Stability: Ethereum at $2,300 as Whales Pause Selling

Ethereum recently bumped its head against the $2,500 resistance mark and couldn’t break through, leading to a bit of a stumble. The leading altcoin has since retreated, currently trading around $2,354. But don’t count ETH out just yet – it’s showing some encouraging signs of a steady climb back up.

What could fuel this potential rebound? Keep an eye on a noticeable shift in how investors are behaving, particularly the big players, often called ‘whale’ addresses. This change in their activity might be exactly what Ethereum needs to kickstart an upward trend.

Ethereum Selling Cools Down

These ‘whale’ addresses—we’re talking about those holding a hefty 10,000 to 100,000 ETH—had been on a selling spree. Over the past week, they collectively offloaded a massive 640,000 ETH, worth a staggering $1.5 billion! This selling pressure definitely played a role in Ethereum’s struggle to push past that $2,500 barrier. However, it seems this intense selling has started to ease off, which could be a sign that sentiment is shifting.

Zooming in to the last 24 hours, we’ve seen these whales take a breather from selling, which interestingly aligns with Ethereum’s price finding its footing recently. This change in their behavior might just signal growing confidence that ETH is gearing up for a recovery. If these large holders continue to hold onto their assets, it could mean less price fluctuation for Ethereum and stronger support to keep prices from falling further.

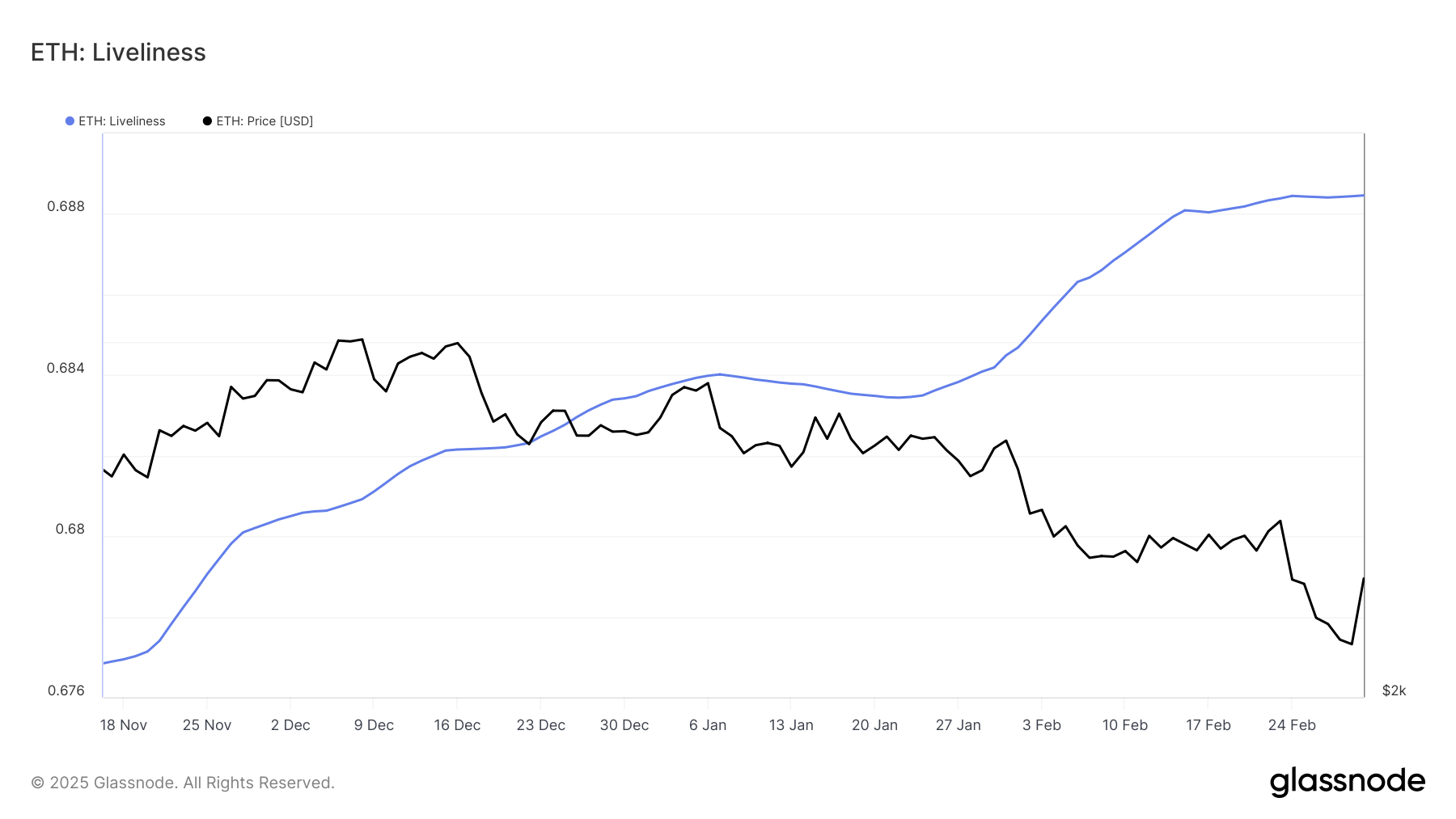

Looking at Ethereum’s Liveliness indicator, it suggests that long-term holders (LTHs) are also hitting pause on selling. This indicator is like a gauge – it goes up when long-term holders are selling off their coins and goes down when they’re buying or simply holding steady. Over the last few days, this indicator has remained pretty flat, again hinting at a slowdown in selling activity.

This trend is good news for Ethereum’s price stability, as it shows that those long-term investors are maintaining their faith in the market. If these LTHs keep holding on, ETH could gather momentum for a potential breakout. If we see the Liveliness indicator consistently trending downwards, that would really strengthen the bullish case, suggesting people are accumulating ETH rather than selling it off.

ETH Price Recovery On the Horizon?

Right now, Ethereum is trying to solidify $2,344 as a solid base of support, currently trading around $2,354. If it can hold above this level, ETH has a good chance of recouping its recent losses and setting its sights on $2,549 as the next hurdle. Successfully pushing back up to this zone and testing it again would definitely signal that bullish momentum is back in play.

Should ETH manage to break through that $2,549 resistance, we could see it rally towards $2,654. Getting past this level might then pave the way for Ethereum to settle into a period of consolidation below $2,814, potentially mirroring patterns we’ve seen in previous market cycles. This could establish a period of price stability before any further significant upward moves.

On the flip side, if Ethereum fails to maintain its position above $2,344, it could trigger a downward slide. In that scenario, ETH might drop below $2,267, and possibly even test $2,170 as the next significant support level. Falling below this point would unfortunately cast doubt on the bullish outlook and suggest that bearish momentum is taking hold in the short run.