Trump-backed American Bitcoin Reveals $273M BTC Holdings on Nasdaq Debut, Stock Soars 72%

Key Takeaways

- American Bitcoin went public on Nasdaq with the ticker ABTC after merging with Gryphon Digital Mining.

- The company pursues a dual strategy of self‑mining and strategic purchases, leveraging its partnership with Hut 8.

Share this article

Trump‑backed American Bitcoin discloses holding $273M in BTC on Nasdaq debut, stock jumps 72%

Trump‑backed American Bitcoin, backed in part by President Trump’s sons and the crypto‑mining firm Hut 8, officially made its debut on the Nasdaq exchange on Wednesday. The company’s listing materialized after a stock-for-stock merger with Gryphon Digital Mining, allowing it to trade under the ticker ABTC.

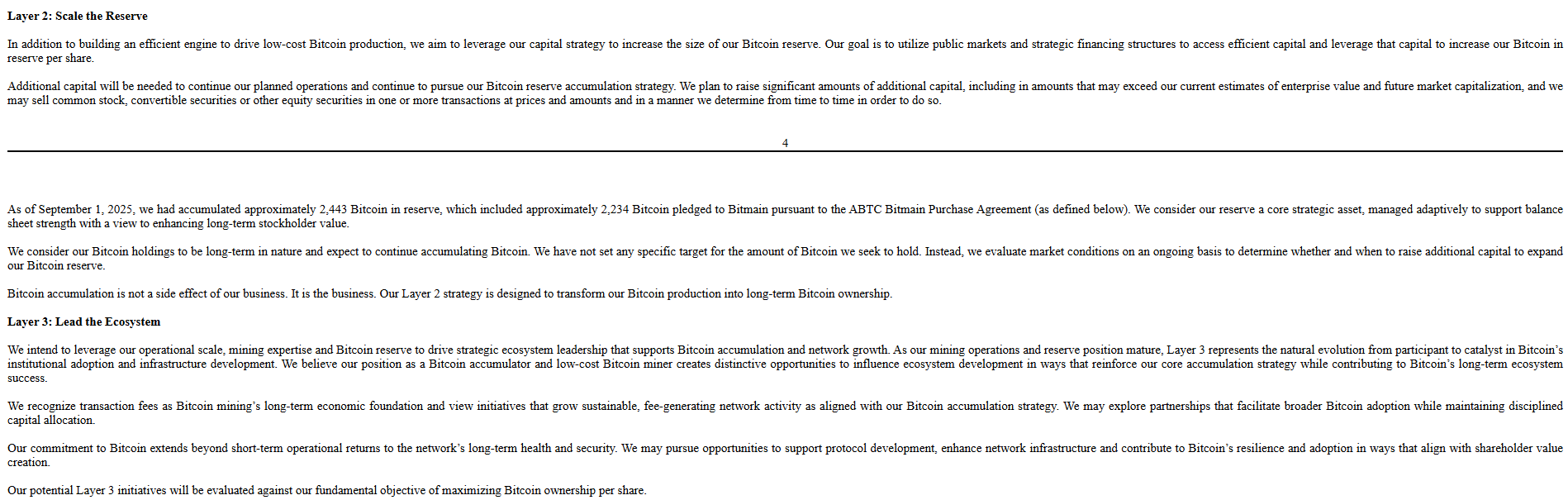

On the day of its Nasdaq launch, American Bitcoin disclosed that it now holds 2,443 Bitcoin (BTC) – a staggering close to $273 million in market value. That figure represents a sizeable jump from the 152 BTC the company reported during its initial SEC filing on September 3.

The firm intends to offer up to $2.1 billion of Class A shares. Proceeds will be allocated to purchasing additional Bitcoin, acquiring state‑of‑the‑art ASIC mining rigs, and supporting broader corporate initiatives, as detailed in a separate SEC filing.

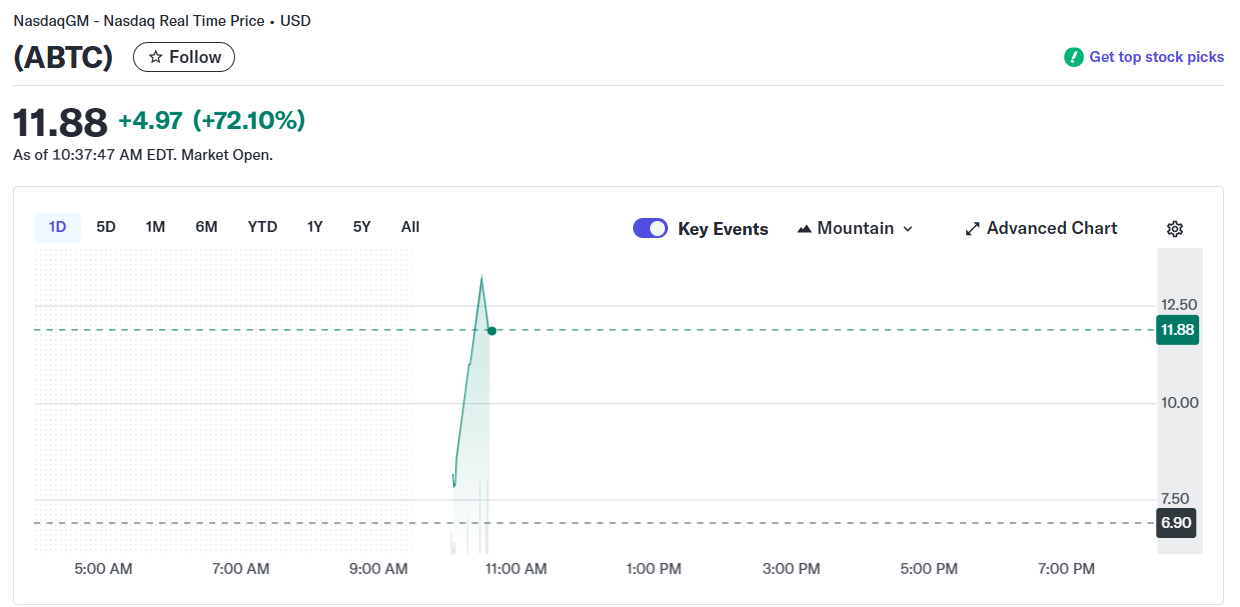

Stock performance on Nasdaq proved to be a strong show‑stopper, with the ABTC shares surging roughly 72 % in the first few minutes of trading. Yahoo Finance confirmed the impressive rise.

Co‑founder Eric Trump highlighted the listing as a milestone for Bitcoin integration into mainstream U.S. markets. The former governor introduced Bitcoin as “the defining asset class of our time.”

“Our Nasdaq debut marks a historic milestone in bringing Bitcoin into the core of U.S. capital markets and advancing our mission to make America the undisputed leader of the global Bitcoin economy,” Trump reiterated.

Donald Trump Jr., a key investor in American Bitcoin, commented on the debut’s broader significance. He emphasized how the company reflects “values of freedom, transparency and independence,” claiming that the listing would elevate these principles on the world stage and benefit the U.S. financial system.

“American Bitcoin embodies the values that define American strength: freedom, transparency, and independence,” Trump Jr. affirmed. “With our Nasdaq listing, we are elevating this mission onto the global stage, giving investors a vehicle we believe will strengthen the US financial system and help build a more resilient national economy.”

American Bitcoin pursues a dual accumulation approach, combining self‑mining operations with opportunistic market purchases. Through its collaboration with Hut 8, the company enjoys access to advanced ASIC technology and the miner’s colocation infrastructure at several high‑performance data centers.

Pictured: Executive Chairman Asher Genoot, CEO of Hut 8, explained how the market debut positions the firm to scale Bitcoin accumulation. Genoot underscored the team’s advantage of simultaneous mining, on‑hand purchases, and Hut 8’s mining platform, all orchestrated to accelerate Bitcoin‑per‑share growth.

Share this article

Curious about how Bitcoin trends influence U.S. markets? Dive into our latest crypto news for deeper insights.