Stablecoin crucial to blockchain legitimacy, says ZachXBT

Update (March 3, 12:50 pm UTC): Just a quick update: We’ve added comments from Frederik Gregaard, CEO of the Cardano Foundation, to this article.

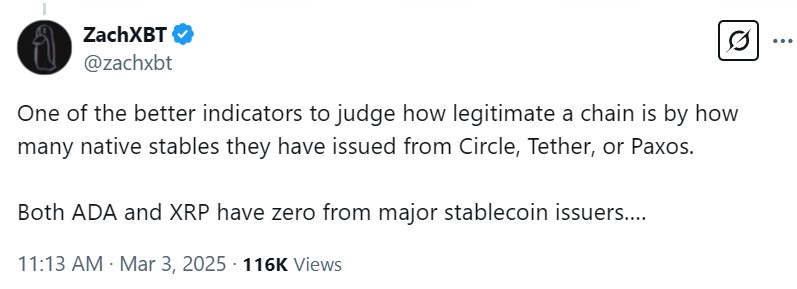

Crypto security analyst ZachXBT, advisor at Paradigm, recently shared his thoughts that a crucial indicator of a blockchain network’s real deal status is the amount of stablecoins from big players like Circle, Tether, and Paxos circulating on it.

This insight came after a noteworthy announcement from US President Donald Trump on March 2. Trump mentioned that certain digital assets would be incorporated into the country’s strategic crypto reserves, specifically naming Bitcoin

, Ether

, XRP , Solana and Cardano

as potential assets for these reserves.

Following closely on the heels of Trump’s announcement on March 3, ZachXBT pointed out a fascinating perspective. He argued that a blockchain’s credibility can be gauged by whether it hosts stablecoins from leading issuers like Circle, Tether, and Paxos. Interestingly, he noted that neither Cardano nor XRP Ledger currently feature these major stablecoins.

Expanding on this, he elaborated that if these big stablecoin issuers saw real “value to capture” within these blockchains, they’d likely have already integrated their offerings into those networks. It’s a question of market opportunity, according to ZachXBT.

Source: ZachXBT

Stablecoin integration is “just one metric”

Speaking with Cointelegraph, Frederik Gregaard, CEO of the Cardano Foundation, offered a counterpoint. He suggested that we in the crypto space should look beyond “simplistic measures of legitimacy.” For him, stablecoin integration is just one piece of the puzzle when assessing a blockchain’s success and usefulness:

“True legitimacy stems from fundamental elements including security, decentralization, sustainability, development activity, real-world utility and community engagement.”

Gregaard explained that the Cardano Foundation is prioritizing the creation of robust infrastructure designed to underpin global financial systems. He told Cointelegraph that Cardano’s ecosystem is laser-focused on technical excellence, security, and the ability to handle massive scale. As these capabilities grow, he anticipates that major stablecoin issuers will naturally become more interested in the network.

“As transaction activity picks up and our platform becomes even more powerful, we expect to see increased interest from the big stablecoin players. It’s all part of Cardano’s evolution and growing maturity as a blockchain,” Gregaard commented.

He also made an important clarification: while stablecoins like Tether’s

and USDC aren’t directly created on Cardano, they can still be utilized within the ecosystem through the Wanchain Bridge. This offers users access to these key stablecoins even now.

Looking ahead, he stated that the Cardano Foundation is “open to collaborations” and actively aims to attract new stablecoins to their ecosystem, signaling a proactive approach to expanding stablecoin options on Cardano.

Chris Larsen-linked addresses hold over $7 billion in XRP

Switching gears a bit, ZachXBT also raised an interesting point in his official Telegram group regarding XRP. He highlighted dormant wallet addresses associated with Ripple co-founder Chris Larsen that still hold a significant 2.7 billion XRP. With XRP currently trading around $2.64, these holdings are worth a staggering $7.12 billion.

ZachXBT noted that these addresses moved approximately $109 million in XRP to exchanges in January, suggesting a potential continued sell-off of this large stash over time. It raises questions about the future movement of these funds.

However, he also pointed out a curious detail: several of these addresses have been inactive for six to seven years. This has led to speculation that Larsen might have lost access to these funds or possibly transferred them way back in 2013 – adding a layer of mystery to the situation.

It’s worth remembering that on Jan. 31, 2024, ZachXBT himself reported that Larsen experienced a hack, losing 213 million XRP, which was valued at around $112.5 million at the time. This prior event adds context to discussions around Larsen’s XRP holdings.

Cointelegraph reached out to Ripple for their take on these observations but hadn’t received a response by the time of publication. We’ll be sure to update if we hear back.

Related: How stablecoins improve US dollar utility — Paxos CEO

Stablecoins in the XRPL and Cardano networks

While it’s true that major stablecoin issuers haven’t yet launched directly on XRPL or Cardano, both networks do have stablecoins developing within their own ecosystems. It’s not a complete absence of stablecoins.

On December 17, 2024, Ripple’s own stablecoin, RLUSD, began trading on platforms like Uphold, MoonPay, Archax, and CoinMENA. This followed regulatory approval from the New York Department of Financial Services on December 10. Adding to this positive momentum, on January 7, Ripple’s president Monica Long announced that RLUSD would soon be listed on even more major exchanges, signaling wider availability.

Cardano too has been active in the stablecoin space. Back in 2022, they launched Djed (DJED), a stablecoin designed to be overcollateralized by ADA and using Shen (SHEN) as its reserve currency. According to CoinGecko, while still relatively small, Djed currently has a market capitalization of $4 million.

More recently, in 2024, Cardano integrated USDM, a stablecoin backed by fiat currency. The launch of USDM on March 18 was met with enthusiasm within the Cardano community and seen as a significant “milestone” for the network, indicating growing stablecoin options on Cardano.

Magazine: Elon Musk’s plan to run government on blockchain faces uphill battle