Stablecoin shift: $1.52B surges into TRON as Ethereum bleeds

Just this past week, Tron has attracted a whopping $1.52 billion in stablecoins – mostly in the form of USDT and USDC.

This impressive influx propels Tron to the forefront, significantly outpacing other blockchains when it comes to net stablecoin inflows. It’s a clear indication that users are increasingly valuing networks that are both cheap to use and highly efficient.

Interestingly, Ethereum has gone the other way, experiencing a net outflow of $1.02 billion. This marks the most substantial decline among the top 15 blockchain networks.

Source: X

This data suggests a significant rotation of capital as users become increasingly mindful of costs, particularly given Ethereum’s often high gas fees and network congestion.

Platforms like Tron, Hyperliquid [HYPE], Toncoin [TON], and Arbitrum [ARB] are reaping the benefits from this shift. On the other hand, chains such as Avalanche, Base, and Solana [SOL] are seeing outflows.

These movements reflect the dynamic nature of user behavior and how capital is being allocated in real-time. Liquidity is definitely gravitating towards platforms that provide smoother and more cost-effective on-chain experiences, especially when dealing with stablecoin transactions.

The growing popularity of coins not tied to the USD

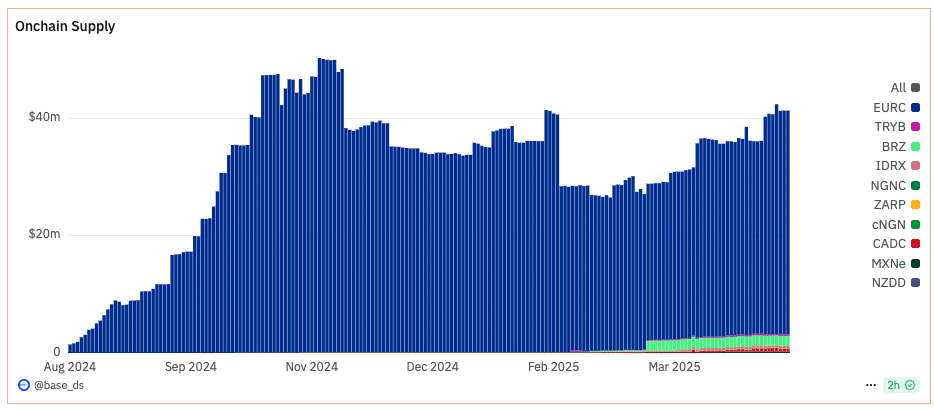

Alongside this capital shift to networks like Tron, we’re also observing a quiet but steady climb in the supply of stablecoins that aren’t pegged to the US dollar – especially on blockchains known for their efficiency and low costs.

Data coming from Base reveals a recent surge in stablecoins like NGNC, IDRX, and BRZ. We’re also seeing smaller but noticeable growth in coins like CADC and MXNe.

Source: X

While stablecoins backed by USD still dominate the scene, these regional stablecoins are increasingly being used for things like hedging against currency fluctuations, facilitating local payments, and supporting regional e-commerce. As the demand for exposure to a wider variety of currencies grows, blockchains that can offer faster and cheaper transactions are becoming the go-to infrastructure for stablecoin diversity.

Ultimately, capital tends to follow where it finds the best utility. As users branch out from Ethereum, chains like Tron appear to be shaping the course for the next phase of crypto.