Prediction: Bitcoin Analyst’s New Forecast After Calling $97K Bitcoin Crash

Reason to trust

We adhere to a strict editorial policy that champions accuracy, relevance, and impartiality.

Our content is crafted by industry experts and undergoes thorough reviews for quality.

We maintain the highest standards in both our reporting and publishing processes.

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

This article is also available in Spanish.

Many in the crypto market were caught off guard by Bitcoin’s sudden drop from $97,000 in late February, but one analyst saw it coming. Doctor Profit, a crypto expert who previously warned of a correction as Bitcoin neared $97,000, has recently shared his updated technical analysis, suggesting that a bullish trend in the near future is unlikely.

In a recent post on X, Doctor Profit explained that the current market downturn is not yet over. This perspective follows his earlier, more detailed analysis, where he pinpointed several key Bitcoin price movements to watch—predictions that have all since materialized.

Doctor Profit: Bitcoin’s Downturn Is Just Beginning

Bitcoin has seen considerable volatility in recent days, with dramatic price swings. These fluctuations caused Bitcoin’s price to dip below $75,000 at the start of the week. Since then, it’s been trying to recover, aiming towards $80,000 over the last four days. Amidst this price turbulence, Doctor Profit, the crypto analyst, has made it clear that he anticipates Bitcoin’s current downward trend to continue even further.

Related Reading

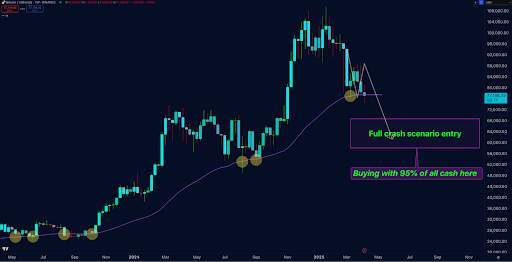

In a recent X post, the analyst characterized the ongoing correction as a “market massacre” that he expects to persist, stating that “the party just started.” He also mentioned that he has begun placing his initial buy orders in the $58,000 to $68,000 range, indicating his belief that Bitcoin’s price will continue to fall until it reaches this level.

Rather than viewing this recent price drop as a setback, the analyst sees it as a deliberate step within a larger strategy. He had previously detailed this strategy in an earlier, more in-depth analysis.

Doctor Profit’s analysis relies on the M2 money supply, a macroeconomic indicator that he feels is commonly misunderstood within the crypto community. While many traders have recently pointed to the increase in M2 as a positive sign for Bitcoin, anticipating immediate price increases due to higher liquidity, Doctor Profit emphasizes that timing is crucial. He points out that Bitcoin tends to react to M2 increases ahead of traditional markets, but even then, the response isn’t instant.

What Bitcoin Investors Should Watch For

He reminds his followers of his July 2024 prediction of a 50 basis point rate cut, a forecast considered quite improbable at the time. When this rate cut actually happened in September, around the same time Bitcoin was trading near $50,000, he called it a very bullish sign and predicted a significant rally. His forecast aligned with the expansion of the M2 money supply beginning in February 2025. However, he now advises caution: despite the rising M2, its impact on Bitcoin prices will unfold over time.

Related Reading

Turning to Bitcoin’s price action on the charts, Doctor Profit is now focusing on the $70,000 to $74,000 range. He suggests this zone is critical: it could act as a launchpad for a new upward rally if the price achieves a strong daily close above the “Golden Line,” located around the weekly EMA50. Alternatively, if the price falls below this range, it could signal a more substantial downward trend.

Should a sharper decline occur, Doctor Profit recommends reducing positions and waiting to buy again at even lower prices, possibly around the $50,000 to $60,000 level. He anticipates that the bull run is unlikely to resume until around May or June, with potential upside targets between $120,000 and $140,000.

Bitcoin recently climbed above $81,000 following Donald Trump’s announcement of a 90-day pause on his tariff plans. As of now, Bitcoin is trading at $82,000, showing a 7% increase over the last 24 hours.

Featured image from Unsplash, chart from Tradingview.com