States Invest $330M in Saylor’s Strategy: Analyst

It turns out that state pension funds and treasuries in North America are paying attention to crypto, with twelve states reporting investments in Strategy (formerly MicroStrategy) stock. By the end of 2024, these holdings totaled a significant $330 million.

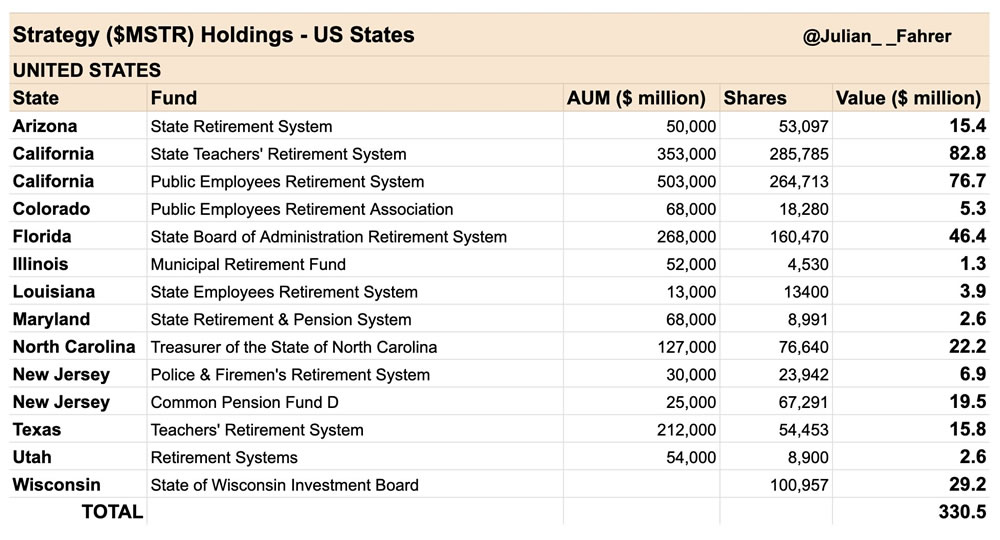

Bitcoin analyst Julian Fahrer pointed out on February 17 that when it comes to Strategy investments, retirement funds and treasuries in California, Florida, Wisconsin, and North Carolina are leading the pack, showing the most substantial exposure.

Taking the top spot is California’s teacher retirement fund, which boasts the largest holdings in Michael Saylor’s business intelligence software firm. According to their Form 13F filing with the US Securities and Exchange Commission on February 14, they hold 285,785 shares, estimated to be worth around $83 million at the time.

California’s State Teachers Retirement System fund, a significant player with a $69 billion portfolio of diverse stocks, isn’t just invested in Strategy. They also hold Coinbase (COIN), with filings revealing 306,215 shares valued at $76 million at the time of reporting.

Adding to California’s crypto footprint, the California Public Employees’ Retirement System also shows a strong position in Strategy stock, holding 264,713 shares worth approximately $76 million. Their appetite for crypto exposure extends to Coinbase as well, with holdings valued at $79 million. This massive state retirement fund manages a total investment portfolio of around $149 billion.

The attraction to Strategy for these funds? It’s largely because Strategy stands as the world’s largest corporate holder of Bitcoin

, boasting 478,740 coins worth around $46 billion at current market prices. Investing in Strategy stock, therefore, offers a way to gain exposure to Bitcoin indirectly.

Reinforcing their commitment to Bitcoin, Strategy’s most recent acquisition involved purchasing 7,633 BTC at $97,255 per coin between February 3rd and 9th.

Florida is also joining the trend, with the State Board of Administration of Florida Retirement System fund holding 160,470 Strategy shares, valued at $46 million. Wisconsin’s State Investment Board isn’t far behind, holding 100,957 shares worth around $29 million at the time of their filing.

North Carolina is also in the mix, with the State Treasurer reporting $22 million invested in MSTR. Meanwhile, New Jersey’s Police and Firemen’s Retirement System and Common Pension Fund together hold a larger stake, totaling $26 million in Strategy stock.

According to Fahrer, the states investing in Strategy extend beyond these leaders, with Arizona, Colorado, Illinois, Louisiana, Maryland, Texas, and Utah also holding the stock in their public funds.

Interestingly, the company at the center of these state investments, formerly known as MicroStrategy, recently rebranded to simply Strategy on February 5, fully embracing its Bitcoin-focused identity with a new visual marketing approach.

These state investments appear to be well-timed, as MSTR stock has gained an impressive 16.5% since the beginning of 2025. Even more impressively, it’s up a whopping 383% compared to the same time in 2024, significantly outperforming the broader crypto market, which has risen by 62% over the past year.