Sector to Buy in 2025: JPMorgan’s Top Pick

When you’re thinking about investing, one really important thing to pay attention to is analyst coverage. Think of it this way: if a stock suddenly gets Wall Street’s attention and confidence, especially if it hasn’t been performing well lately, that often signals a pretty good reason why experts are becoming optimistic about it.

Now, what we just talked about for individual stocks? It’s even *more* true when we look at entire sectors. It’s not very often that Wall Street firms completely change their minds about whole industries as dramatically as they do with individual stocks, but it does happen. And guess what? It actually happened very recently.

To be precise, on March 24th, JPMorgan released a revised outlook for the mining and metals sector. Up until then, they had actually given it an ‘underweight’ rating, suggesting they weren’t too keen on it. But get this – the banking giant didn’t just nudge up their rating a bit; they boosted the sector straight to their highest possible rating: ‘overweight’.

Currently, JPMorgan is predicting nothing short of a “V-shaped” recovery for the sector, expecting it to start by the end of the first quarter of 2025. Just to give you a sense of timing, the first quarter ends only five days from when this was written. Let’s dig deeper into the firm’s outlook and see how investors could potentially position themselves to benefit.

First off, let’s get into JPMorgan’s reasoning behind this big shift. The analysts at this major bank pointed out that mining stocks have been lagging behind the prices of industrial metals by roughly 20% since the beginning of 2024.

There’s also a significant difference between the performance of the S&P Metal and Mining Select Industry Index and the S&P 500 overall. The mining index has seen a return of just 2.01% compared to this time last year, while the S&P 500 has surged by a much stronger 10.42% in the same period.

JPMorgan is basing its upgraded outlook on a few key things: they see underlying fundamentals getting better, they’re forecasting a rebound in commodity prices, and they believe that recent economic stimulus measures from China will provide a boost.

The banking giant recommends going long on copper and gold stocks

Okay, let’s get down to specifics. JPMorgan is particularly enthusiastic about mining and metal stocks that have a strong focus on copper, aluminum, and gold. They’re especially optimistic about copper in the long term, predicting that supply and demand dynamics, combined with low inventory levels, will drive a 15% increase in the metal’s price by the second quarter of 2026.

Adding to that, they also foresee a potential 10% to 20% jump in EBITDA estimates for mining companies at today’s prices. Interestingly, they anticipate that gold producers will be the biggest winners here.

It’s worth noting that this positive sentiment around copper isn’t just JPMorgan’s view. Commodities veteran Jeff Currie recently expressed similar bullishness on copper, while Bloomberg’s senior commodity strategist Mike McGlone has a theory that declining treasury yields and money flowing out of cryptocurrencies could push the price of gold all the way up to $4,000.

For those looking to capitalize on this potential upswing (assuming JPMorgan is correct, of course!), exchange-traded funds (ETFs) could be the simplest approach. While the firm did highlight a few individual stock picks, only one is traded on major U.S. exchanges – and conveniently, it provides exposure to both copper and gold.

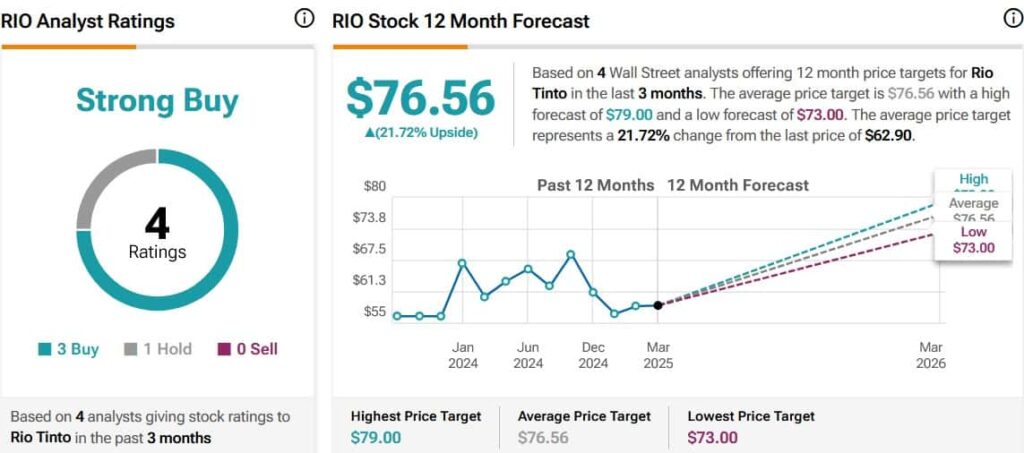

That stock is Rio Tinto (NYSE: RIO). It’s already been outperforming the broader market so far in 2025, delivering a 7.02% return since the year began. As of the time of writing, RIO stock was trading at $62.94.

What’s even more encouraging is that JPMorgan’s optimistic assessment isn’t an isolated opinion. Currently, Wall Street analysts, on average, are projecting a potential upside of 21.72% for RIO shares, with an average price target of $76.56.

Having said all that, for investors who prefer a more diversified strategy, it might be worth exploring copper and gold funds. Some ETFs to consider are the iShares Copper and Metals Mining ETF (ICOP) and the iShares MSCI Global Gold Miners ETF (RING). These could offer a broader way to tap into this potential sector growth.

Featured image via Shutterstock