Stablecoin Delay: Bitcoin’s $90K Ascent

- Stablecoin growth has stalled, and that’s a signal: liquidity might be drying up, which unfortunately strengthens the feeling of risk aversion across the crypto market.

- Could it be that traders are just waiting on the sidelines, trying to get a clearer picture of where the market is headed?

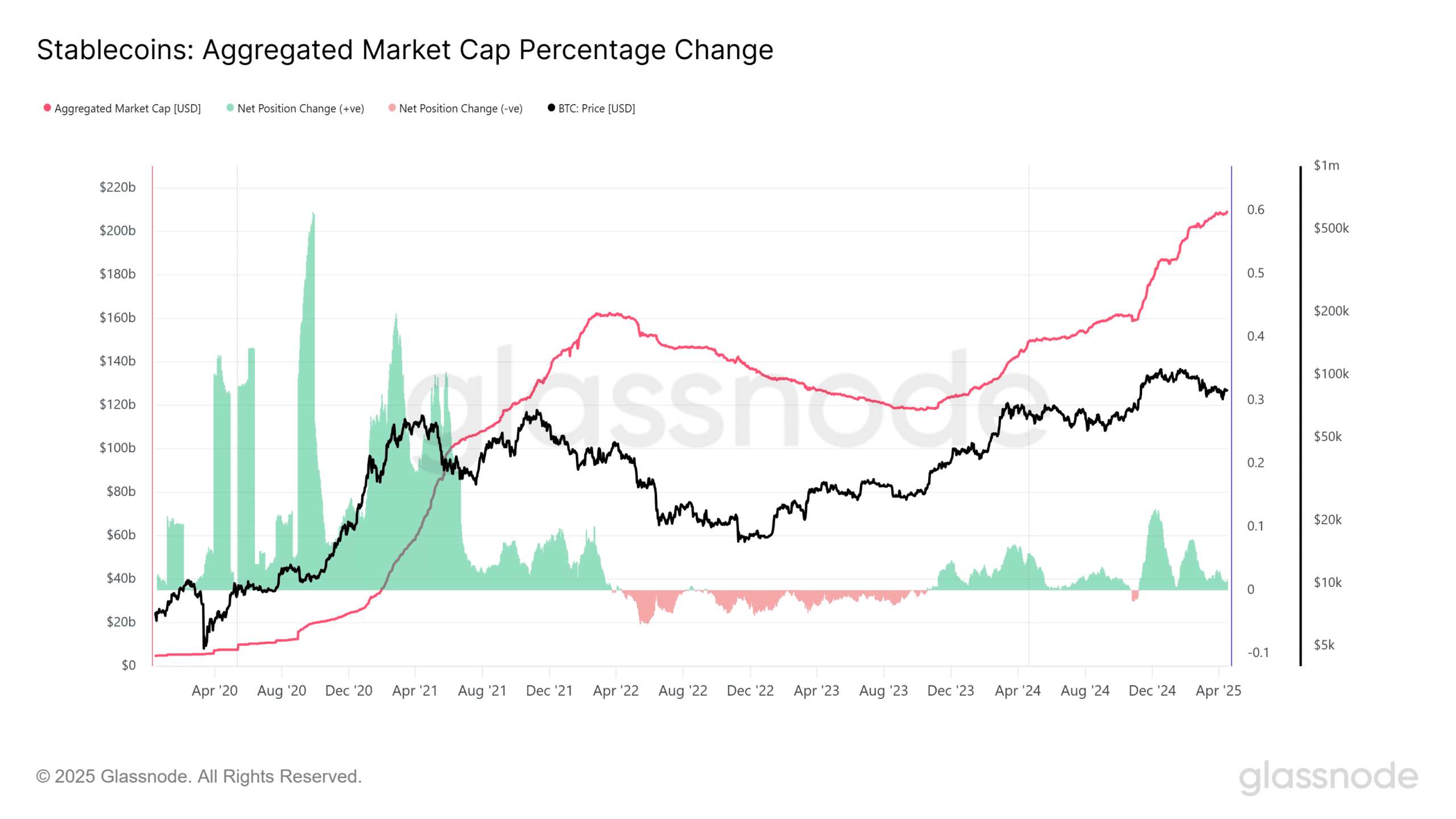

Let’s talk about stablecoins. The “Stablecoins: Aggregated Market Cap Percentage Change” metric is what we use to see if the total value of major stablecoins—think USDT, USDC, and DAI—is collectively growing or shrinking.

Basically, it gives us a near-instant snapshot of how much ready cash is floating around within the crypto system as a whole.

When we look at this metric in relation to Bitcoin [BTC], it actually gives us a heads-up about whether people are feeling risky or playing it safe with their investments and if new money is flowing in.

If this growth slows down, it suggests investors are becoming more cautious. They’re probably holding onto their funds, hesitant to jump into assets perceived as riskier.

The total stablecoin market cap is substantial, sitting at $209 billion. However, recent Glassnode data reveals a dip in net position changes. This pullback really does speak volumes about the current cautious mood.

So, the big question arises: are Bitcoin traders taking a breather, unsure if now’s the time to fully commit to another big bull run?

Hesitancy in capital deployment

Now, if you glance at the chart below, you’ll see that the overall supply of stablecoins has been on an upward trend. In fact, the combined market cap hit a new high recently.

What’s more, the net position change is still in positive territory (the green!), which usually signals a healthy influx of liquidity into the market.

Source: Glassnode

Historically, when Bitcoin goes on a bullish run, we’ve seen a strong connection with stablecoin inflows increasing. The reason is simple: it shows that people are feeling more comfortable with risk and that there’s a pile of cash sitting on the sidelines, ready to be moved into more volatile investments.

Take, for example, BTC’s impressive surge towards $100k. During that time, the net position change for stablecoins shot up to a peak of 13%! This clearly demonstrated a strategic shift, with investors pulling their capital out of the perceived safety of stablecoins and aggressively putting it into riskier assets.

That’s a textbook example of a “risk-on” market environment in full swing. Right now, even though the metric is still slightly positive at +1.67%, the lack of any real upward momentum hints at ongoing risk aversion.

In other words, it suggests that many market participants are a bit hesitant to really commit and aggressively invest in Bitcoin at its current price level.

Unless we see the Net Position Change decisively climb above that +4% mark, the idea of a continued bullish surge for Bitcoin remains shaky.

Bitcoin’s upside capped by stablecoin liquidity drag

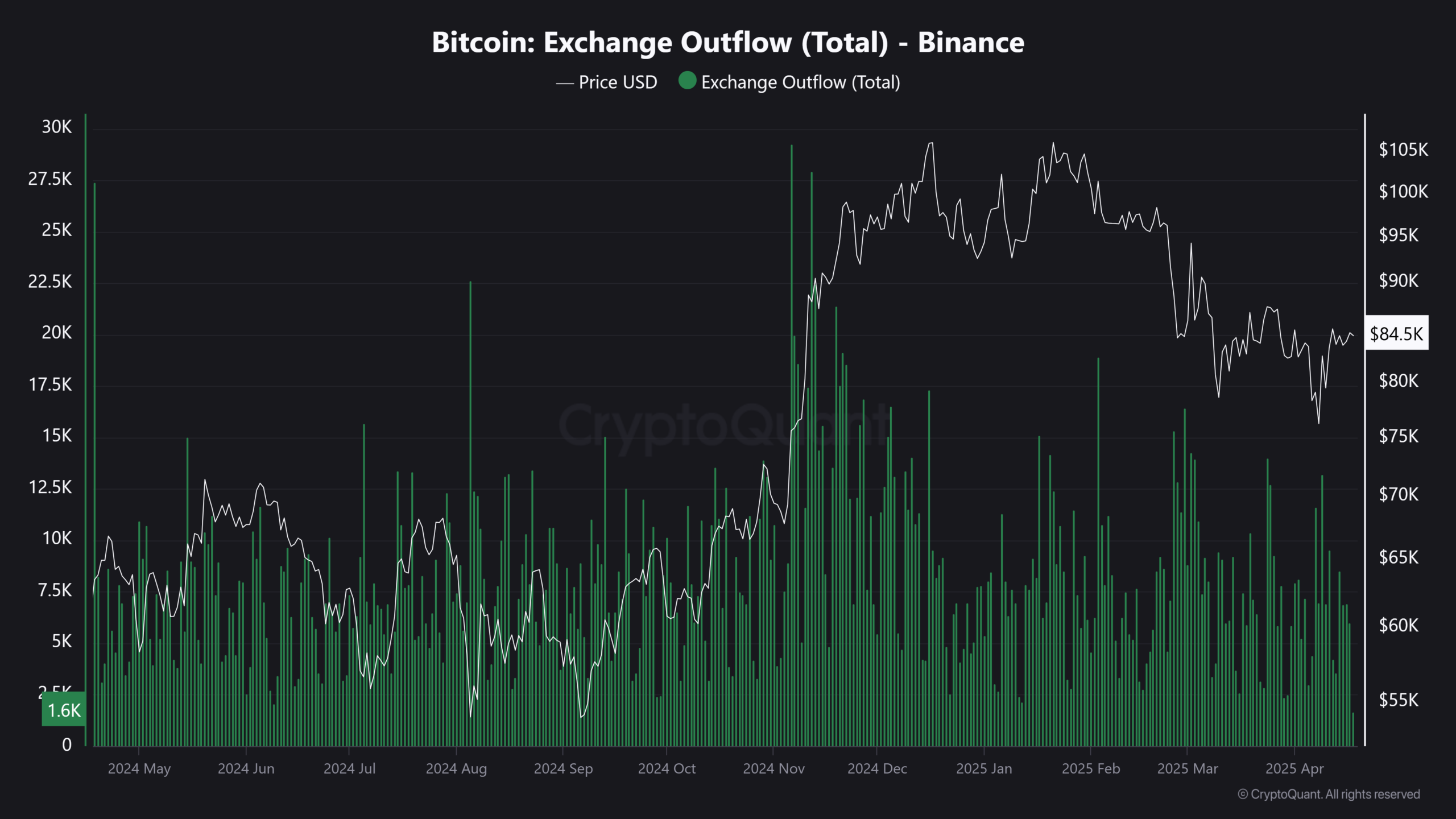

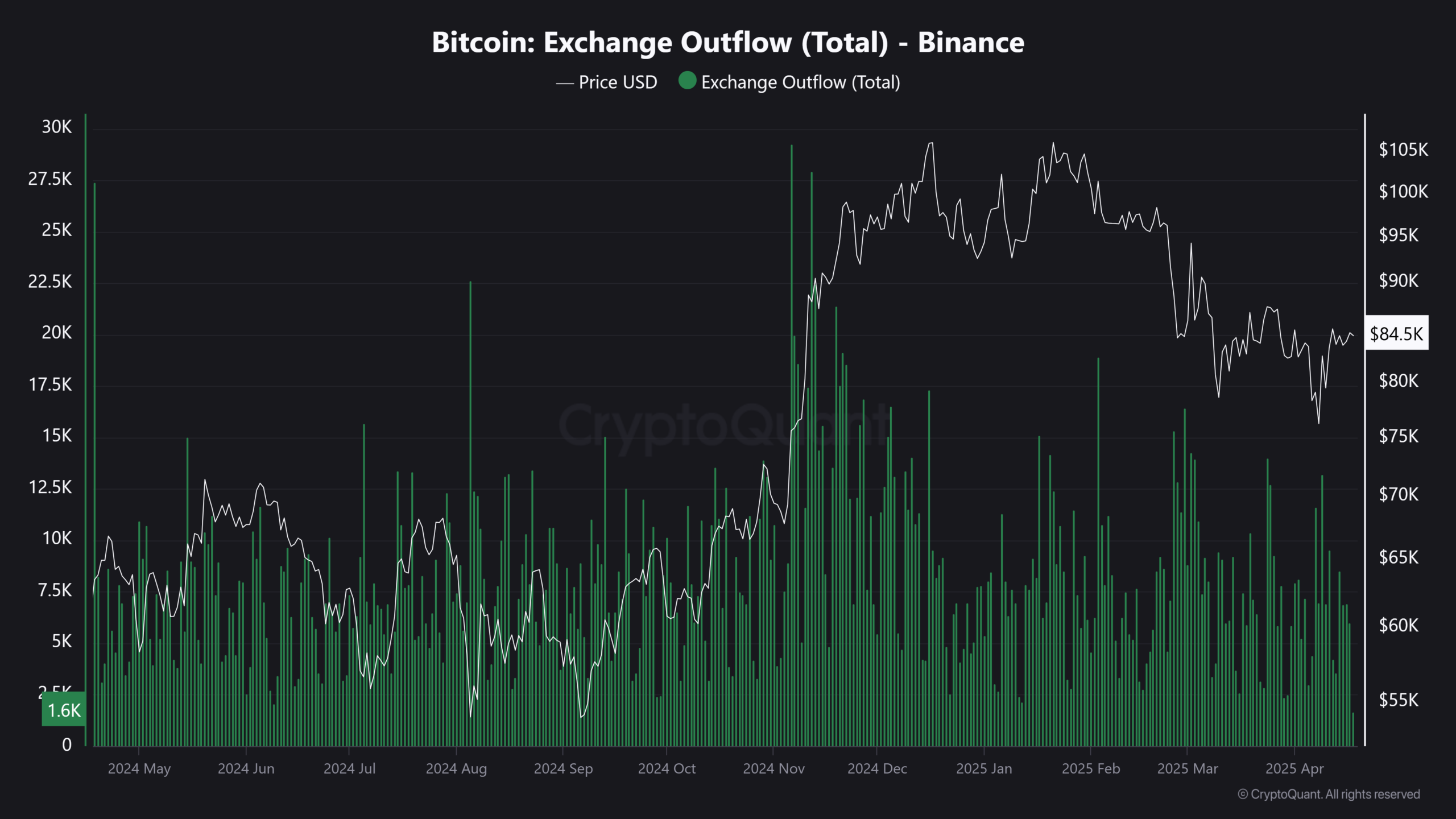

CryptoQuant data tells us that Binance is still a major player, handling 23.4% of all Bitcoin exchange activity at the time of writing, which is roughly 113.2K BTC.

This really emphasizes Binance’s ongoing importance as a key place where crypto liquidity is concentrated.

As you can see in the chart below, whenever Bitcoin’s price dips, we consistently see sharp increases in Bitcoin leaving Binance. This often points to moments when the order books are feeling stressed and sellers might be dominating.

Source: CryptoQuant

Even with prices hovering around $84.5k, Binance hasn’t seen a significant exodus of Bitcoin yet. This suggests that there’s still a good amount of potential selling pressure sitting on the exchange.

When you combine this with the signs of decreasing stablecoin liquidity we discussed earlier, it really doubles down on the idea that the market is currently in a risk-off mode.

According to our analysis at AMBCrypto, this points to a couple of key takeaways. First, it’s likely that Bitcoin hasn’t found its absolute price bottom just yet. And second, Bitcoin’s ability to move significantly higher might be limited for now.

Ultimately, for Bitcoin to break out and appreciate further, we probably need to see a shift in the broader market mood and improvements in overall liquidity conditions.

Until these factors line up, that $90k resistance level for BTC is likely to hold strong, making it an uphill battle for any major price breakouts.