Mutuum Finance: Top DeFi Pick Amid Bitcoin Crash Concerns

Okay, here’s a more natural and engaging rewrite of the content while keeping all HTML tags exactly as they are, and maintaining the original tone, style, and intent, just with improved clarity and flow:

Bitcoin’s price is having a tough time holding onto key support levels right now, and that’s got people increasingly worried about a potential market correction. As this uncertainty hangs in the air, analysts are starting to look beyond just Bitcoin for opportunities with serious growth potential, and one name keeps popping up: Mutuum Finance (MUTM).

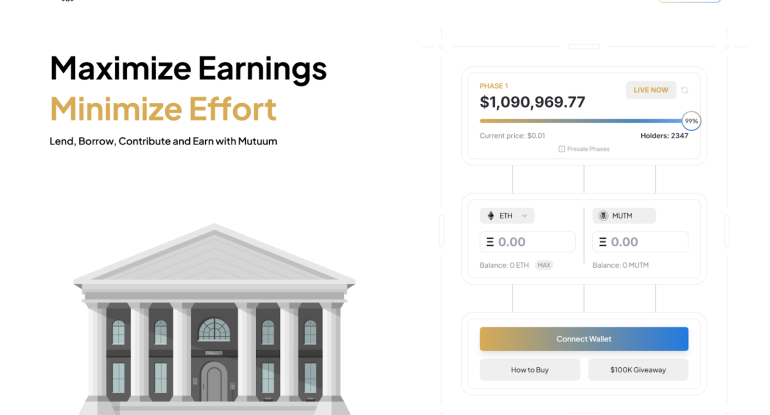

Currently, you can snag MUTM for just $0.01 during its presale. What is Mutuum Finance? It’s being built as a decentralized lending platform with a focus on real-world financial applications. Unlike some crypto projects based purely on speculation, Mutuum Finance provides actual borrowing and lending services, and it’s designed to reward its users through a well-thought-out ecosystem. They’ve already raised over $1 million and are practically sold out of Phase 1 (97% gone!), so it’s easy to see why many investors are viewing MUTM as an interesting alternative while Bitcoin is seeing some ups and downs.

What is Mutuum Finance (MUTM)?

Mutuum Finance (MUTM) is quickly making a name for itself in the world of decentralized finance (DeFi). Think of it as a lending hub where you can borrow, lend out your crypto, and earn some passive income along the way. The platform’s setup cuts out the middleman, letting users access the cash they need without having to sell off their crypto assets.

One really interesting thing about Mutuum Finance is its overcollateralized stablecoin. This is designed to be a safe and transparent way to borrow. It’s built on Ethereum and, importantly, it’s backed 1:1 by assets held on the blockchain. This backing aims to ensure price stability while staying true to the decentralized spirit of crypto. So, borrowers get access to funds while still holding onto their original crypto, which can be a smart way to make your capital work harder for you.

To make sure MUTM tokens hold their value over the long haul, Mutuum Finance has a clever mechanism: they buy back and distribute. Basically, a portion of the platform’s earnings is used to buy MUTM tokens directly from the market. These bought-back tokens are then given out to people who stake mtTokens. This system is designed to create consistent demand for MUTM, all while rewarding those who are actively participating in the ecosystem.

MtTokens are at the heart of Mutuum Finance’s lending system, offering users a way to generate passive income while keeping their assets readily available. When you deposit crypto assets into the platform, you receive mtTokens in return, at a 1:1 ratio with what you put in.

For example, if you supply Ethereum (ETH), you’d get mtETH. The cool thing is that mtETH’s value grows over time as borrowers repay their loans. Instead of the exchange rate changing, the value you can redeem your mtTokens for gradually increases. This means lenders directly benefit from the interest earned within the lending pools.

These mtTokens are fully ERC-20 compatible, which is great because it means you can easily transfer them, hold them, or even use them in other DeFi applications – all while they’re still earning you yield. And when you decide you want to withdraw your funds, you just redeem your mtTokens and get back your original crypto, plus all the interest it has accumulated.

This whole setup ensures a smooth and efficient way for lenders to really maximize their returns without constantly micromanaging their holdings. It all ties back into Mutuum Finance’s aim: to build a sustainable and rewarding space for decentralized lending.

Presale Success and Growth Potential

Mutuum Finance’s presale is already proving to be a hit, having raised over $1 million, with over 97% of the Phase 1 tokens already scooped up. Investors are getting in on MUTM at $0.01, knowing the price is set to go up in the next phase. Looking ahead, with a clear roadmap, plans for exchange listings, and a beta platform launch in the works, many analysts are predicting that Mutuum Finance has a real shot at becoming a high-growth asset in 2025.

So, as Bitcoin goes through a period of ups and downs, traders are naturally exploring other investment avenues. Mutuum Finance, with its focus on a real-use DeFi ecosystem, is positioning itself as a strong contender for those seeking more stable returns beyond just market speculation.

Will Bitcoin (BTC) Face Another Price Drop?

Bitcoin (BTC) is in a bit of a tricky spot again, as it’s struggling to stay above key support levels. Having tested the $95,000 range repeatedly, analysts are cautioning that if it breaks below this, we could see further price declines. On-chain data is also hinting at a shift in market mood, with traders becoming less willing to take on risk. Furthermore, liquidations of long positions in Bitcoin futures have hit a two-year high, suggesting that leveraged positions are being forced closed, adding to the selling pressure.

If Bitcoin does lose its current support, analysts are pointing to potential downside targets between $88,000 and $91,000, with a more pessimistic scenario taking it closer to $77,000. However, some believe that a sharp bounce back from these lower levels could spark renewed buying interest and prevent a prolonged downturn. While the short-term picture for Bitcoin remains uncertain, many investors are keeping an eye on alternative assets like Mutuum Finance (MUTM) as potential opportunities in the midst of BTC’s volatility.

For more information about Mutuum Finance (MUTM) visit the links below:

Website:

Linktree: