The ripple effects of Trump’s tariffs

The ripple effects of Trump’s tariffs

The ripple effects of Trump’s tariffs are reaching Main Street, with retail giants now weighing in on the conversation. Target, the nation’s second-biggest retailer, recently issued a profit warning for their first quarter, directly citing the newly imposed tariffs on Chinese goods as a key factor.

Target said, “Considering the ongoing wobble in consumer confidence and a slight dip in net sales this February, coupled with the uncertainty around tariffs and the anticipated timing of some expenses throughout the year, we anticipate significant pressure on our first-quarter profits compared to the rest of the year.”

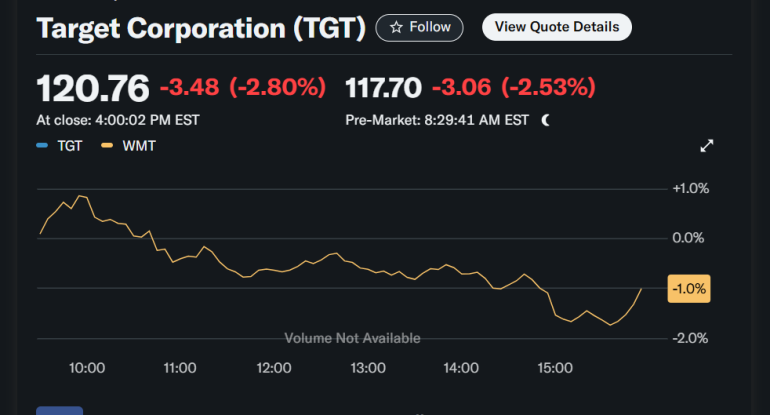

Investors haven’t been thrilled lately, as Target’s stock price has slipped 21% over the past year and another 9% this year alone. Looking back further, Target stock is down a significant 28% over the last five years, while the broader S&P 500 has actually grown by 13% in the same period.

Interestingly, this profit warning comes despite Target actually outperforming expectations for sales, gross profit margin, and earnings in the fourth quarter, announced just this morning before the market opened. The retailer attributed this positive holiday season performance to continued strong demand for clothing and home goods. However, it seems the post-holiday period has painted a less rosy picture.

Digging into the details reveals that while those fourth-quarter figures were positive, both sales and margins did decline compared to the previous year. Furthermore, Target’s growth in both brick-and-mortar and online sales is still trailing behind its competitor Walmart, who has been aggressively cutting prices and expanding its grocery offerings.

Target’s revenue streams

Looking at the numbers, net sales for the fourth quarter were down 3.1% year-over-year, landing at $30.9 billion, slightly above the anticipated $30.67 billion. The gross profit margin came in at 26.2%, a slight decrease from last year’s 26.6% and a bit below the expected 25.5%. Dividends per share also saw a dip, 19% lower than the same period last year at $2.41, compared to expectations of $2.26.

On a brighter note, comparable sales did increase by 1.5% year-over-year, beating the 1.18% estimate, and comparable digital sales jumped by a healthy 8.7%.

Inventory levels are up, with an $854 million increase compared to last year. During the quarter, Target also bought back $506 million of its own stock and still has a substantial $8.7 billion available for future stock buybacks under a previous authorization.

Transaction volume was up 2.1% during the quarter, but the average amount spent per transaction decreased by 0.6%. Looking ahead, Target anticipates full-year earnings per share to be in the range of $8.80 to $9.80, a downward revision from the previously expected $9.24.

Trump tariff uncertainty is weighing on businesses

The source of this economic unease? President Trump has slapped tariffs of 25% on goods from Canada and Mexico and 20% on goods from China. The potential for a full-blown trade war is looming, as Canada, China, and Mexico have all indicated they are prepared with “contingency plans” to retaliate with taxes on US goods.

The impact on businesses is already being felt. In January, the trade policy doubt index reached its highest point since records began in 1960, highlighting the significant confusion and uncertainty in the business environment. And this doesn’t even factor in the more recent tariff threats emerging from the White House.

Illustrating this point, a US transportation equipment provider, responding to February’s survey by the Institute for Supply Management, reported that customers are hitting pause on new orders, paralyzed by the uncertainty surrounding tariffs.

The tariffs’ reach extends into our homes, as many everyday American household goods, from closets to living rooms to children’s play areas, originate in China.

Take Basic Fun!, a toy company, as an example. They were just beginning to navigate the 10% tariffs Trump recently imposed on all Chinese products. Now, the prospect of an additional 10% tariff looms, potentially creating a $5 million hole in their finances. This is because a large majority of Basic Fun!’s toys are manufactured in China, and pre-existing contracts with customers mean they’ll largely have to absorb these extra tariff costs until around 2026.

It’s not just companies reliant on Chinese manufacturing that are worried. Even the CEO of Alcoa, a major US aluminum producer, has warned that Trump’s threat to impose 25% tariffs on all metal imports could cost the US a staggering 100,000 jobs.

Cryptopolitan Academy: Want to grow your money in 2025? Learn how to do it with DeFi in our upcoming webclass. Save Your Spot