The US Inflation Effect on 2025: A Tokenization Analysis

Right here is the rewritten content material preserving the HTML tags as is:

- Bitcoin worth has confronted downward stress, dropping 6% in February resulting from U.S. tariff wars and inflation considerations.

- Gold costs have climbed 6% over the identical interval, as traders hedge in opposition to financial uncertainty.

- The RWA sector, together with tokenized gold and actual property, has surged 6.6%, reflecting a shift in investor sentiment.

Bitcoin worth consolidated at $97,000 on Feb 15, down 6% inside the month-to-month time-frame, reeling below bearish headwinds from US tariff wars and rising inflation. Conversely, Gold (XAU) has elevated 6% over the identical time-frame. As traders flock towards safe-haven property amid an unsure macroeconomic panorama, a real-world-asset tokenization professional provides important market insights.

Bitcoin (BTC) worth tumbles, Gold (XAU) advances amid testy US macroeconomic panorama

Bitcoin worth has confronted intense bearish headwinds in February 2025, with three main elements triggering downward volatility. The blowback from a US tech inventory sell-off after DeepSeek disrupted OpenAI’s market place in late January set the tempo for a adverse begin to the month.

Former President Donald Trump exacerbated the BTC worth dip when he introduced sweeping tariffs on Canada, Mexico, and China. Whereas the tariffs on Canada and Mexico had been rapidly rolled again, these imposed on China went forward, including stress to monetary markets. Additional draw back was triggered by a hotter-than-expected US Consumer Price Index (CPI) report this week, fueling considerations about extended inflationary pressures.

Bitcoin (BTC) Worth Motion vs Gold (XAU) | Supply: TradingView

As traders reassess danger publicity in an more and more unstable macroeconomic atmosphere, the enchantment of safe-haven property like gold has strengthened. Gold costs climbed to $2,882.43 per ounce, up 6% over the previous 15 days. In the meantime, Bitcoin stays range-bound, consolidating at $97,000 and down 6% over the identical interval.

Tokenized Belongings in demand as unstable Bitcoin costs spark RWA Increase

Past Bitcoin’s worth motion, key market metrics counsel that the unsure macroeconomic panorama is reshaping investor conduct.

Whereas Bitcoin costs have dropped 6% in February, the Actual World Asset (RWA) sector inside crypto markets has skilled notable capital inflows.

As an alternative of shifting funds off-chain after de-risking from BTC, traders now look like reallocating capital into tokenized RWAs, together with gold, actual property, and fixed-income securities.

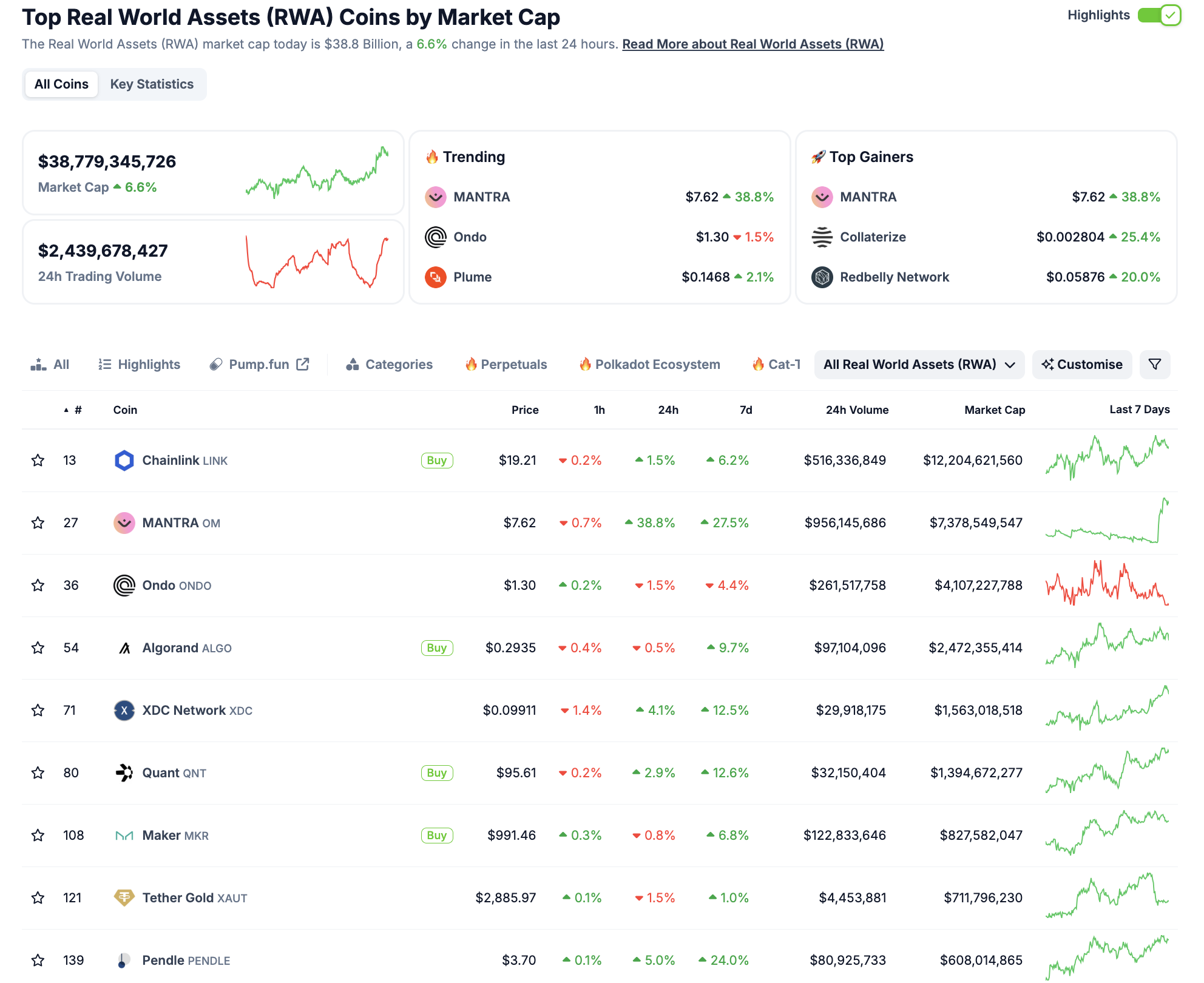

Based on CoinGecko information, the RWA market capitalization has surged 6.6% as of Feb 18, reaching $38.8 billion—a rise of over $2.5 billion inside the final 24 hours. Throughout the identical timeframe, Bitcoin remained trapped inside the slender $97,000–$98,000 vary.

Chainlink (LINK), Mantra (OM), and XDC Community (XDC) have emerged as key front-runners within the RWA increase.

With Mantra main the way in which with 27.5% positive aspects over the previous 24 hours, all prime 10 RWA protocol property posted positive aspects this week, apart from Ondo Finance, which noticed a gentle 4.4% retracement. This displays rising investor demand for tokenized safe-haven property as BTC worth stagnates below bearish stress from hawkish macroeconomic expectations.

Amid rising curiosity in tokenized gold and surging capital inflows towards RWA protocols, hypothesis is rising that tokenized commodities may turn into a extra dominant asset class ought to inflationary pressures persist.

Will RWA sector progress set off demand for Tokenized Gold ?

With Bitcoin below stress from macroeconomic headwinds, together with inflation considerations and geopolitical tensions, gold and tokenized RWAs are more and more seen as viable options. If inflation stays elevated, Bitcoin could proceed to wrestle, whereas tokenized commodities and gold-backed property may see continued inflows in 2025.

In a current unique interview with FXStreet, Kevin Rusher, founding father of real-world asset platform RAAC, provided professional insights into this narrative.

- Q1: Bitcoin has dropped over 6% this month, whereas Gold has risen 6%. Do you suppose this indicators a shift in investor sentiment from crypto to conventional safe-haven property?

Kevin Rusher: “As we all know, Bitcoin was designed to be the final word inflation hedge. Nonetheless, due to its widespread adoption by establishments like BlackRock and JP Morgan, it tends to maneuver with the market. Nonetheless, once we see a very severe crash just like the banking disaster of March 2023, we do see completely different exercise. So, no, I do not suppose there’s a distinction between Bitcoin and gold, however I do suppose that traders are searching for security.”

- Q2: How does tokenized gold evaluate to bodily gold and Bitcoin as an inflation hedge?

Kevin Rusher: “The great thing about gold is that it will likely be an inflation hedge regardless of the way you maintain it. All through historical past, folks have held gold to protect their wealth and that can by no means change. For those who maintain gold in an ETF, that is a particularly secure technique to do it, and your funding will rise with the worth of the asset minus the charges of the fund. With tokenized gold, you’ll profit from the appreciation of the asset in addition to – relying on the platform – doubtlessly a yield, and several other different alternatives to make use of that funding all through the decentralized finance ecosystem.”

- Q3: What benefits does tokenized gold supply over conventional gold ETFs or futures contracts?

Kevin Rusher: “You’ll be able to’t beat an ETF for security on the subject of holding gold, and futures will all the time be the popular instrument of merchants seeking to revenue from very short-term strikes up and down. Tokenization provides you the choice to earn a yield in your holding or use it to borrow and lend inside the decentralized finance ecosystem.”

- This autumn: Past gold, what different real-world property are gaining traction in tokenized markets, and why?

Kevin Rusher: “Property is probably the unique base case for tokenized property. With fewer and fewer folks in a position to entry the steady and dependable returns that property can afford, tokenized property makes a whole lot of sense. That is particularly the case once we’re rental property within the public sector which is extraordinarily secure and has a assured yield. Historically, solely institutional or very excessive net-worth traders may entry these alternatives. Nonetheless, via the tokenization afforded in decentralized finance, anybody can now entry these steady and dependable property.”

- Q5: What regulatory hurdles does tokenized gold face in comparison with Bitcoin and different cryptocurrencies?

Kevin Rusher: “By nature of being a cryptocurrency, tokenized gold faces a lot the identical challenges as another cryptocurrency and each jurisdiction has completely different guidelines. Buyers should all the time test the legal guidelines of their native jurisdiction and be sure that they’re complying with them.”

- Q6: Are institutional traders exhibiting rising curiosity in tokenized gold over Bitcoin? If that’s the case, what’s driving this development?

Kevin Rusher: “We’re seeing monumental curiosity not simply from establishments however from gold miners themselves on the subject of tokenizing gold. There are such a lot of alternatives to capitalize on the world’s oldest and most dependable asset that there are few events not thinking about getting concerned in its tokenization. Relating to what’s driving this development? It is historical past. There may be nothing extra dependable than gold. I would not say it’s gold versus Bitcoin, although. I believe the 2 supply fairly various things. Though each are long-term shops of worth, with one it’s a must to settle for various volatility, whereas the opposite offers you a lot much less volatility and reliability.”

- Q7: How does RAAC make sure the safety and legitimacy of tokenized property like gold?

Kevin Rusher: “On the RAAC platform customers can maintain tokenized variations of gold, in addition to property and – sooner or later – different real-world property in a method that enables them to reap the benefits of the massive liquidity within the Curve ecosystem – the largest in decentralized finance. Because of this, they’ll use the tokens they get in return for his or her funding in a number of alternative ways – or just select to carry them on the platform to earn a yield. No funding is ever fail-safe, together with gold, however RAAC makes use of essentially the most respected and liquid platforms accessible in DeFi.”

- Q8: In the long term, do you see tokenized gold coexisting with Bitcoin, or may it doubtlessly substitute BTC as a retailer of worth?

Kevin Rusher: “I believe tokenized gold and Bitcoin will all the time coexist as they do very various things. Though Bitcoin is sometimes called digital gold, it’s extremely unstable and you actually should have a really long-term mindset for it. Gold, however, is far more steady, and so – for those who solely need to save within the quick time period – you are a lot much less prone to see the wild ups and downs with gold that you will notice with Bitcoin. Each, nonetheless, are nice long-term choices to retailer worth. As such, they’ll each be round for a really, very very long time.”

In abstract:

Bitcoin’s current worth struggles amid inflationary pressures and geopolitical turbulence underscore the evolving dynamics of safe-haven property. Whereas BTC’s 6% decline in February displays investor unease, gold’s corresponding 6% rally highlights its enduring position as a hedge in opposition to macroeconomic uncertainty. The surge in tokenized real-world property, significantly gold, means that traders are more and more diversifying into blockchain-powered options with out absolutely sidestepping conventional shops of worth.

Institutional curiosity in tokenized gold is rising, pushed by its stability, accessibility, and integration inside decentralized finance. Nonetheless, Bitcoin stays a long-term contender, providing a unique worth proposition regardless of its volatility. As inflationary considerations persist, the competitors between Bitcoin and tokenized commodities will probably intensify. Moderately than a binary alternative, market specialists trace at a future the place each asset courses coexist, catering to distinct investor preferences.