Technical Dip Alert: XRP Price Predicted to Fall to $1.60

XRP’s attempt to bounce back from its April 7 dip is losing momentum, as a worrying signal appears on its price charts.

Over the past week, the fourth-largest cryptocurrency, XRP, has been valiantly trying to recover from the market-wide downturn we saw on April 7. You might recall that XRP’s price tumbled to $1.6401 that day, a significant drop that pushed it below the $2 mark for the first time since December. Since then, XRP has shown resilience, climbing back above the $2 level.

XRP’s Recovery Stalling?

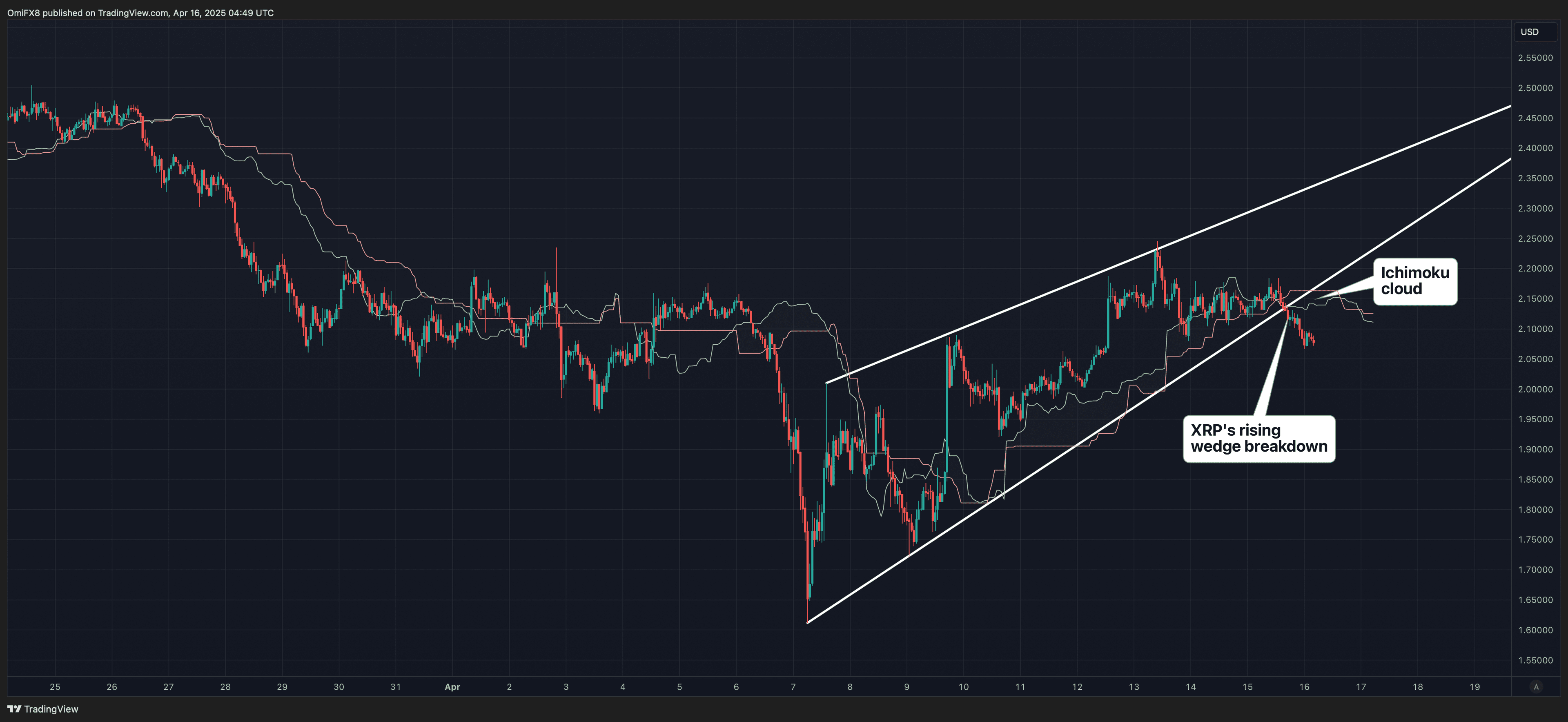

However, it looks like this recovery might be running out of steam. Why? Because XRP’s price chart is showing a rising wedge breakdown, which is often seen as a bearish sign. For those unfamiliar, a rising wedge is a pattern traders watch for. It can suggest that an upward trend might be reversing and heading downwards.

This pattern takes shape as two upward-sloping lines converge, connecting the series of higher lows and higher highs. Think of it like a narrowing funnel pointing upwards. The concerning part is when the price breaks below the lower trendline of this wedge. This break suggests a shift in momentum, from buyers being in control to sellers taking over.

Specifically for XRP, this rising wedge breakdown showed up on Wednesday. This bearish signal indicates that buyers might be losing their enthusiasm for XRP, potentially handing the reins to sellers.

Could XRP Price Fall Back to $1.6?

According to veteran investor Thomas Bulkowski’s technical analysis principles, which he detailed on his website, the starting point of the wedge often acts as an initial support level after a breakdown. Applying this to XRP, the support level appears to be around $1.60. This means there’s a possibility we could see XRP testing this level again if the market takes another dip.

Adding to the bearish outlook, XRP has also dipped below the Ichimoku Cloud. This might sound technical, but the Ichimoku Cloud is essentially a tool used to gauge the overall trend of an asset.

Essentially, when an asset’s price is floating above the “cloud,” it’s generally considered a bullish sign. But, as we’re seeing on XRP’s hourly chart, when the price falls below the cloud, it often signals a shift towards a bearish trend.

Currently, XRP is trading around $2.07, having slightly decreased by 0.60% in the last 24 hours. Looking at the bigger picture, however, it’s still up by 3.81% over the past week.

Expert Throws in a Contrasting $24 Prediction for XRP

Despite these bearish signals popping up on XRP’s charts, it’s not all doom and gloom. Popular crypto educator Davinci Jeremie has suggested a very different scenario, predicting that XRP could potentially skyrocket to a target price of $24 this year.

Jeremie’s optimism stems from his belief that several U.S. officials are showing support for XRP, which he thinks could spark a major rally towards that ambitious $24 target. To reach this level, XRP would need to surge by a massive 1,059% from its current price!

Interestingly, despite this bullish price target, Jeremie actually advises investors against buying XRP. He refers to it as a ‘banker’s coin’ and goes as far as urging market participants to sell their XRP holdings in favor of Bitcoin. Quite a contrasting viewpoint!

Disclaimer: This content is for informational purposes only and should not be taken as financial advice. The views presented in this article are personal opinions of the author and do not represent the official stance of The Crypto Basic. Readers are strongly encouraged to conduct their own thorough research before making any investment decisions. The Crypto Basic disclaims any responsibility for financial losses incurred.