Solana Price Surge Today

Solana

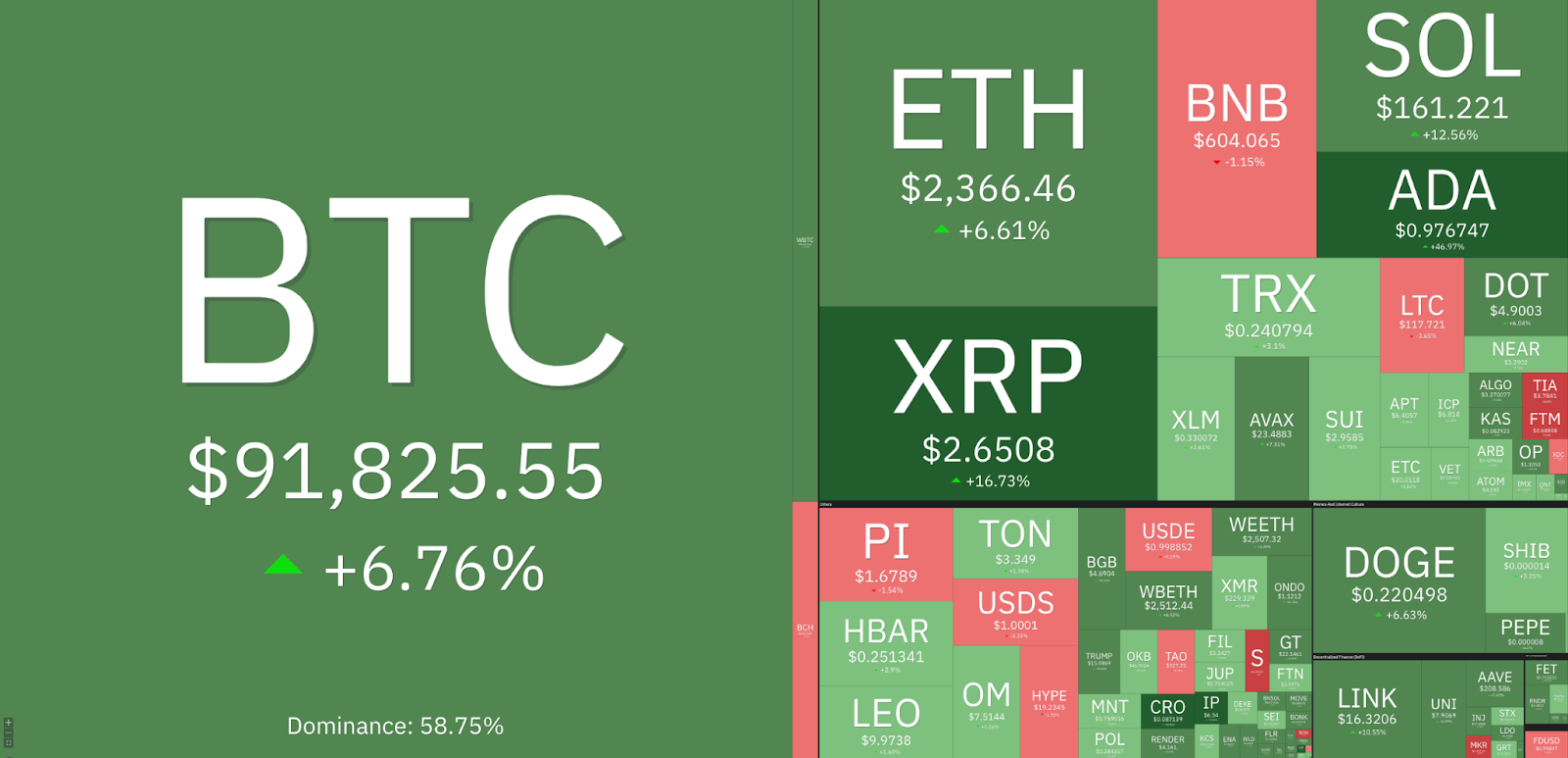

price is experiencing a welcome boost today, energized by a robust recovery sweeping through the entire cryptocurrency market. This positive turnaround for SOL appears to be sparked by President Trump’s recent announcement that Solana would be designated as part of the Strategic Crypto Reserve.

Fresh data from TradingView, powered by Cointelegraph Markets Pro, reveals SOL trading around $162. That’s a significant climb, showcasing a jump of over 15% in the last 24 hours and an impressive 28% leap from its recent low of approximately $125 on February 28th.

SOL/USD daily chart visualized. Source: Cointelegraph/TradingView

Let’s break down some of the key factors fueling SOL’s price surge today:

-

Firstly, SOL’s price rally mirrors the broader crypto market’s enthusiastic recovery, largely sparked by President Trump’s Strategic Crypto Reserve declaration.

-

Secondly, we’ve seen around $38 million in short SOL positions wiped out in liquidations over the past day.

-

Finally, technical chart analysis for SOL points to a classic bullish pattern, suggesting a potential target well above $260.

SOL price lifts as the wider crypto market gains momentum

This wave of bullish optimism wasn’t just confined to Solana; crypto prices across the board saw a lift following President Trump’s direction to establish a US Strategic Crypto Reserve that crucially includes not only Solana, but also XRP

and Cardano

.

Here are some key highlights:

-

Bitcoin

itself climbed by a solid 7% over the last day, pushing it above $91,800 at the time of this report.

-

Ether

has also enjoyed a strong rally, increasing by over 6.6% in the last 24 hours and currently trading just above $2,360.

A snapshot of the 24-hour performance of leading cryptocurrencies: Source: Coin360

-

XRP and ADA stood out with particularly impressive gains, surging by 16% and a remarkable 64% respectively over the past 24 hours.

-

Overall, the total crypto market capitalization has expanded by 7% in the last day, reaching a whopping $3.03 trillion.

The price of SOL took a significant leap after President Trump publicly announced on March 2nd that SOL, alongside XRP and ADA, would be incorporated into a US Strategic Crypto Reserve.

Some key details to note:

-

This announcement builds upon an initial executive order issued on January 23rd, which tasked a working group with exploring the concept of a national digital asset stockpile.

-

Trump’s openly pro-crypto stance, a clear contrast to the Biden administration’s more cautious regulatory approach, has significantly boosted investor confidence in the cryptocurrency sector.

-

During his campaign trail, Trump even pledged to position the US as the future “Crypto Capital of the World.”

-

This all points towards a potential policy shift that is working to legitimize and institutionalize crypto assets, with Solana now explicitly recognized as a strategic asset.

Short position liquidations amplify SOL’s upward momentum

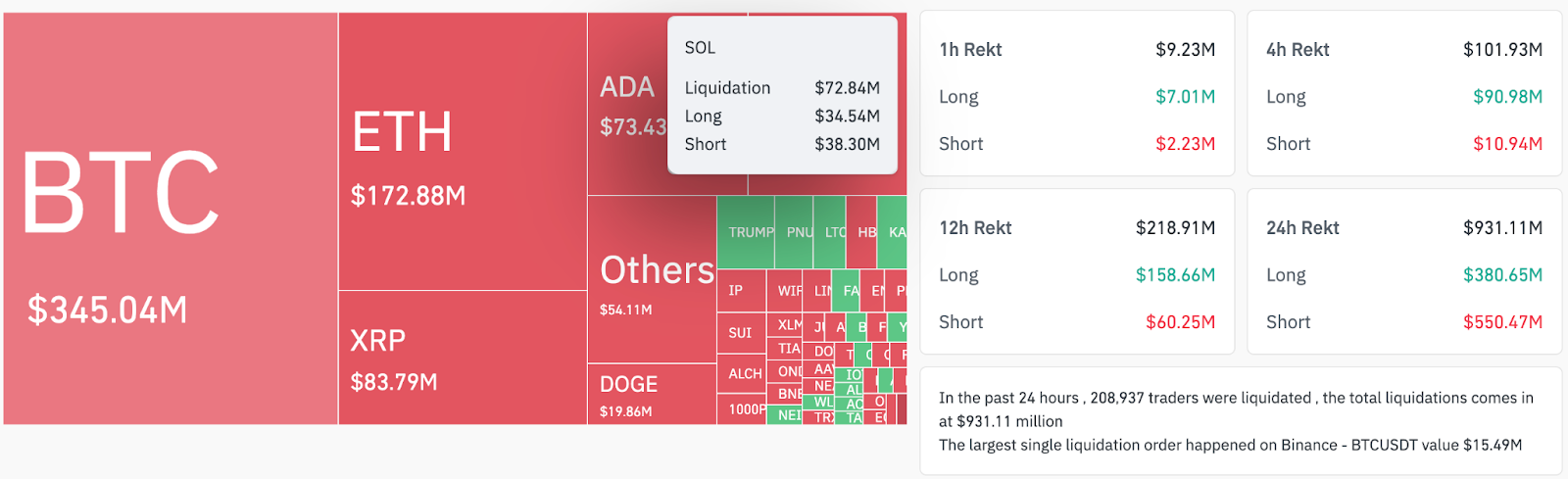

Adding fuel to the fire of Solana’s bullish momentum on March 3rd are substantial liquidations occurring in the derivatives market, according to data from CoinGlass.

-

The crypto futures market has witnessed a massive liquidation event, with over $931 million in leveraged positions being closed out in the last 24 hours, of which a notable $550.5 million were short positions.

-

Specifically for Solana, over $38.3 million in short positions have been liquidated, outweighing the $34 million in long position liquidations during the same timeframe.

A visualization of total crypto liquidations. Source: CoinGlass

-

When short positions face liquidation, traders who were betting against the price are compelled to buy back the asset to close their positions.

-

This forced buying action further pushes prices upwards, creating additional upward pressure on the price.

Related Reading: XRP, ADA, SOL go parabolic following Trump’s US crypto reserve announcement: Are other altcoins next?

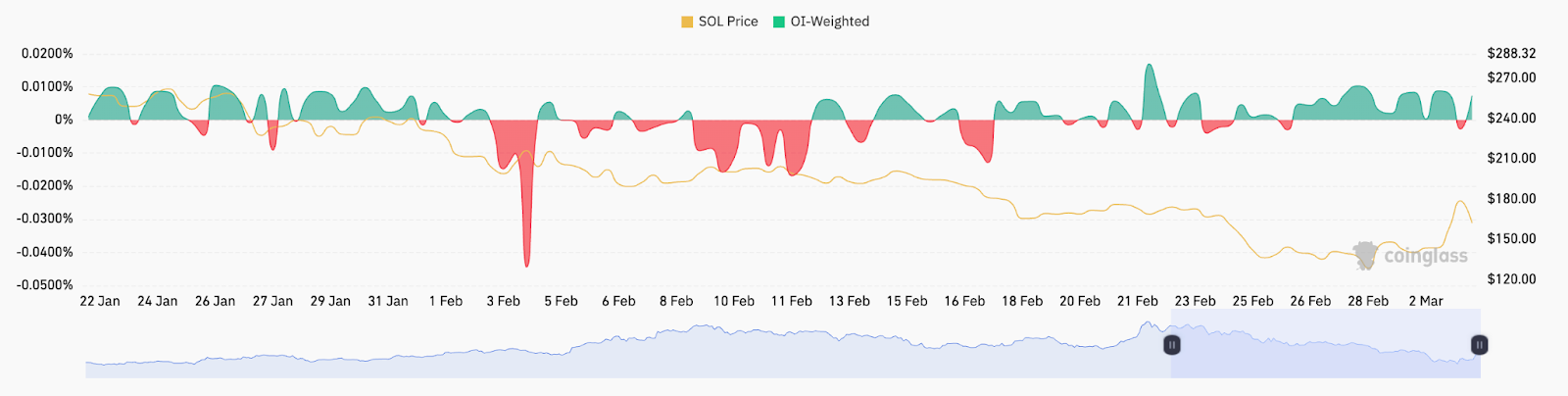

Adding to the bullish picture, the rally in SOL’s price coincides with a rebound in its funding rates.

SOL funding rates and performance illustrated. Source: CoinGlass

Is a V-shaped recovery to $260 on the cards for SOL price?

Looking at SOL’s daily price chart, a potential V-shaped recovery pattern is emerging, hinting at further bullish potential.

Here are the key takeaways regarding this pattern:

-

A V-shaped recovery is recognized as a bullish sign in technical analysis, forming when an asset rebounds sharply in price after a steep decline.

-

The pattern is considered complete once the price rallies back up to the resistance level at the peak of the “V” formation, often called the neckline.

-

Examining SOL’s price action since January 19th, it appears to be tracing out a chart formation that resembles this V-shaped recovery, as highlighted in the chart below.

-

Currently, the price is navigating levels below key supply-demand zones: the $184 mark, where the 200-day simple moving average (SMA) sits, and the $200-$206 range, which includes the 100-day and 50-day SMAs.

-

This indicates that for a potential move to retest the $245 resistance, buyers will need to successfully propel SOL’s price above these SMA resistance levels.

-

Beyond that, the next logical target would be the neckline of the V-shaped pattern, positioned around $265.

-

Such a move to $265 would represent a substantial 68% climb from the current price.

SOL/USD daily chart analysis in focus. Source: Cointelegraph/TradingView

Following yesterday’s impressive surge in SOL’s price, independent analyst Grim suggests that the immediate short-term target to watch for lies between $205 and $220.

**Disclaimer:** Please remember, this analysis is for informational purposes only and is not financial advice. Investing in and trading cryptocurrencies comes with significant risk. Always do your own thorough research and consider your personal risk tolerance before making any decisions.