MELANIA: Freefall – Buyers Absent, Sell-Offs Accelerate

- We’re seeing a significant jump in MELANIA sell orders in the last 24 hours, which could be a sign that the price is heading for another drop.

- Keep an eye on a crucial support level on the price chart. If this level breaks, it could trigger another big downturn in the market.

Melania Meme [MELANIA] is still struggling as one of the market’s weakest performers. It’s already down 43.46% over the past month, and another 20.54% just in the last week.

And things don’t seem to be turning around. Over the past day, MELANIA has taken a dive, losing 4.75%. Our team at AMBCrypto has pinpointed a key factor that might push the price even lower.

MELANIA Team Triggers Price Drop with Massive Sell-off

It looks like the recent price decline is being driven by the very team behind the meme token. According to data from Lookonchain, they’re continuing to sell off their holdings.

During this latest round, the team cashed out a hefty $2.24 million worth of MELANIA tokens. This brings their total sales for the past month to a staggering 13 million tokens, equivalent to $8.02 million.

This current sell-off is particularly concerning because it’s coming directly from the team itself. This kind of action can really spook investors and potentially push the price down even further.

Source: Lookonchain

It makes you wonder, doesn’t it? Is the team losing faith in their own token? Their actions suggest they’d rather hold onto more stable assets. Could this be a signal to other investors that they’re jumping ship to avoid even bigger losses?

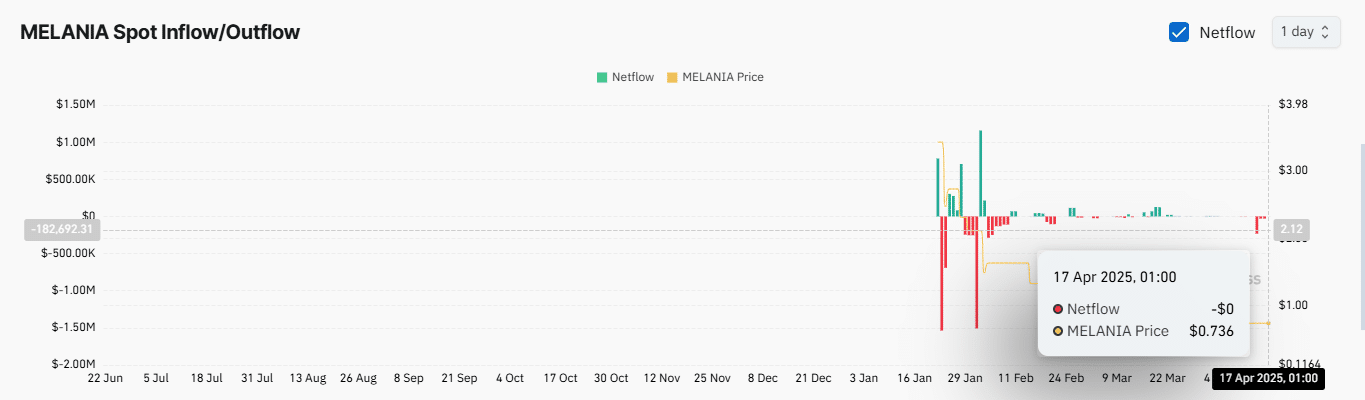

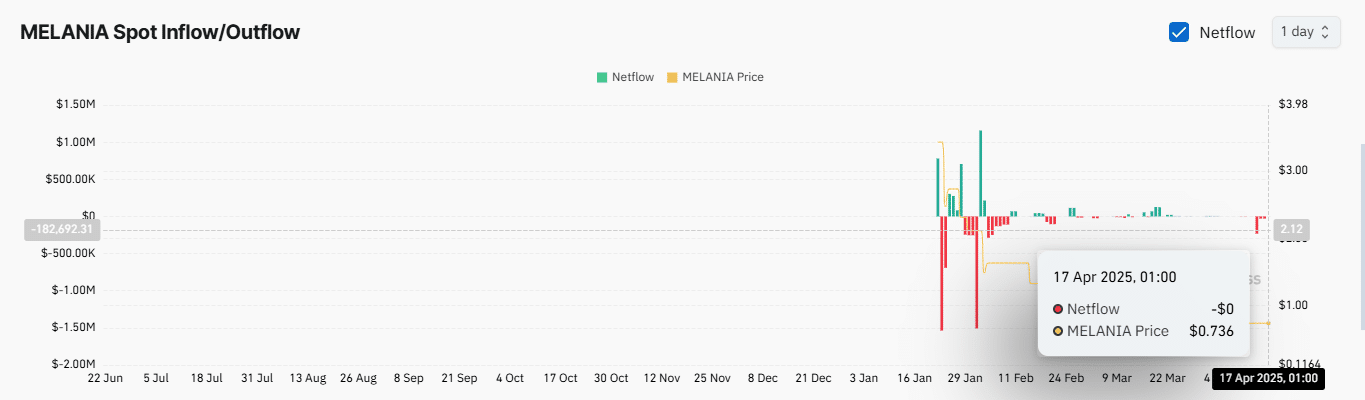

Adding fuel to the fire, our analysis of Coinglass data shows spot investors are mostly sitting on their hands, with not much buying or selling going on. This lack of activity further confirms the overall lack of confidence in MELANIA right now.

As we’re writing this, the exchange netflow is still at $0. This essentially means there’s an equal amount of buying and selling, with neither side making a decisive move.

Source: Coinglass

What’s Different About This Dip?

Typically, when prices fall this low—especially into these lower price ranges—you’d expect to see investors buying the dip, especially if they strongly believe in the asset’s future. But that’s not what’s happening with MELANIA right now.

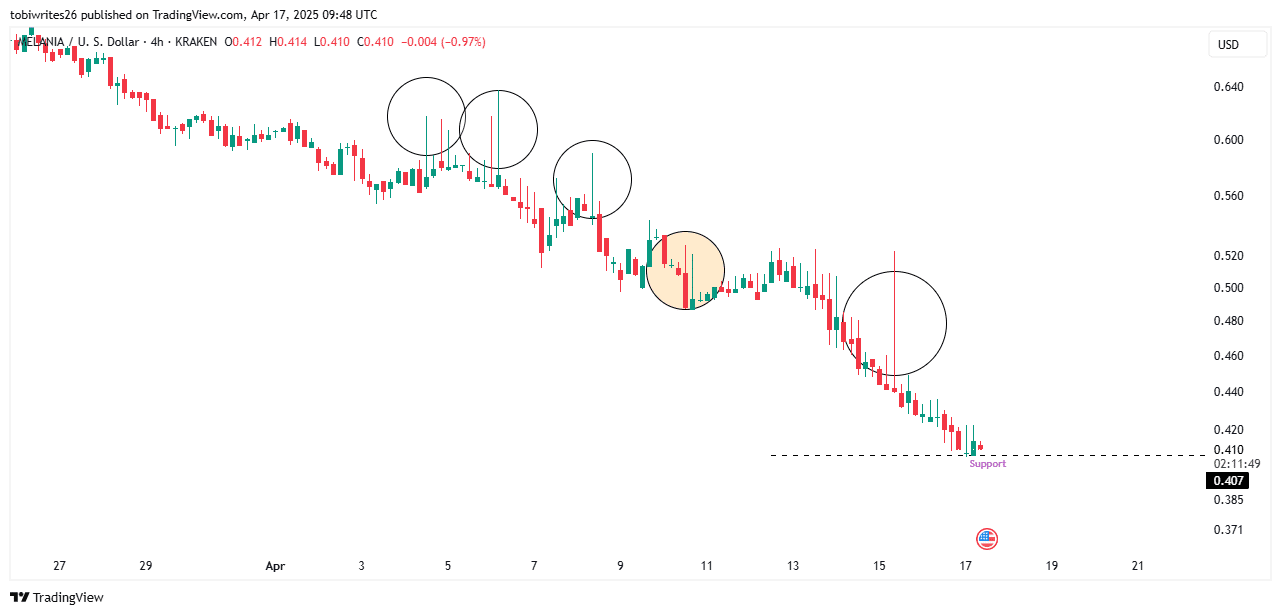

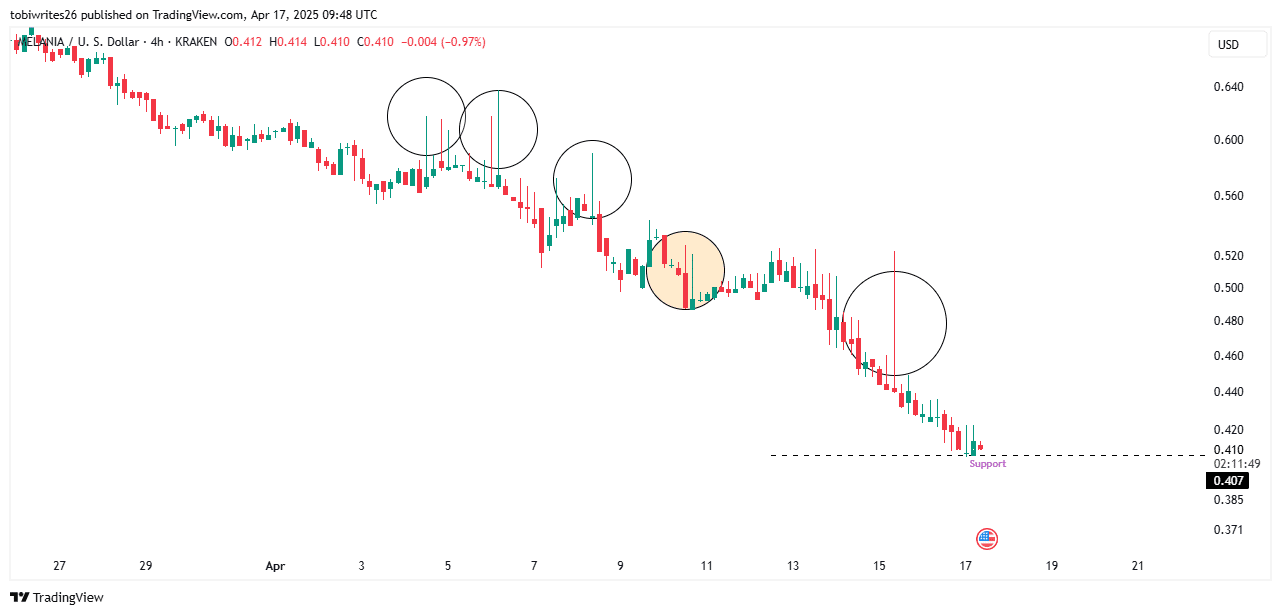

Our analysis of MELANIA’s 4-hour chart points to a potential price sweep as a key factor for further losses.

Looking back, we noticed five instances on the chart (circled for you) where a price sweep was followed by a sudden and sharp drop. This move usually liquidates leveraged buyers as the market turns against their predictions.

We saw this happen on April 15th, when the team sold around $572,000 worth of MELANIA, and similarly on April 10th. It’s looking like we might be setting up for a repeat of this pattern soon.

Source: TradingView

But even if this price sweep doesn’t materialize, MELANIA could still be in for more pain if the $0.407 support level gives way and is breached.

The gloomy mood is strong in the derivatives market too. The OI-Weighted Funding Rate, a measure of market sentiment, has plummeted to one of its lowest points this year, sitting at 0.5619% at the time of this report.

A significant price drop, combined with this funding rate continuing to slide, strongly suggests that traders in the derivatives market are betting heavily against MELANIA and are willing to pay extra to keep their short positions open.

Could MELANIA Rebound?

While overall market sentiment is leaning bearish, there’s an interesting divergence on Binance—the world’s largest crypto exchange by trading volume.

It appears that top traders on Binance are actually bucking the trend and placing bets that MELANIA will go up. Currently, this group has a Long/Short Ratio of 3.075, meaning there are significantly more bets on the price going up (long contracts) in the futures market.

In fact, a substantial $15.69 million worth of MELANIA has changed hands on Binance, with the majority of that volume coming from long positions.

If this bullish interest from Binance traders spreads to other exchanges and the crucial support level manages to hold, MELANIA might just find some stability and avoid another sharp decline.