Strategic: SEC Proposal Suggests XRP as US Financial Asset

A fascinating proposal advocating for XRP to become a strategic financial asset for the United States has surfaced on the U.S. Securities and Exchange Commission (SEC) website. The five-page document, authored by Maximilian Staudinger, it seems, was submitted directly to the SEC’s recently formed Crypto Task Force.

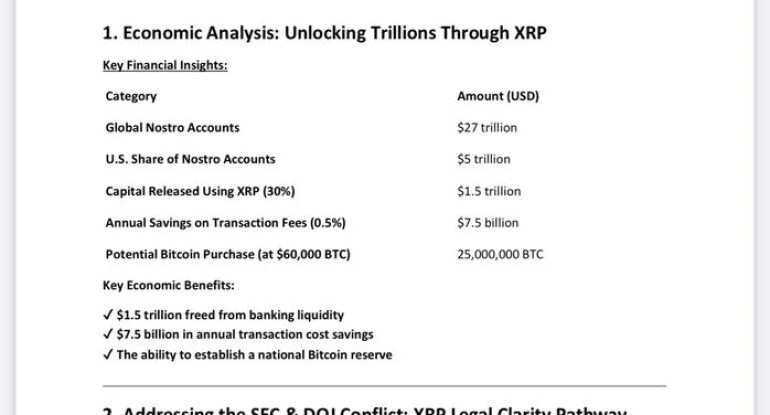

According to the proposal, the U.S. stands to gain significant financial advantages if it adopts XRP as a payment asset. This proposal, which envisions integrating Ripple’s XRP into the U.S. financial framework, suggests it could potentially free up as much as $1.5 trillion from Nostro accounts.

Nostro accounts are essentially accounts that banks hold in foreign banks, denominated in foreign currencies, to simplify international transactions. The proposal highlights that a staggering $27 trillion is currently held in these accounts globally, with the U.S. accounting for $5 trillion of that sum. Furthermore, the document suggests XRP could step in as the replacement liquidity for 30% of these funds.

The proposal further suggests that XRP could function as the payment rail for financial transactions, potentially saving the U.S. as much as $7.5 billion each year. While specifics on implementation are still somewhat vague, the proposal envisions the government utilizing XRP for state-level payments, such as Social Security benefits.

Interestingly, the proposal also touches upon the idea of a Bitcoin reserve, suggesting that the $1.5 trillion unlocked from Nostro accounts would be channeled into acquiring Bitcoin for a strategic reserve. However, it makes a factual error by claiming the U.S. could purchase as much as 25 million BTC at $60,000 per BTC using these funds—a figure that exceeds Bitcoin’s absolute maximum supply of 21 million BTC.

The proposal calls for a regulatory overhaul to make XRP payment network

As expected from such an ambitious plan, the proposal also outlines key recommendations for integrating XRP into the U.S. financial system. The primary recommendation is a presidential executive order directing the SEC, Treasury, and Department of Justice (DOJ) to officially classify XRP as a payment asset. Proponents of the proposal argue that this executive order would also help resolve the ongoing lawsuit between the SEC and Ripple regarding XRP’s regulatory status.

Going further than just an executive order, this multi-stage plan also includes legislative recommendations. These recommendations call for laws that would mandate banks to adopt XRP, and compel the Federal Reserve and the Office of the Comptroller of the Currency to make the use of XRP obligatory for banks as a Nostro account alternative.

The document emphasizes the significance of the SEC and Ripple lawsuit, underscoring the need for legal clarity on XRP’s status. It suggests that implementation of the proposal could be achieved within 12 to 24 months, with the timeline contingent on whether stakeholders pursue a regular or accelerated implementation plan.

Crypto community reacts

Predictably, the proposal has drawn criticism from numerous voices within the crypto community, many of whom dismiss it as completely unrealistic and not worthy of consideration. Frank Corva, political correspondent for Bitcoin Magazine, for instance, labelled it “illogical” in a recent opinion article.

Corva wrote:

“Given how faulty the logic behind this proposal is, it’s difficult to consider XRP a strategic asset. Plus, why would the U.S. government do so when two thirds of the supply is still in the hands of the organization that issued the asset?”

While the proposal’s presence on the SEC website has certainly attracted attention, observers online have pointed out that the SEC’s platform is open for individuals to submit proposals and public comments, which are then published on their site. Therefore, it’s crucial to understand this is not an official stance from the SEC itself. Staudinger himself has verified this, explaining that he authored it to illustrate the potential of XRP.

Cryptopolitan Academy: Coming Soon – A New Way to Earn Passive Income with DeFi in 2025. Learn More