Polkadot: Is DOT Ready to Break $4.60 for a Bullish Rally?

- Polkadot’s price dipped to oversold levels, but buyers stepped in to hold the line at $3.35 support.

- Even with bearish liquidations happening, negative funding rates along with increasing Open Interest suggest we could see some volatility ahead for DOT.

Polkadot [DOT] has faced significant selling pressure recently, but some folks in the market are starting to see glimmers of hope for a potential comeback.

Although DOT has found it tough to climb upwards, both on-chain data and technical analysis are pointing towards a possible change in market mood.

Right now, DOT is trading around $3.47, down about 3.10% in the last day. However, it’s worth noting that a crucial support level has remained unbroken, raising the possibility that buyers might be gearing up for action.

Is DOT ready to bounce from oversold conditions?

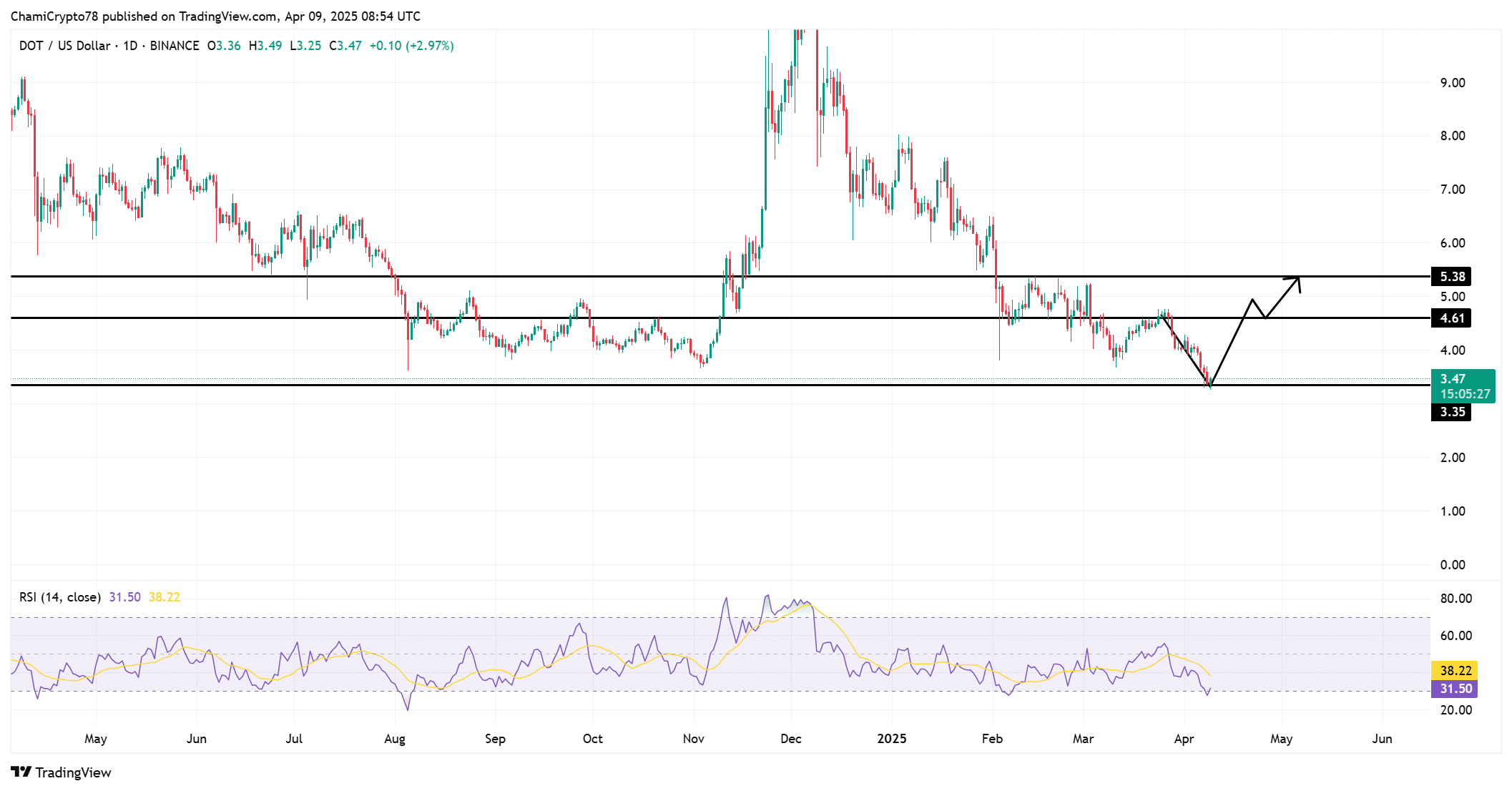

DOT has recently bounced back from the $3.35 support level, an area known for drawing buyers in the past. This recovery happened just as the Relative Strength Index (RSI) reached 31.50, indicating the asset was in oversold territory.

This means a short-term price turnaround is definitely on the cards if buyers can continue to defend this support.

On the flip side, if DOT fails to hold above $3.35, we could see further drops. For now, all eyes are on the $4.61 resistance level. If we see a daily candle close above this point, it would be a strong signal of a bullish reversal.

What’s more, breaking through $4.61 could create further upward movement towards the $5.00 and then $5.38 price targets. Looking at the price charts, some analysts are even spotting a potential W-shaped recovery forming.

Source: TradingView

Who’s getting liquidated?

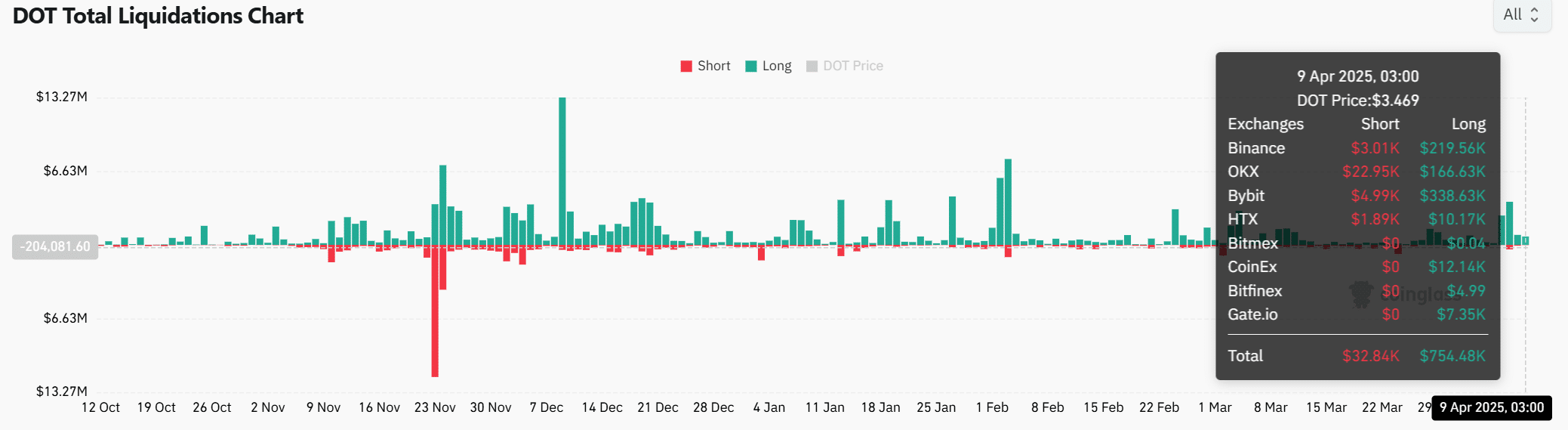

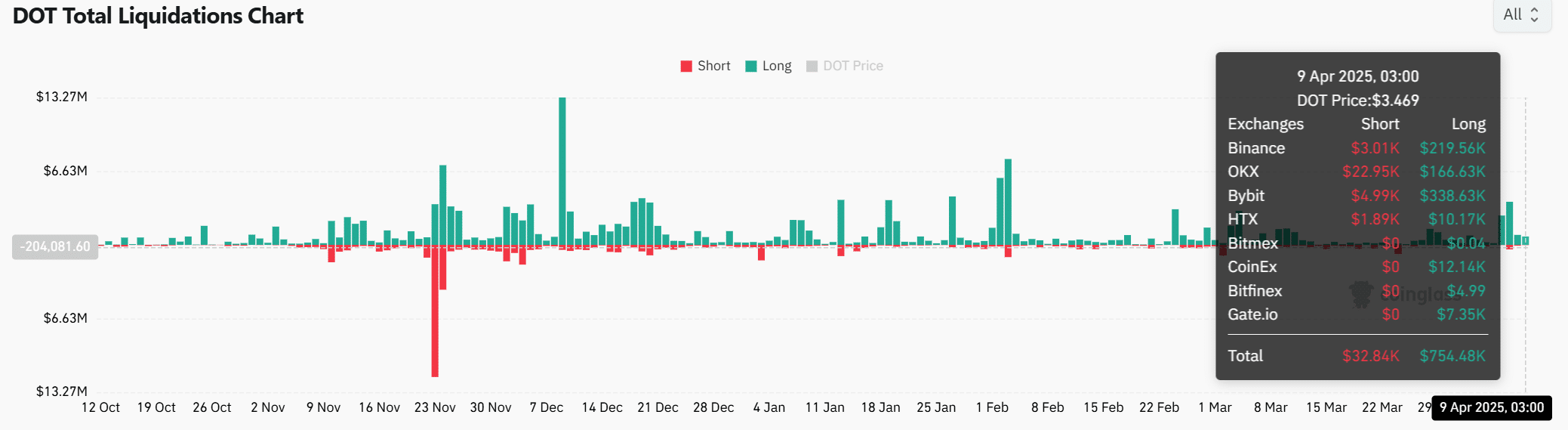

Recent liquidation data reveals a clear picture: a whopping $754.48K in long positions were liquidated, compared to a much smaller $32.84K in short positions.

This massive long liquidation suggests that traders betting on DOT to go up were using too much leverage and got caught out by the recent price drop.

This kind of heavy long liquidation actually strengthens the short-term bearish trend and highlights a lack of buying power during this downturn.

Interestingly, these liquidations mostly happened on exchanges like Bybit, Binance, and OKX, which are known for having a lot of retail traders. This hints that the optimism from smaller investors was pretty much wiped out.

As long as liquidations are skewed this heavily towards long positions, it’s a sign that the market isn’t quite ready for a bullish takeover just yet.

Source: Coinglass

Are the bulls finding support?

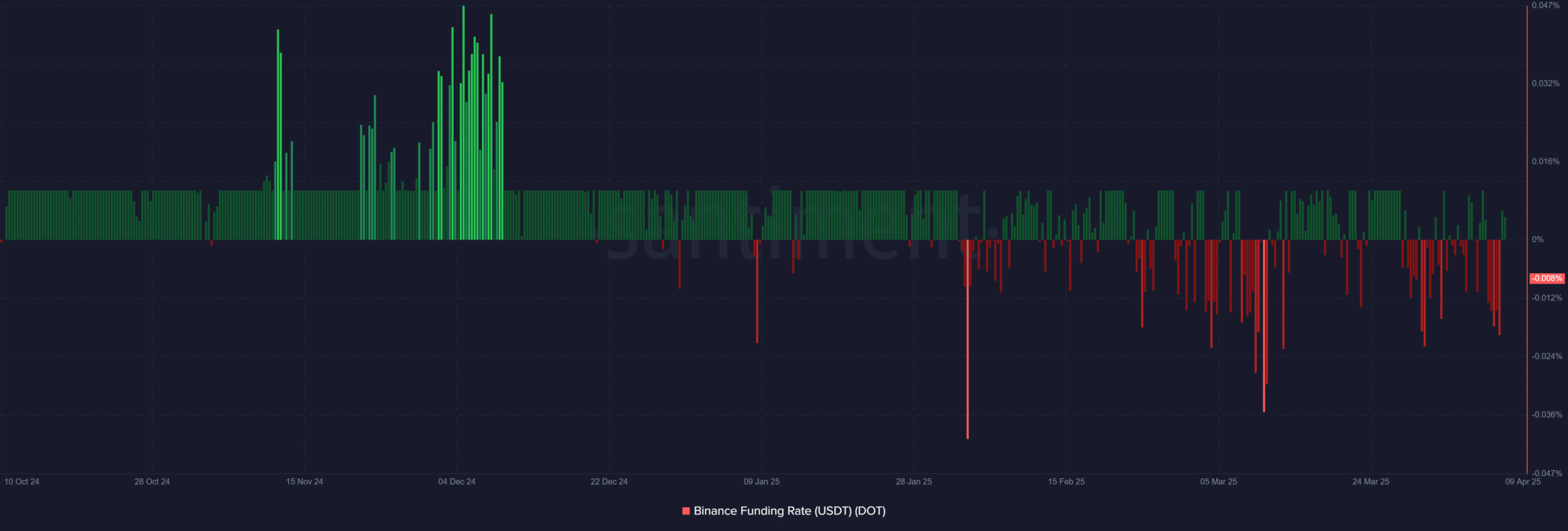

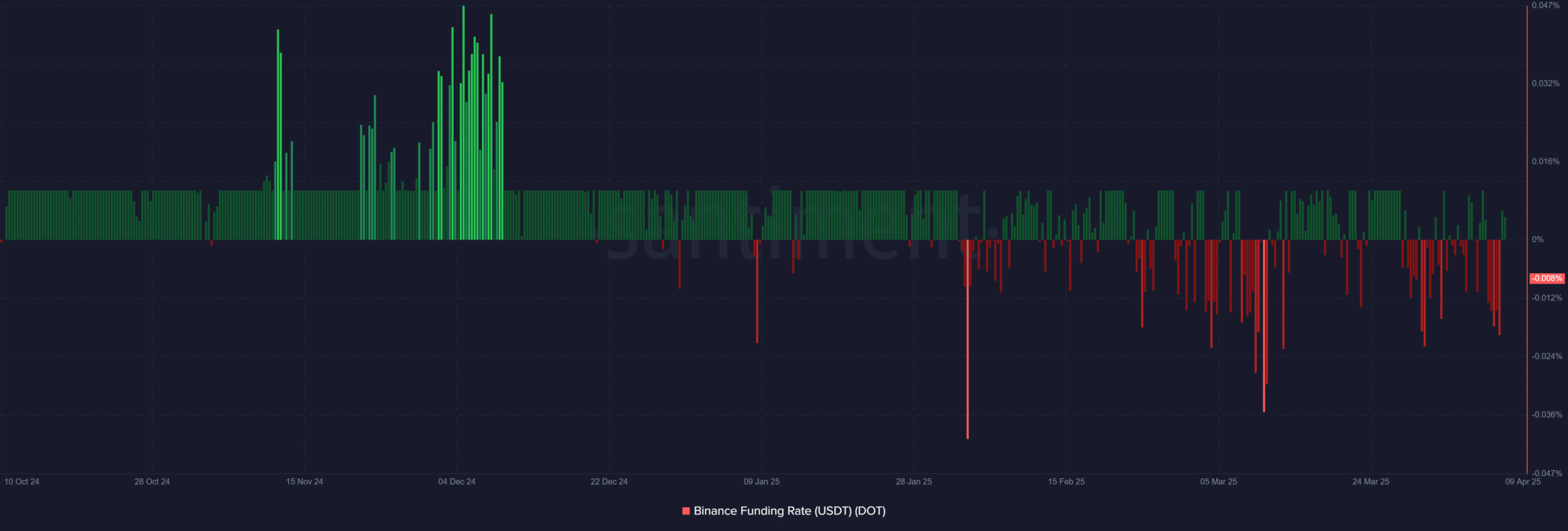

Looking at Binance Funding Rates, we saw a significant drop to -0.007954% on April 9th. This negative funding rate tells us that those betting against DOT (short sellers) were in control of the market.

However, sometimes when everyone’s bearish, it can actually be a sign of the opposite! If DOT’s price starts to rise, these short sellers might panic and rush to close their positions, potentially causing a rapid price surge known as a short squeeze.

Source: Santiment

Adding to the mix, DOT’s Open Interest has also increased by 3.26% to $305.42M. This rise in open interest suggests that there’s growing interest in DOT and new positions are being opened, which is often a precursor to significant price movements.

When you combine rising Open Interest with negative funding rates, it creates a situation that’s ripe for volatility in the market.

Can Polkadot’s price reclaim $4.60?

DOT definitely has a chance to get back up to $4.60, but it’s still a bit of a bumpy ride ahead. Looking at the downsides, the big spike in long liquidations indicates that buyers are still weak and there’s still selling pressure in the market.

The price movement is still slow and hesitant. We’ve seen DOT struggle to break past key resistance levels, and we haven’t yet seen a strong bullish candlestick to confirm a reversal. Plus, the overall market sentiment is still cautious, with sellers seeming to be in charge for now in the short term.

However, the increase in Open Interest along with the very negative Funding Rates could inject some volatility and actually increase the chances of a turnaround – especially if buyers can strongly defend that $3.35 support level.

So, if the market momentum starts to swing towards the buyers, then breaking through $4.60 could become a very achievable goal in the near future.