SOL $300: Solana’s Ethereum Fight

The crypto rivalry between Solana and Ethereum is really starting to sizzle! Data from deBridge shows a whopping $72 million has been bridged over to Solana (SOL). This big move of funds could mean users are ditching Ethereum for SOL’s super-fast speeds and cheap transaction fees. If this trend keeps up, could Solana’s price finally break free from its current level and maybe even shoot up to $300?

Competition Between Solana and Ethereum Heats Up

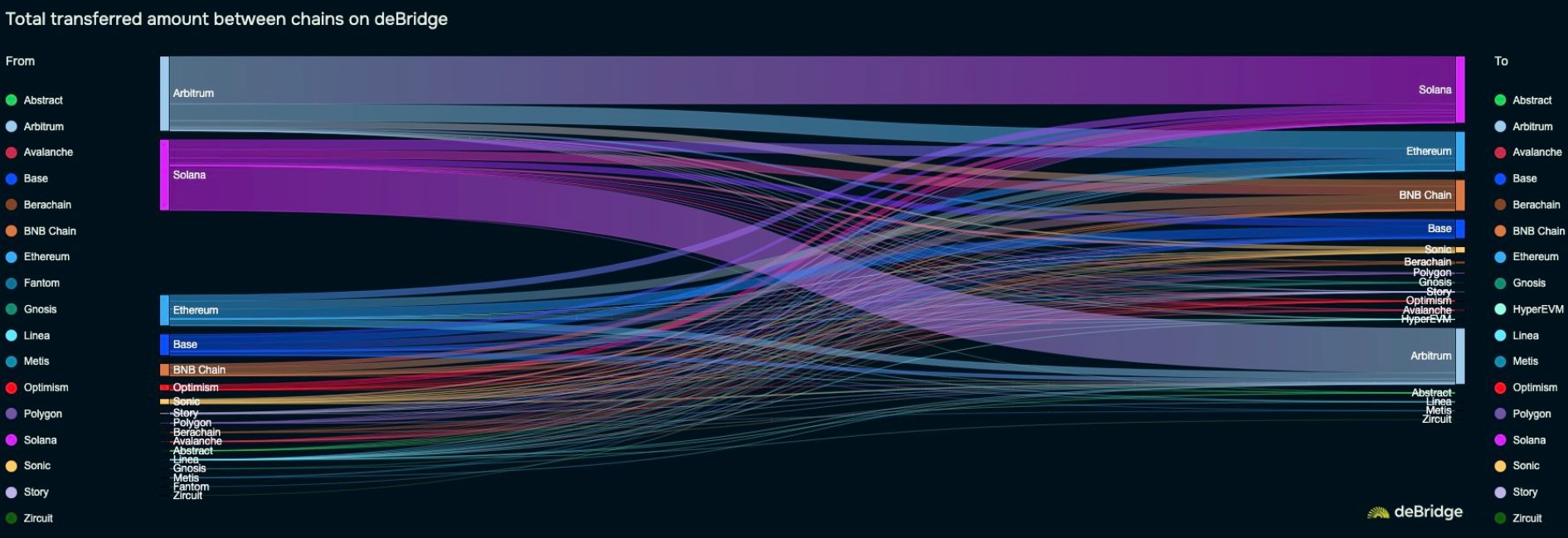

It looks like crypto users are increasingly choosing Solana over Ethereum, and that could be great news for Solana’s price! According to deBridge data, there’s a noticeable shift happening. Even deAlex, co-founder of deBridge Finance, pointed out that Solana is currently leading the pack when it comes to the amount of assets being bridged over.

TokenTerminal data further emphasizes just how strong Solana’s position is in the world of layer 1 blockchains. Check this out: Solana’s weekly active addresses jumped to a massive 17 million! That’s almost ten times more than Ethereum’s 1.8 million active addresses. Crazy, right?

And it’s not just addresses that are up – deposits on Solana are surging too! DeFiLlama reports Solana’s TVL (Total Value Locked) is now at 54.87 million SOL, reaching its highest point since July 2022. Things are definitely heating up!

This network buzz could get even louder with the launch of PumpSwap by PumpFun, the meme coin platform. This new Solana DEX could reignite the meme coin craze on Solana and bring even more value to the network. Get ready for potential meme coin mania!

With all this positive on-chain data, Solana price predictions are looking pretty good. Experts think SOL could bounce back from its current support level. The big question is: if it does, could Solana actually make a run all the way to $300? Let’s dive into the charts.

Solana Price Analysis: Bullish Signs Are Emerging

It seems like bullish momentum is definitely picking up for SOL. Looking at the 4-hour chart, Solana’s been forming higher lows, which often signals an upward trend is starting. But, this positive movement depends on SOL staying above that $117 support level.

The Relative Strength Index (RSI) is also creeping upwards, although it’s still just under 50. Currently at 48, the momentum is still in neutral territory. If the RSI pushes past 50 and the MACD keeps rising, that could really solidify the upward trend for SOL.

If these bullish signals continue, the first target for SOL could be around $154. Breaking through this Fibonacci level could pave the way for a significant bullish surge, potentially driving Solana’s price towards that $300 mark. Keep an eye on it!

SOL Derivatives Market: A Word of Caution?

Now, let’s take a peek at the Solana derivatives market – and it’s telling a slightly different story. Activity here seems to be slowing down quite a bit. According to Coinglass, both open interest and trading volumes for derivatives have decreased, by 3% and a significant 38% respectively. And it’s been tough for those betting on SOL going up (“long” traders), with $6.21 million in long positions being wiped out just in the last day. Ouch!

This wave of liquidations has pushed the SOL long/short ratio down to 0.95. Basically, there are now more people betting *against* Solana (short traders) than those betting for it (long traders). If long traders get spooked and stop opening new positions, it could lead to a more negative outlook on the market and potentially drag Solana’s price downwards. Something to keep in mind!

Frequently Asked Questions (FAQs)

Absolutely, Solana has a shot at hitting $300! Its growing competition with Ethereum, fueled by increasing network activity, could be the rocket fuel for a big price jump. Keep an eye on that network action!

It’s definitely possible! If Solana keeps seeing these kinds of weekly active address increases, it could seriously challenge Ethereum and potentially become the top dog in the layer 1 blockchain space.

Excitingly, yes, it’s on the table! The 4-hour chart is hinting at building bullish momentum, meaning a return to its all-time high this year could be within reach for Solana. Fingers crossed!

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.