Outflows Surge: Bitcoin ETFs Lose Billions as Market Weakens

- Market turmoil hits Bitcoin and digital asset ETPs hard, leading to unprecedented outflows.

- On February 24th, US Spot Bitcoin ETFs experienced a massive $1 billion+ exodus.

- Bucking the trend, XRP ETPs demonstrated surprising resilience, attracting $38 million even as the market slumped.

It’s been a rough patch for digital asset exchange-traded products (ETPs) and Bitcoin funds lately. Market jitters are taking their toll, leading to noticeable outflows from these investments, and Bitcoin, along with other cryptocurrencies, is definitely feeling the heat.

According to James Butterfill, research head at CoinShares, this week’s outflows have hit a staggering $2.6 billion – a record high for Bitcoin and digital asset ETPs! However, Butterfill offers a glimmer of hope, suggesting that the intense selling pressure might be easing off as the basis trade unwinds.

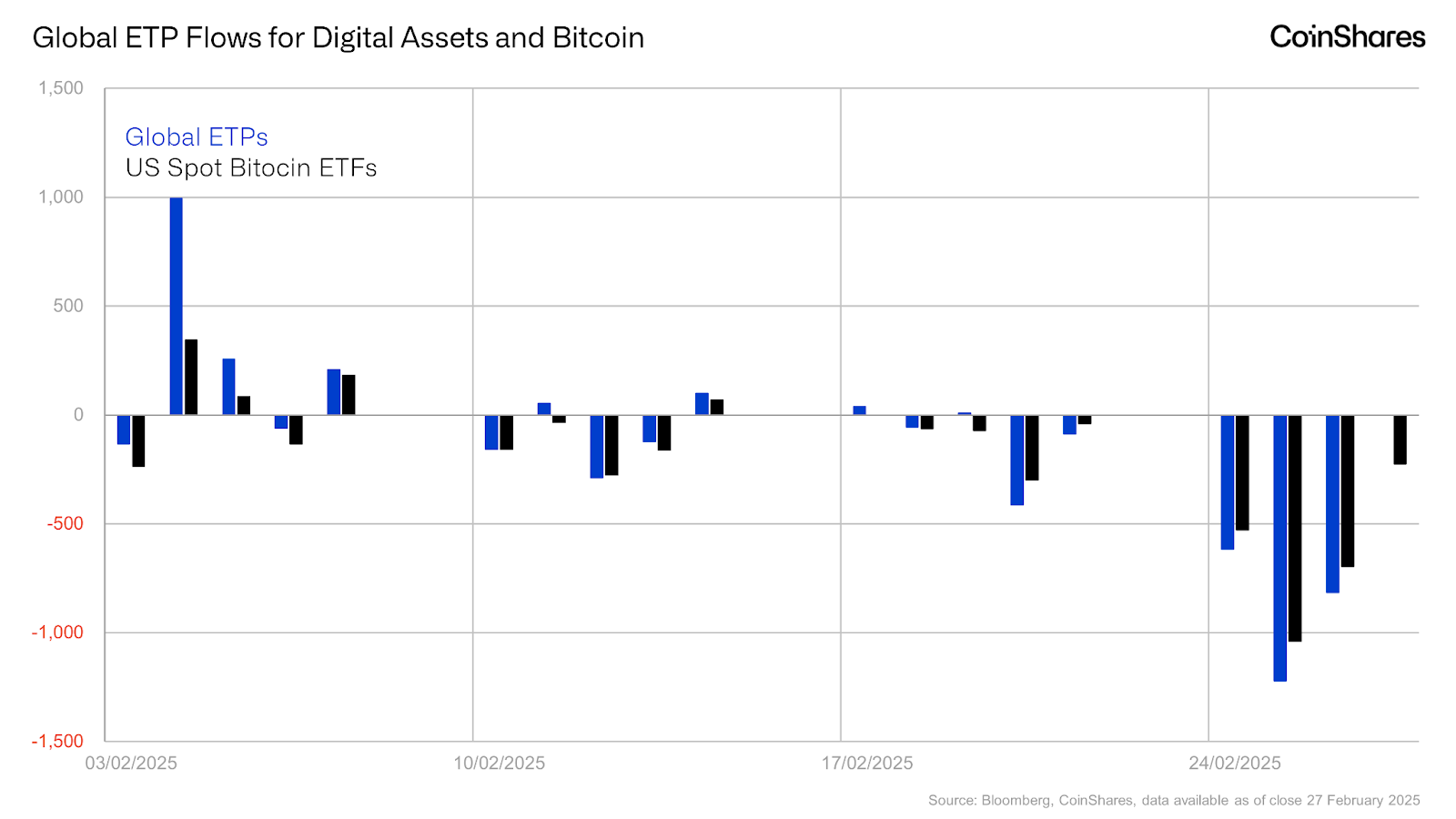

Looking back at the period from February 3rd to 24th, 2025, the global digital asset ETP market, including Bitcoin, has been on a rollercoaster ride. The market initially surged, with global ETPs attracting over $1 billion in inflows. But the good times didn’t last, as the following weeks saw a downturn, with significant dips occurring around February 10th and 17th.

Interestingly, even as the broader market was experiencing significant swings, US Spot Bitcoin ETFs had been relatively stable for a while… until February 24th, that is. On that day, these ETFs experienced a notable outflow, signaling a potential shift in investor mood, even amidst the already present economic uncertainties.

Related: Crypto Giant CoinShares Slashes Bitcoin ETP Management Fees

Spot Bitcoin ETFs Suffer Massive Losses

Then came February 24th. The US Spot Bitcoin ETFs, those much-anticipated 11 SEC-approved funds, witnessed their worst day ever. In a mere 24 hours, over $1 billion in investments was pulled out!

This sudden sell-off wasn’t just any dip – it was officially the roughest day for Bitcoin ETFs since they launched last year. It even eclipsed the previous low point back in December, when outflows hit $672 million.

Related: Spot Bitcoin ETF Surge Set to Eclipse $50 Billion Crypto ETP Market

Bitcoin ETF Outflows: Economic Concerns and Market Pressure

And this massive outflow came on the heels of a six-day period where these same funds had already shed over $2 billion in value.

What’s behind this exodus? Many point to growing worries about US economic policy. Trade tariffs? Inflation? The recent US presidential inauguration? All these factors are piling pressure onto the crypto market, contributing to the continued slide in digital asset prices.

XRP ETPs See Inflows, Contrasting Bitcoin’s Trend

Interestingly, the outflow was largely concentrated in Bitcoin itself, with the king of crypto accounting for a hefty $571 million of the total. But here’s a twist: while Bitcoin stumbled, altcoins, particularly XRP ETPs showed surprising strength. XRP ETPs actually *gained* $38 million, continuing a trend of positive investor sentiment. This optimism seems to be fueled by hopes that the US SEC might just drop its lawsuit against Ripple. In fact, XRP ETPs have attracted a whopping $819 million since November 2024.

Unsurprisingly, Bitcoin’s price hasn’t been immune. Mirroring the wider market’s struggles, Bitcoin has taken a hit, sliding from over $100,000 to below $85,000 since early February. What’s behind the dip? Factors like US trade policies, the big ByBit crypto exchange hack, and a string of memecoin scandals are all likely playing a role.