by watching how fast it’s changing and remembering that roughly two-month delay before it really impacts Bitcoin.

As the global economy shifts and central banks adjust their strategies, liquidity trends will continue to be a major factor for Bitcoin’s price. The next few weeks are going to be interesting. If Global Liquidity keeps accelerating like it is now, Bitcoin could be setting up for a significant surge.

Enjoyed this breakdown? Want to dive deeper into Bitcoin price movements and market patterns? Check out our recent guide on mastering Bitcoin on-chain data!

Want to stay ahead of the curve? Explore live data, interactive charts, key indicators, and in-depth analysis at Bitcoin Magazine Pro.

Disclaimer: Just a friendly reminder, this is for informational purposes only, not financial advice. Always do your own homework before making any investment decisions.