MiCA Compliance: Binance to Delist Stablecoins in Europe on March 31

Update (March 3, 1:00 pm UTC): We’ve updated this article to reflect that Binance hasn’t yet clarified whether it will need to completely remove non-MiCA-compliant tokens from its platform once they secure their MiCA license.

Big news for European crypto users: the exchange Binance is set to delist several stablecoins within the European Economic Area (EEA) as they move to align with the upcoming Markets in Crypto-Assets (MiCA) Regulation.

Starting March 31st, users in the EEA will see spot trading pairs for nine stablecoins disappear from Binance. Among those being removed are well-known names like Tether’s USDt

and Dai . The exchange made the announcement on March 3rd, outlining their move to comply with the European MiCA rules.

However, Binance reassured users that even after the delisting, they’ll still have options. They can continue to sell their holdings of these non-MiCA-compliant stablecoins using the Binance Convert feature.

The good news is that stablecoins already meeting MiCA standards, like those issued by Circle such as USDC

and Eurite (EURI), will remain available and operate as usual on Binance, the exchange confirmed.

Deposits and withdrawals remain supported

Binance is now advising EEA users to consider shifting their non-MiCA-compliant stablecoins to alternatives that are compliant, such as USDC and EURI, or even to traditional fiat currencies like the euro. Importantly, despite the delisting, Binance will continue to provide custody services for the affected stablecoins.

“You can rest assured that custody for non-MiCA-compliant stablecoins will continue, and you’ll be able to withdraw or deposit these stablecoins whenever you need,” the announcement emphasized, aiming to reassure users about continued access to their assets.

An excerpt from Binance’s announcement of delisting non-MiCA-compliant stablecoins. Source: Binance

A Binance spokesperson clarified to Cointelegraph, reiterating that “EEA users will still be able to hold and deposit non-MiCA-compliant stablecoins and convert them to MiCA-compliant stablecoins or withdraw them.” However, they also pointed out a key limitation:

“They will not be able to use these stablecoins for any other products and services on our platform.”

In essence, Binance is encouraging its EEA users to make the switch from non-MiCA stablecoins sooner rather than later to ensure they can continue to enjoy the full spectrum of products and services the platform offers, the spokesperson further explained.

Binance is yet to receive a MiCA license

For those curious about the specifics, the complete list of non-MiCA-compliant stablecoins being affected on Binance includes: Tether USDt, Dai, First Digital USD

, TrueUSD , Pax Dollar

, Anchored Euro (AEUR), TerraUSD (UST), TerraClassicUSD

and PAX Gold .

While Binance has stated they will continue to support deposits and withdrawals for these stablecoins after March 31st, questions are circulating regarding whether this approach truly meets the full requirements of MiCA compliance.

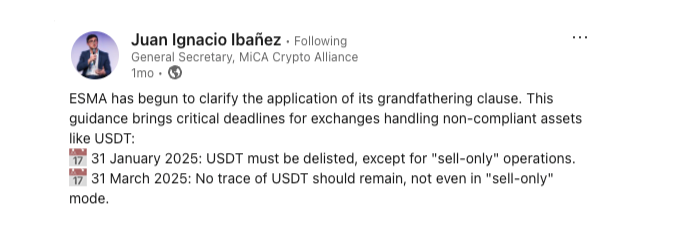

In fact, the European Securities and Markets Authority (ESMA), a key supervisor for MiCA compliance, actually urged European crypto service providers back in January to completely delist non-compliant tokens by March 31, 2025.

Source: LinkedIn

Juan Ignacio Ibañez, a member of the Technical Committee of the MiCA Crypto Alliance, emphasized this point plainly on LinkedIn in January, stating, “No trace of USDT should remain, not even in ‘sell-only’ mode, by March 31.”

This announcement from Binance arrives as the exchange is still in the process of securing its MiCA license. Previously, Binance had announced adjustments to its deposit and withdrawal procedures in Poland to get in sync with the MiCA framework, expected to be in full effect by January 2025.

Interestingly, Binance has not yet commented on their specific plans for obtaining a MiCA license, nor have they clarified definitively whether they will be obligated to completely stop listing these non-compliant tokens once they are licensed.

Magazine: How crypto laws are changing across the world in 2025