Tokens Big Players Are Scooping Up

As we gear up for May 2025, crypto whales are visibly making moves, with three tokens particularly catching their eye: Ethereum (ETH), Artificial Superintelligence Alliance (FET), and Onyxcoin (XCN). Over the past week, all three have seen a clear surge in accumulation by these large holders, suggesting growing interest from the big players despite the recent market’s ups and downs.

While Ethereum and Onyxcoin are both navigating recent price corrections, this wave of whale buying could signal confidence in a potential rebound. Meanwhile, Artificial Superintelligence Alliance (FET) is riding a fresh surge of momentum in the AI sector, with whale activity ramping up right alongside its price gains.

Ethereum (ETH)

Let’s talk Ethereum (ETH). A key indicator is the number of ‘Ethereum whales’—that’s wallets holding between 1,000 and 10,000 ETH. Interestingly, this number has been steadily increasing since April 15th. To put it in perspective, back on April 15th, there were 5,432 of these whale addresses. Now, that figure has climbed to 5,460 – marking the highest number of ETH whales we’ve seen since August 2023. Adding to this story, the total amount of ETH these whales hold is also reaching new peaks, reinforcing the idea of significant accumulation by these large investors.

Now, this surge in whale accumulation can be viewed in a couple of ways. On one hand, it could signal strong confidence in Ethereum’s long-term potential. On the other, it does raise some eyebrows about centralization and the possibility of significant sell-offs if these whales decide to cash in their profits.

Looking at the price chart, Ethereum has seen a decrease of over 19% in the last month. Should this downward trend persist, we might see the price test the $1,535 support level. If it breaks below that, further drops to $1,412 or even $1,385 could be on the cards. However, if the tide turns and buyers step in, ETH could face initial resistance around $1,669 and then $1,749. If the bullish momentum really takes hold, a push towards $1,954 becomes a possibility.

So, in the current market picture, the increasing influence of these Ethereum whales presents a double-sided coin. They could become a stabilizing factor, or they might represent a potential risk – it all hinges on how they react to any shifts in the market.

Artificial Superintelligence Alliance (FET)

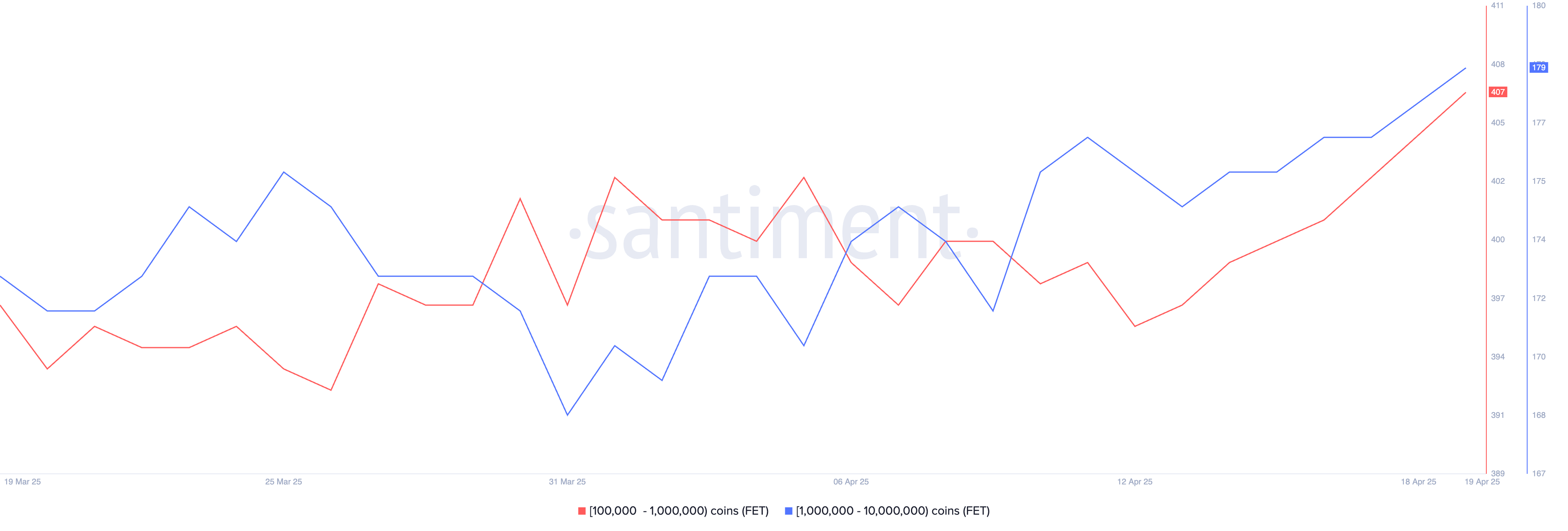

Turning our attention to Artificial Superintelligence Alliance (FET), we’re observing a similar trend. The number of FET whales—that’s wallets holding between 10,000 and 1,000,000 FET tokens—has climbed from 572 on April 13th to 586 by April 19th. This consistent increase in large holders suggests growing confidence among the big crypto investors. This also coincides with a broader resurgence of interest in the AI crypto space.

In fact, we can see this AI narrative picking up steam across the board. Major AI-related cryptocurrencies like FET, TAO, and RENDER have all jumped by over 9% in the past week. FET itself has been particularly strong, gaining over 8% in the last 24 hours alone, and an impressive 13.5% over the last week. This performance really hints at a potential resurgence for the artificial intelligence theme within the crypto market.

If this positive momentum keeps rolling, FET could aim for the $0.659 resistance level. A solid break above this point could pave the way for further upward movement, with $0.77 and then $0.82 appearing as the next potential price targets. On the other hand, if the rally loses steam, we might see FET retrace to test the $0.54 support level. Falling below that could lead to a deeper correction down to around $0.44.

With both whale activity intensifying and the AI sector flexing its muscles again, FET’s next price moves could be a crucial indicator for where this AI narrative is heading in the near future.

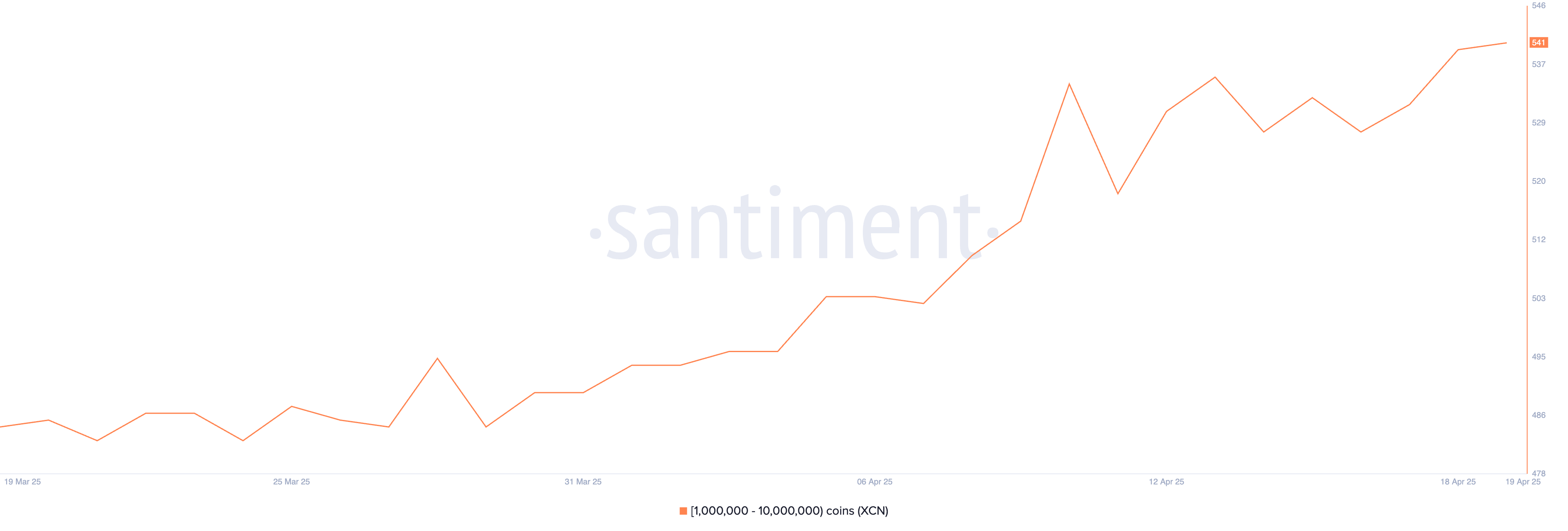

Onyxcoin (XCN)

Lastly, let’s look at Onyxcoin (XCN). While it was a star performer back in January, its upward momentum has slowed down recently. After a significant surge—up over 57% in the last month—XCN is now undergoing a correction, falling by 19% in the past week. However, despite this pullback, accumulation by larger investors continues. The count of crypto whales holding between 1 million and 10 million XCN has increased from 528 on April 16th to 541. This suggests that some big players might be seeing this dip as a buying opportunity.

If this correction deepens further, XCN might struggle to hold the $0.0165 support level. Dropping below this could potentially trigger further declines towards $0.0139 and even $0.0123. Conversely, if the trend reverses and buying interest returns, XCN could first test the $0.020 resistance. A decisive break above that mark could open up a path towards $0.027. With increased whale activity and volatility back in the picture, XCN’s next move could be a pivotal one.

Disclaimer

Okay, before we wrap up, a quick but important disclaimer. In line with the Trust Project guidelines, remember this analysis is for informational purposes only and shouldn’t be taken as financial or investment advice. Here at BeInCrypto, we’re committed to bringing you accurate and unbiased reporting, but the crypto markets are known for their rapid changes. Always do your own thorough research and speak with a qualified financial advisor before making any investment decisions. And just a heads-up, our Terms and Conditions, Privacy Policy, and Disclaimers have recently been updated, so it’s worth taking a look.