Solana’s $185 Friday Test After Rebound

Solana is under significant selling pressure, currently trading at its lowest point since November 2024. This downturn has effectively erased all gains made since the post-election rally. Once a leading force in the altcoin market, Solana now faces considerable challenges. The meme coin craze that initially propelled its surge has now reversed into a market downturn, sparking concerns about Solana’s long-term viability.

Related Reading

Initially, the speculative frenzy surrounding meme coins injected substantial transaction volume and liquidity into the Solana ecosystem. However, as the hype subsides and significant sell-offs persist, SOL’s price is feeling the impact. Analysts are suggesting that this rapid cycle of speculative investment followed by liquidation has made Solana susceptible to further price declines.

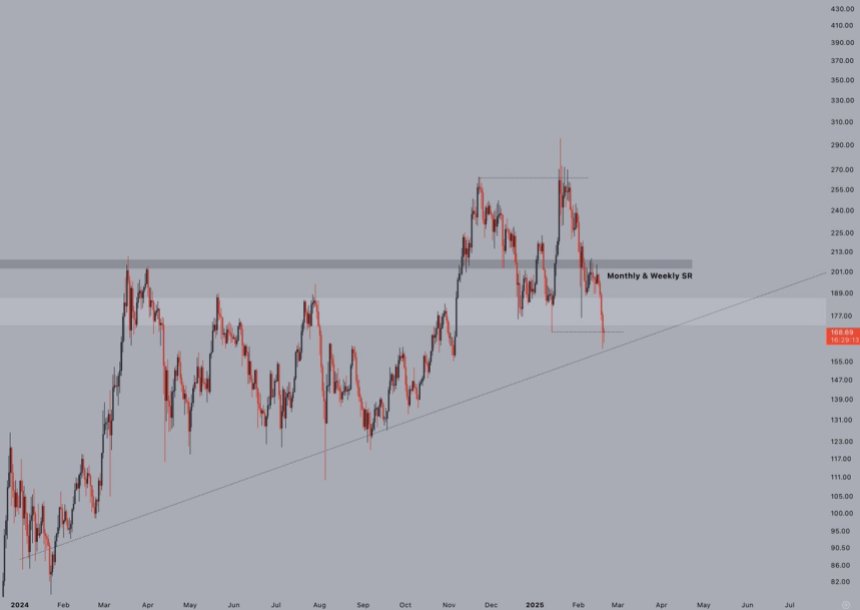

Crypto analyst Jelle shared an insightful analysis on X, noting that while SOL broke through recent lows, it managed to close above previous lows, hinting at a potential relief rally. Jelle highlights this as a potentially pivotal moment for SOL, suggesting that reclaiming key price levels could trigger a robust recovery. However, the market is now at a critical juncture, and the coming days will be crucial in determining whether we see a bounce or further downward movement. Investors are keenly observing Solana’s price action as it balances precariously on the edge of a significant shift.

Solana Testing Critical Demand Levels

Since reaching its all-time high in late January, Solana has been hit with substantial selling pressure. Its price is now struggling to recover amidst a broader slump in the altcoin market. Negative market sentiment remains strong, as the meme coin enthusiasm that previously boosted Solana’s growth has now become a burden, diminishing liquidity and investor confidence.

Related Reading

The swift boom and bust cycle of speculative meme coins on the Solana network has fostered an unstable trading environment, causing traders to hesitate before reinvesting in the ecosystem. This hesitancy has contributed to a decrease in decentralized exchange (DEX) volumes, further complicating Solana’s efforts to sustain upward momentum. While the network’s underlying fundamentals remain solid, current price action indicates growing caution among investors.

Jelle’s analysis on X points out that SOL dipped below recent lows but ultimately closed above prior lows. This could signal a potential relief bounce, though it’s far from a confirmation of a complete recovery. Jelle is looking for a decisive bounce from this point—ideally seeing SOL recapture the $185 level before the end of trading on Friday.

Traders and investors are closely monitoring the 3-day and weekly candle closes to gauge Solana’s next major move. Successfully reclaiming the $185 level could restore confidence and potentially push the price back towards $200. Conversely, failing to do so could intensify downward pressure, as Solana remains vulnerable to broader market trends and the ongoing volatility within the meme coin sector.

SOL Price Trying To Reclaim Key Levels

Solana (SOL) is currently trading at $173, holding just above a critical $170 support level. It’s imperative for bulls to defend this price point to sustain short-term momentum and prevent a more significant correction. A push above the $185 mark is crucial for any signs of recovery, as this level coincides with the 200-day moving average – a key indicator of long-term market health. Recapturing this level could signal a shift in momentum and pave the way for a stronger upward move towards higher resistance levels.

However, if SOL fails to break above the $185 threshold in the days ahead, selling pressure could intensify, potentially triggering another price decline. As long as the price remains below this crucial level, bears retain control, and a rejection at $185 could indeed lead to further losses, potentially retesting support levels around $160 or even lower.

Related Reading

For Solana, the coming days are critical. Traders will be watching closely for confirmation of either a reversal or a continuation of the current bearish trend. A breakout above $185 could supply the necessary momentum for SOL to regain its bullish course, while an inability to reclaim this level would likely result in further losses. Overall market sentiment remains uncertain, with investors carefully monitoring price action, seeking any indication of a sustainable recovery.

Featured image from Dall-E, chart from TradingView