Top Strategic Imperatives for 2025

Key takeaways

- The Web3 fundraising landscape isn’t what it used to be. Now, investors want to see solid business plans, well-thought-out tokenomics, and proof that the market actually wants what you’re building.

- Don’t just chase the money—go for “smart money.” Strategic investors bring more than just funding; they offer valuable mentorship and crucial industry connections.

- You’ve got options for funding! Venture Capital (VCs), angel investors, grants, ICOs, and even crowdfunding each have their own perks.

- Know when to switch gears. If you’re not gaining traction and your funds are running low, it might be time to rethink your approach or explore new ventures.

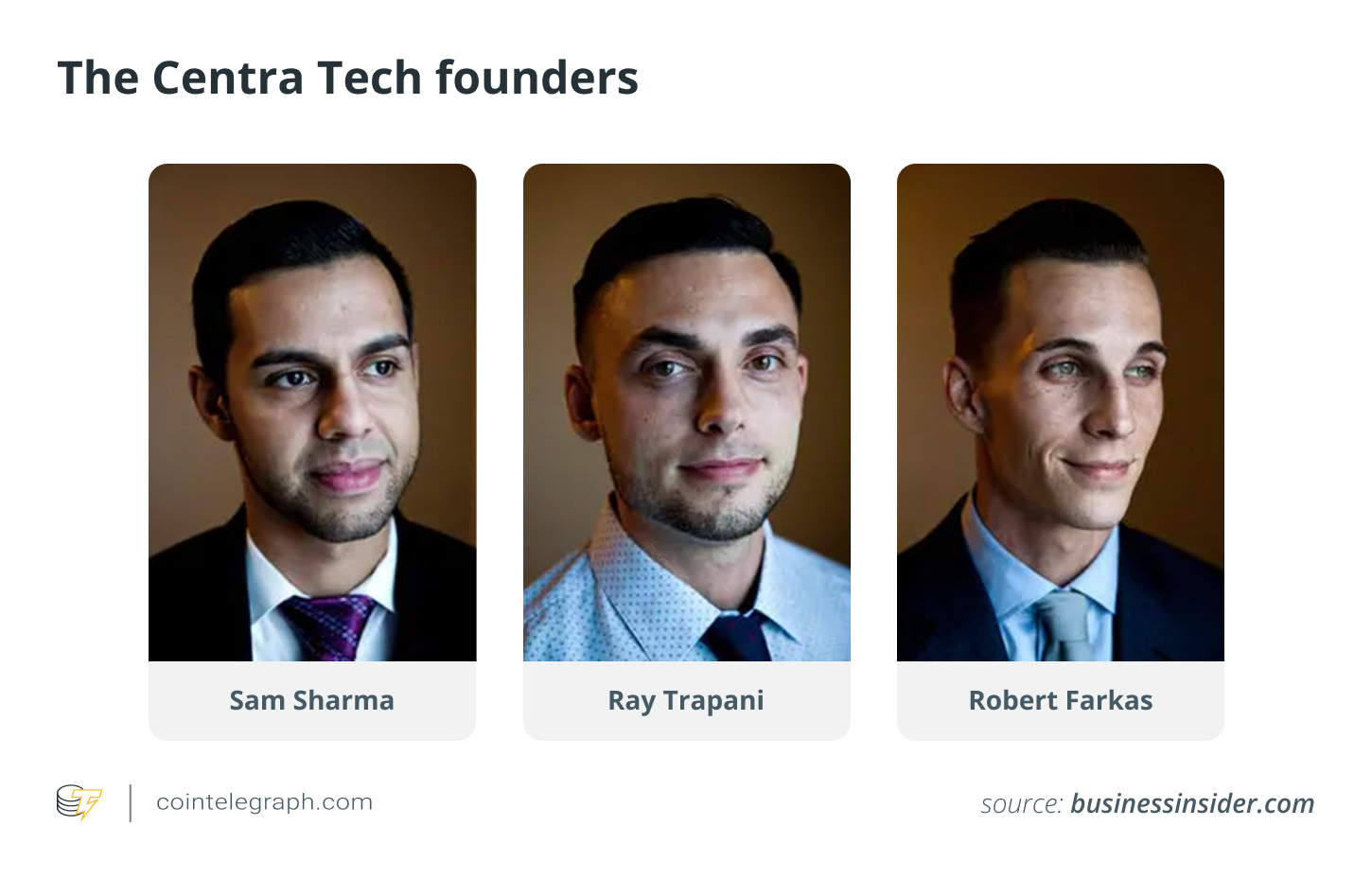

Remember the wild days of crypto back in 2017? If you do, you might recall Centra Tech, a company from Miami that launched an ICO. They promised a cryptocurrency debit card, supposedly backed by big names like Visa and Mastercard. Spoiler alert: they didn’t have a real product at all.

Even though Centra Tech was just a concept on paper, they managed to rake in over $32 million through their ICO! They even got celebrity endorsements from the likes of Floyd Mayweather Jr. and DJ Khaled. Crazy, right?

But the party didn’t last long. Less than a year later, the founders were arrested. Turns out, those partnerships with payment networks? Non-existent. The real product? Nowhere to be found.

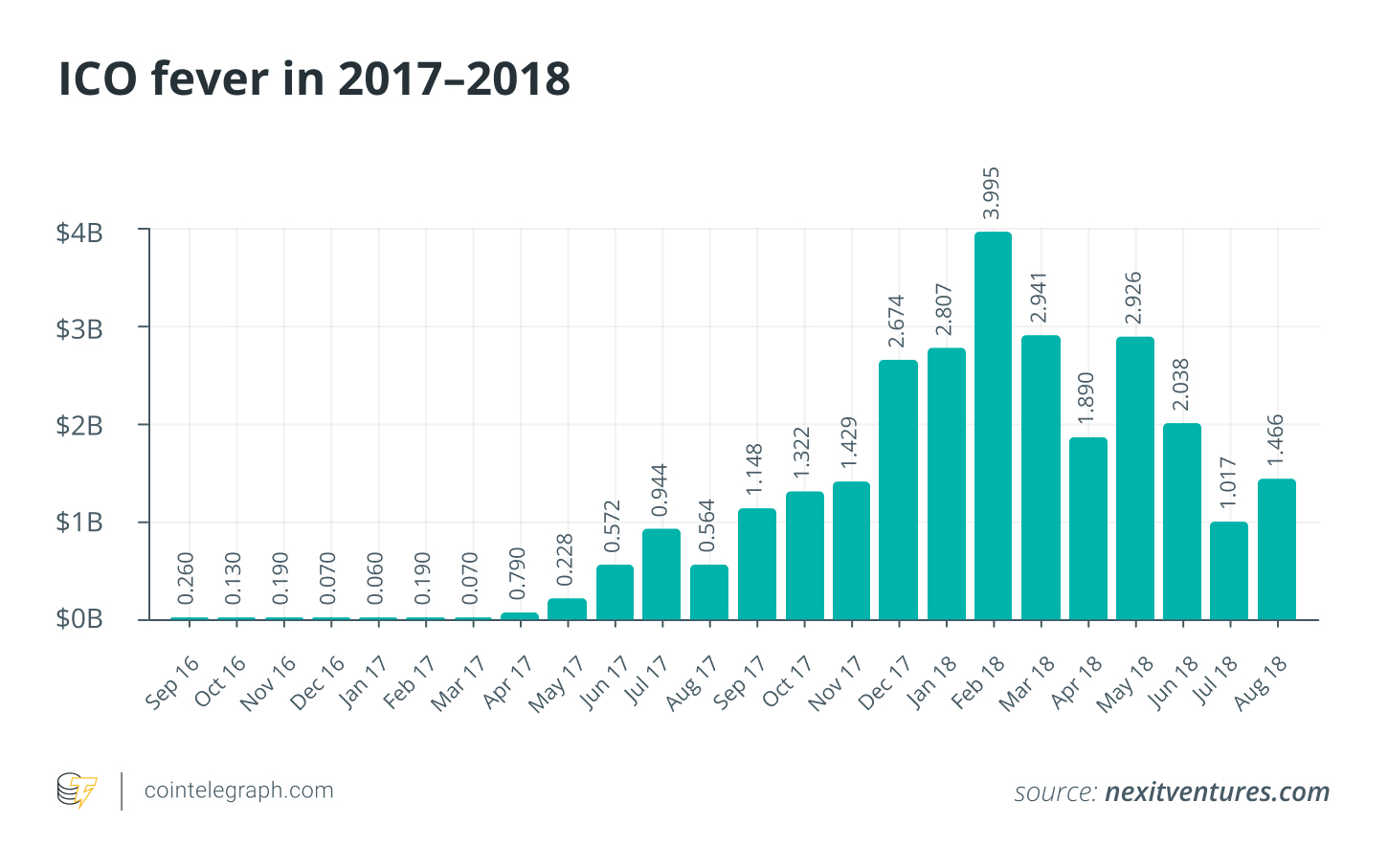

Centra Tech is just one example from the “ICO Boom” era, where projects could get funded based on just a white paper, no actual working product needed. A report from Fabric Ventures and TokenData revealed that in 2017 alone, 435 ICOs successfully raised about $5.6 billion – averaging around $12.7 million per project!

Here’s the kicker: Less than half of those ICOs were still active just four months after their token sales ended. And get this – a study suggested that over 80% of ICO projects in 2017 were actually scams.

Yeah, those days of easy money are definitely over. In 2025, many startups are still chasing investment, hoping for that old ICO enthusiasm. But they’re facing a much tougher reality: increased regulations, cautious investors, fierce competition, and, ultimately, lower chances of success.

But hey, it’s not all bad news! Investors are still out there, ready to back projects that are genuinely exceptional.

Today, we’re diving deep into the most popular ways to get funding for your Web3 project. We’ll cover everything, even if you’re starting with just a mobile phone and a dream!

Plus, we’ve got a bonus for you—an exclusive chat with the head of business development at Cointelegraph Accelerator, who shares some valuable insights into the current Web3 investment scene.

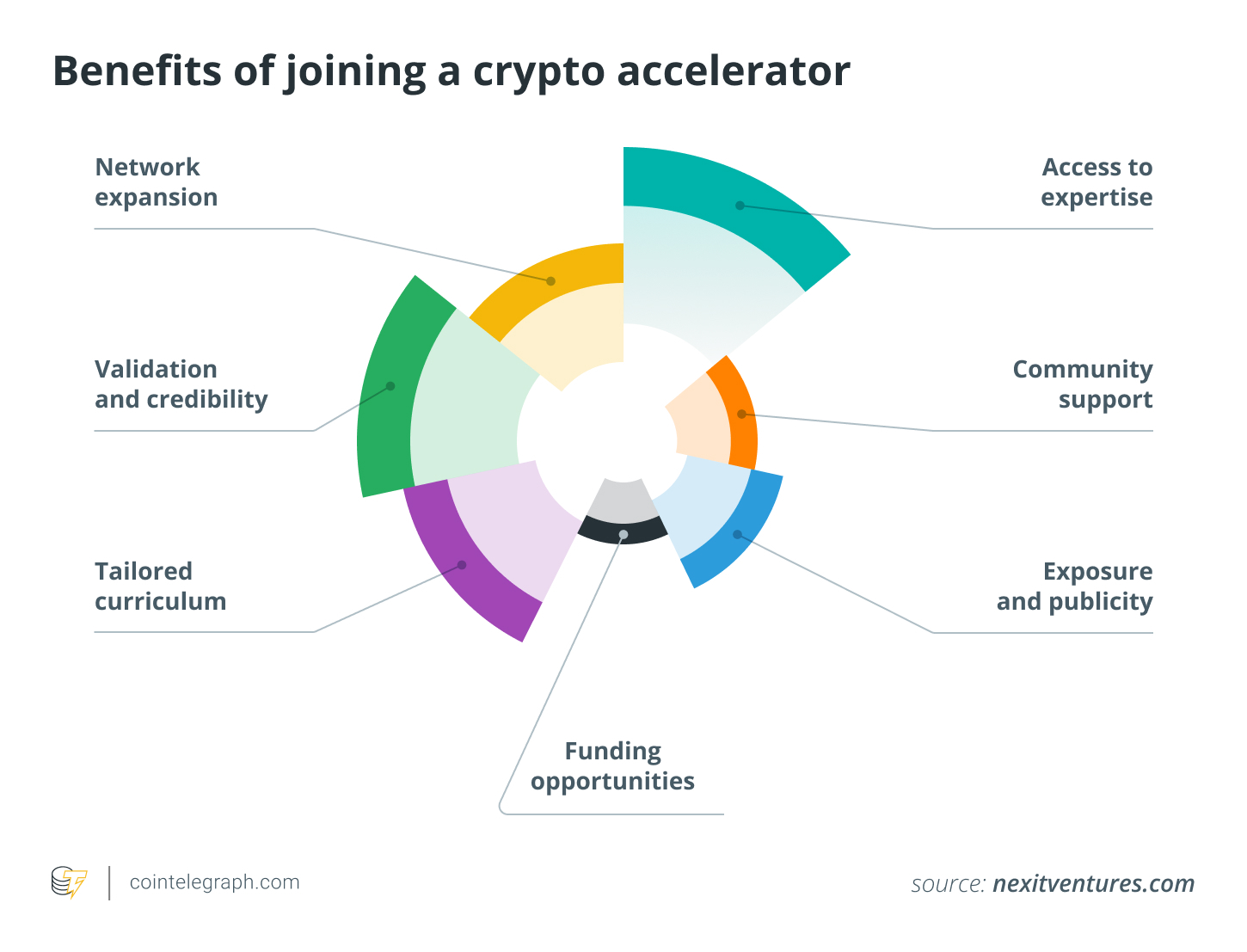

1. Incubators and accelerators

Incubators and accelerators are super helpful for Web3 startups trying to go from a simple idea to a real product in the market. These programs offer mentorship, resources, and yes, funding, specifically to support projects in their early stages. Let’s break down the difference:

- Incubators: Think of these as idea nurseries. They’re for startups still in the very early “idea” phase. You’ll get guidance, networking opportunities, and resources to help you actually build your MVP.

- Accelerators: These are for startups that already have a basic product (an MVP). They give funding and mentorship to help you grow and scale quickly. Many accelerators end with a “demo day,” where you get to pitch your project to potential investors.

Some well-known Web3 programs you should check out include:

- Outlier Ventures Base Camp: This is a 13-week accelerator program specifically for Web3 and crypto startups.

- Alliance: They offer daily mentorship and flexible funding options for Web3 founders.

- Antler: A global investor that focuses on the early stages, they have a 26-week startup program.

- Brinc: A 10-week accelerator providing funding, mentorship, and access to a global network.

And of course, Cointelegraph has its own accelerator program! We offer up to $100,000 of “smart money,” which means you get direct connections to infrastructure providers, investors, mentors, foundations, exchanges, market makers, and more.

Thinking about applying to a Web3 accelerator or incubator? Do your homework! Research programs that fit your project, prepare a killer pitch deck, and apply through their official websites. Each program has its own application process and deadlines, so be sure to check the details beforehand.

2. Venture capital (VC) funding

If your Web3 startup needs some serious cash to grow, Venture Capital (VC) firms are often the way to go.

But keep in mind, investors are being more picky now. They’re looking for clear business models, sustainable tokenomics, and solid legal foundations. Here’s what you need to know.

Finding the right Web3 VC

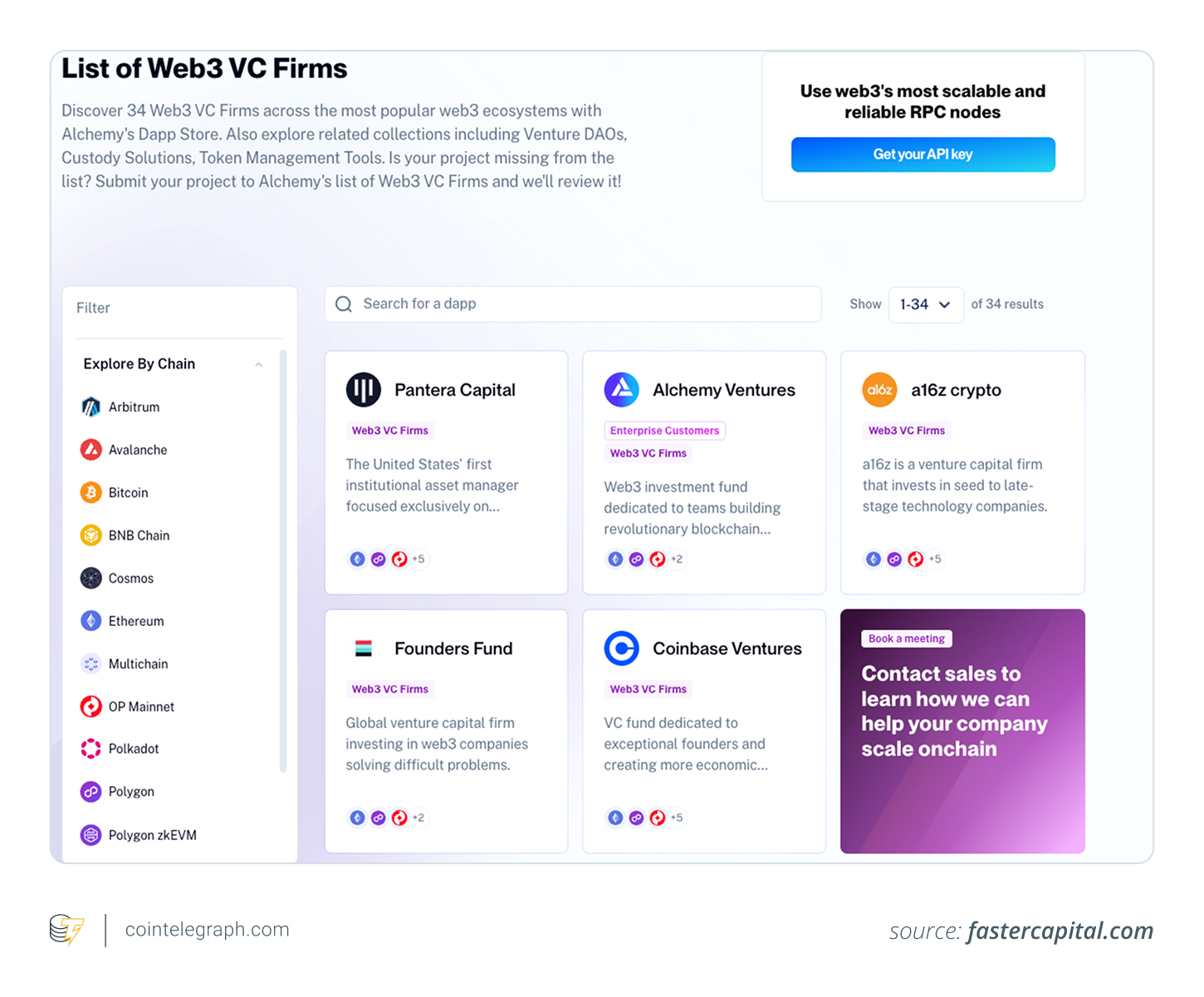

Not every VC is into blockchain, so it’s important to target the firms that actually specialize in Web3.

Seek out investors who have backed similar projects and have a history in crypto, DeFi, or NFTs. Resources like Alchemy’s list of Web3 VC firms can help you find the right players.

When you reach out, make sure your pitch really shows what makes your project special. VCs get tons of applications, so you need to stand out – maybe through a unique use case, impressive early traction, or an amazing team.

Structuring VC deals

Funding in Web3 often involves a mix of traditional equity and token allocations.

Investors might take a percentage of your company and also get a share of your project’s tokens, which could increase in value over time. Here are some key points to negotiate:

- Investment amount: How much money are you raising, and what’s the company valuation?

- Equity vs tokens: Will the deal include both? If so, what’s the split between them?

- Vesting schedules: Investors might have “lock-up” periods, meaning they can’t sell their tokens right away to prevent market dumps.

- Governance: Will VCs have a say in how your project is run?

The best deals are structured so that the founders and investors are both motivated to see the project succeed. A poorly structured deal could mean losing control of what you’re building.

Due diligence: what VCs expect

Before they sign anything, investors will do their “due diligence” – basically, they’ll dig deep into your project’s finances, legal stuff, and business plan. To be ready, you’ll need:

- Legal documentation: Company registration papers, contracts, and proof that you’re following regulations.

- Tokenomics model: A clear plan for how your tokens will be distributed, what they’re used for, and why it’s sustainable for the long run.

- Roadmap and traction: Show that you’re making progress, whether it’s through partnerships, a working product, or a growing community.

A solid business case, along with proper legal and financial paperwork, will make your project much more attractive to investors.

Did you know? Watch out for scammers who pretend to be VCs in Web3! They try to take advantage of startups desperate for funding, using tricky tactics to steal money or sensitive info. Always stay alert!

3. Angel investors

Angel investors are basically wealthy individuals who invest their own money. They can provide early-stage funding and often offer more flexibility than VCs. But getting angel investment isn’t just about the money; it’s about finding someone who genuinely believes in what you’re doing.

For example, if you’re building a scaling solution for Bitcoin, a general tech investor might not be the best fit. You’re better off finding a “Bitcoin whale” who is personally invested in seeing the Bitcoin network grow. Investors are way more likely to support a project they feel connected to, whether it’s because of their beliefs or financial interest.

So, where do you find these angel investors?

At conferences!

Events like Token2049, ETHDenver, and Consensus are packed with angels looking for the next big thing. We even talked to random attendees at Token2049, and almost all of them had money ready to invest.

Besides conferences, platforms like Web3 X (formerly Twitter), Telegram, and private investor groups are great places to network. A warm introduction can make all the difference between getting a meeting and being ignored.

Angel investors can become some of the most supportive backers in Web3. You just need to be in the right place, have the right pitch, and catch them at the right time.

4. Grants and ecosystem funds

Many blockchain platforms have set up grant programs to support projects that improve their networks.

Think of it like, “Build on our blockchain, and we’ll support you!”

For example, the Rootstock grant offers $2.5 million every quarter to developers building on the Bitcoin blockchain. Similarly, Starknet’s seed grant program provides non-dilutive funding (meaning they don’t take equity) to early-stage teams who have an MVP and are aiming to launch it.

To boost your chances of getting a grant:

- Align with what the grant is for: Make sure your project’s goals match the goals of the organization giving the grant.

- Show your project is solid: Present a clear plan, including milestones and a business model that can last.

- Highlight the impact: Explain how your project will benefit the blockchain ecosystem and its users.

- Follow the rules carefully: Stick to the application guidelines and provide all the required documents.

For more detailed advice, check out the Rootstock grant application guide, which gives insights into who’s eligible and how applications are judged.

Did you know? The potential partnership between Lotte and Arbitrum suggests that big traditional companies might be getting interested in blockchain-based virtual worlds again, as Ethereum’s largest layer-2 network looks to connect more deeply with the South Korean giant.

5. ICOs and token sales

Believe it or not, Initial Coin Offerings (ICOs) and token sales are still a thing for blockchain projects to raise money.

An ICO is basically when you create and sell a new cryptocurrency token. Investors buy these tokens using established cryptocurrencies like Bitcoin

or Ether

.

These tokens might give holders access to certain features, voting rights, or a share in the project’s future success. The ICO process usually involves:

- White paper release: This is like your project’s bible – a detailed document explaining your idea, tech details, team, and how much funding you need.

- Marketing campaign: Getting the word out! Trying to get people excited and build a community around your project.

- Token sale event: The actual period when investors can buy your new tokens.

Important to remember: in many places, ICO tokens are considered securities, which means they come with legal rules. For example, in the US, the Securities and Exchange Commission (SEC) has said that many ICOs are indeed securities offerings and have to follow federal securities laws.

Ignoring these rules can lead to legal problems, fines, and damage your project’s reputation. So, you absolutely need to talk to legal experts to make sure you’re following all the laws.

To increase your chances of a successful ICO:

- Create solid tokenomics: Clearly define what your token is for, how many there will be, how they’ll be distributed, and how you’ll keep people interested in holding them.

- Set realistic fundraising goals: Figure out exactly how much money you need to hit your project goals and avoid raising way too much.

- Build community trust: Be open and honest with potential investors, keep them updated regularly, and show that your team is capable and dedicated.

By planning carefully and playing by the rules, ICOs and token sales can still be a good way to raise money and build a loyal user base.

Did you know? Influencers can be part of your ICO fundraising strategy! Sometimes they get tokens directly to promote your project – it’s often called an ‘influencer round.’

6. Crowdfunding

Starting from just an idea, without any funding, and trying to cover development costs to build even a basic product can be a real struggle.

Plus, you might not have connections to angel investors or the money or time to go to all those investor events.

It’s a tough spot, especially if you’ve been sending cold LinkedIn messages to investors for months and haven’t gotten anywhere.

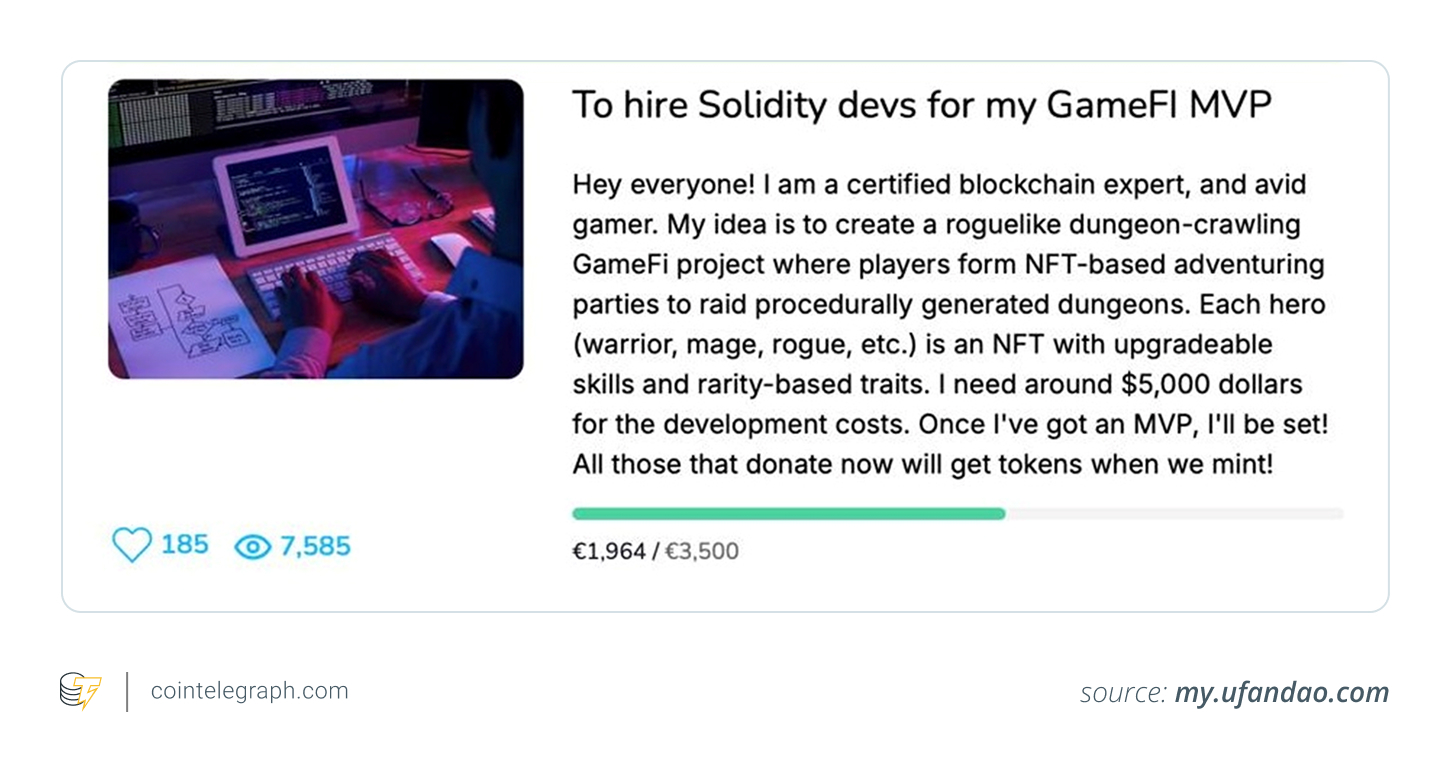

So, for those of you who might be in this situation, we’re talking about Web3 crowdfunding as a way to help bridge that gap. It might not solve all your problems, but it can help with some initial MVP development costs.

Traditional crowdfunding platforms like Kickstarter and GoFundMe are built on centralized systems and don’t really work with blockchain fundraising. So, Web3 startups usually look to projects like Gitcoin grants – these offer crowdfunding for public goods and open-source blockchain initiatives.

And if you’re still finding it hard to get funding, you could try a more general platform like UFANDAO.com.

What makes this platform special is that it lets you raise crypto for pretty much any idea, with donations coming from people who connect with your vision and want to support making the world a happier place.

While it’s probably not going to get you hundreds of thousands of dollars, it might just be the little push to get you started.

UFANDAO offers:

- Peer-to-peer donations: Donations go directly between users in real-time, so you get immediate access to funds without any middlemen taking a cut.

- Zero commissions: The platform doesn’t charge any fees on donations, so you get the full amount.

- Access to a global community: Anyone with internet can use it, anywhere in the world.

- Flexible fundraising: You can raise funds for anything, from personal projects to big Web3 innovations.

And there you go – our “wildcard” option for those starting from scratch with nothing but a smartphone and an idea.

Can’t say we didn’t cover everything!

The state of Web3 fundraising in 2025 with Anna Shakola

As part of putting this article together, we chatted with Anna Shakola, who heads up business development at Cointelegraph Accelerator, to get an insider’s view on Web3 fundraising right now.

Here are three key takeaways from our conversation that we thought you’d find valuable.

1. What are Web3 investors currently looking for?

Forget the days when you could raise millions just with a white paper!

The Web3 industry has seen some tough times with underperforming investment portfolios, including projects that didn’t grow or turned out to be scams.

While the industry is growing, it also means more startups, tougher competition, and investors playing it safer.

Right now, we’re seeing a focus on infrastructure, B2B, and projects that are a bit further along, showing real market demand. I think this really reflects the overall investor mood.

I’d say infrastructure is the hottest area right now.

2. What’s your advice to a Web3 startup in 2025?

Here’s what I’d suggest focusing on at the beginning:

- Really think about what you are. Be specific, be honest, and remember you don’t need to reinvent the wheel. Be crystal clear on the problem you’re solving. Having a strong identity for your project is key.

- Check out investor portfolios. Look into the accelerators, VCs, and angel investors you want to reach out to. Don’t just contact everyone randomly – it’s a waste of your time.

- Consider grants and ecosystem funds. These are often overlooked. You could even validate your idea through hackathons or bug bounty programs. Investors are watching these spaces closely.

- Aim for “smart money.” Just getting money from hands-off angel investors might not be enough. Focus on deals that bring you real, comprehensive support.

3. At what stage should a founder give up trying to fundraise for their project?

That’s a tricky one because usually, the advice is to never give up.

However, you have to think about the cost of your time spent reaching out to VCs, going to events, reworking your product, and the money involved.

I have a list of founders I check in with each year because they keep launching new projects whenever a new trend pops up. Being adaptable is crucial. If something isn’t working, don’t be afraid to drop it.

My take is that when the cash is gone, the project feels like a burden, the team is burnt out and not productive, and you’re not having any serious talks with investors, those are all signs that it might be time to move on.

Remember, more often than not, VCs will find you, you’re not going to find them.

Beyond ICOs to smart money: Navigating the future of Web3 fundraising

If the overwhelming number of automated “great project!” messages from VCs on Telegram hasn’t made it clear, Web3 fundraising has changed dramatically since the ICO craze of 2017.

Today, getting investment takes more than just a white paper and some connections. You need a strong project identity, a solid business plan, and proof that there’s real demand for what you’re building.

Whether you’re going after venture capital, angel investors, grants, token sales, or crowdfunding, it’s crucial to understand the right funding path for your stage of development.

And most importantly, as Anna mentioned, getting “smart money” – investment that comes with strategic help – can be a game-changer.

If one funding method isn’t working, pivot, refine your approach, and keep pushing, even if it means starting with crowdfunding for your MVP on UFANDAO.

But if the challenges become too much and you’re just not getting traction, knowing when to move on is just as important as knowing when to keep going.

Good luck!