Price Target: Rivian Stock – Wall Street’s 12-Month View

It looks like 2025 is shaping up to be another tough year for electric vehicle (EV) maker Rivian (NASDAQ: RIVN). Investors haven’t been rushing to buy its stock, and it’s mostly been in the red because there just aren’t many big positive events to get them excited.

So far this year, Rivian’s stock price has taken a hit, dropping more than 18%. Right now, it’s trading around $10.75. It did see a small bump of 1.3% in the last trading session, but for investors keeping a close watch, that $20 mark is still a significant hurdle to overcome.

On March 16th, financial expert Market Maestro pointed out that Rivian’s stock is currently sitting near a crucial support level of $10. He also noted that based on technical indicators, we could see a potential breakout if the overall economic picture improves.

Market Maestro’s analysis further suggested that the stock is still caught in a long-term downward trend. To see a potential upward swing, he indicated it would need to break above both the descending resistance line and the 23.6% Fibonacci retracement level.

However, he did raise a note of caution, explaining that the Federal Reserve’s current high interest rates and ongoing efforts to tighten monetary policy could limit growth, which in turn could negatively impact EV stocks like Rivian. Adding another layer of uncertainty, potential policy changes from Donald Trump could also throw a wrench in Rivian’s long-term plans.

Interestingly, Rivian’s ongoing stock market challenges are happening despite some real wins for the company, particularly on the financial front. For example, in the fourth quarter, Rivian not only surpassed earnings expectations but also achieved a significant milestone: its first quarterly gross profit of $170 million.

Looking ahead, Rivian is aiming for a “modest gross profit” in 2025, though they haven’t predicted when they’ll reach overall GAAP profitability. They do anticipate that adjusted losses will decrease, falling to between $1.7 and $1.9 billion, compared to $2.69 billion in 2024. In Q4, Rivian’s revenue reached $1.73 billion, exceeding the anticipated $1.4 billion, and they managed to reduce their net loss to $743 million from $1.52 billion the previous year.

Turning to analyst projections, estimates for Rivian’s Q1 revenue are around $993.66 million—a 17.47% decrease year-over-year. However, analysts are forecasting a strong rebound in Q2, with a projected 22.59% jump to $1.42 billion. For the full year of 2025, revenue is expected to reach $5.39 billion, an 8.38% increase year-over-year, with a more substantial surge of 38.87% to $7.48 billion predicted for 2026.

So, what does this mean for investors with a long-term view? Despite Rivian’s forecast of a slower 2025, there might still be an opportunity. Delivery expectations for this year are between 46,000 and 51,000 vehicles, down from the 51,579 delivered in 2024. It’s also worth noting that Rivian isn’t planning to release any new models in 2025, which could be another headwind for the EV maker until next year.

Looking at potential positive drivers for growth, expanding commercial sales beyond just Amazon is key. There’s growing interest from businesses looking to switch their fleets to electric vehicles. And some unique partnerships, like Ben & Jerry’s using Rivian vans for electric ice cream trucks, highlight the broad potential in the delivery van market.

Furthermore, Rivian’s future looks promising thanks to its strong pipeline of new vehicles, including the much-anticipated R2, R3, and R3X models. The R2, expected to launch in 2026, is particularly important because it will be more affordable, allowing Rivian to reach a wider customer base, including international markets.

Wall Street sets Rivian stock price

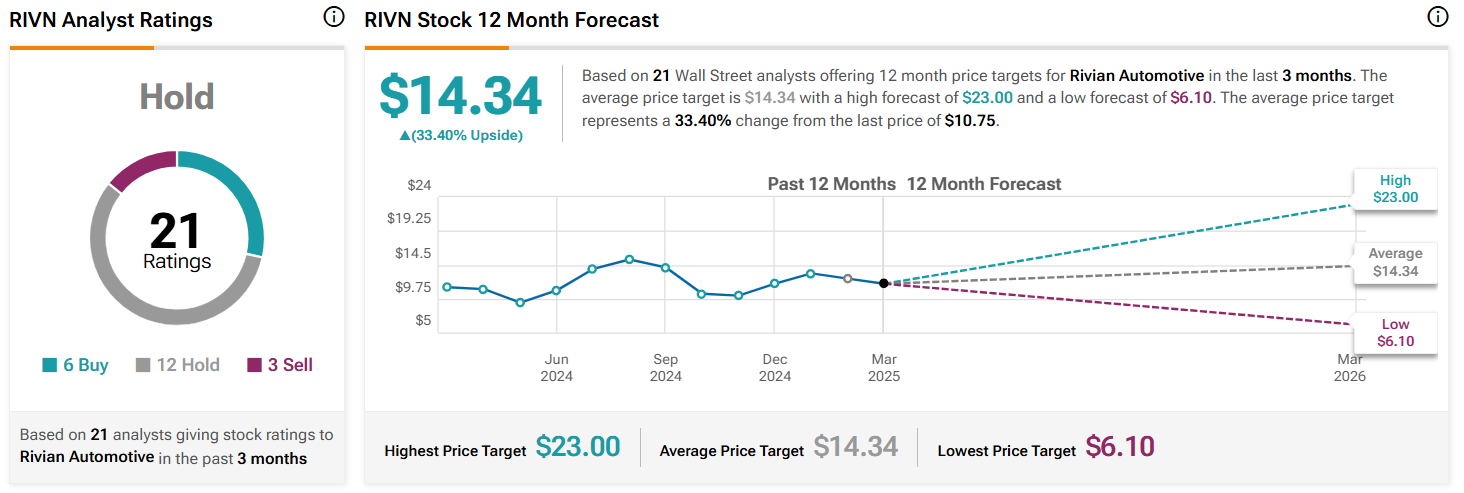

While Rivian’s overall picture may seem mixed right now, some analysts on Wall Street believe the stock has room to grow over the next year. To be specific, 21 analysts surveyed by TipRanks have set an average price target for RIVN at $14.34, suggesting a potential upside of 33.4% from its current price. However, there’s a wide range of opinions, with the highest estimate at $23 and the lowest at $6.10.

Overall, analysts are leaning towards a ‘Hold’ rating on the stock. Among them, six recommend a ‘Buy,’ while only three are suggesting a ‘Sell’.

Looking into individual analysts, Itay Michaeli from TD Cowen started covering Rivian on March 6, 2025, with a ‘Hold’ rating and a price target of $12.70. He pointed to the lack of immediate positive catalysts because of the somewhat uncertain outlook for 2025 and the delay of the R2 launch until 2026. However, he also mentioned that Rivian’s 2025 delivery projections might be a bit conservative, and if they can successfully roll out autonomy updates later in the year, it could boost investor confidence.

On the other hand, Bernstein analyst Daniel Roeska has a more pessimistic view. On February 27, he assigned an ‘Underperform’ rating with a price target of just $6.10. His concern is that Rivian might not meet its goals for improvement in 2024, citing ongoing high losses per vehicle and a slowdown in sales growth.

Morgan Stanley analyst Adam Jonas offered a different perspective on February 25th, suggesting that Rivian has potential beyond just building cars. He thinks their AI-powered autonomous driving technology could become a major source of revenue. While acknowledging Rivian’s continuing financial challenges, he highlighted their $1 billion Software & Services segment, their joint venture with VW, and their potential role in the developing autonomous vehicle market.

On the same day, Dan Levy from Barclays maintained an ‘Equal Weight’ rating, but increased his price target to $14. He anticipates continued ups and downs for Rivian’s stock in 2025, and warned about ongoing pressures from the growing EV market in China and broader challenges within the automotive industry.