USDT on Lightning: Exploring the Benefits and Challenges

You know that saying, the one often (but wrongly) called a Chinese proverb? “May you live in interesting times.” Supposedly, it’s a curse. It sounds super profound, right? Like something an edgy grandpa might quote.

But seriously, have you ever thought about the opposite of “interesting times”? The Anglo-Saxon Chronicle mentions almost two whole centuries where, basically, nothing worth recording happened. Vivian Mercier famously described Waiting for Godot as “a play in which nothing happens, twice.” But imagine nothing happening for 191 years! Give me “interesting times” any day.

And guess what? That’s exactly what we’re living in right now. Tether, the folks behind the stablecoin USDT, is coming to Lightning! We’ve been talking a lot lately about how Lightning is becoming the universal language of the bitcoin economy, and how bitcoin really is a medium of exchange (seriously, check out our report if you doubt it).

Well, these two ideas? They seem to be clicking together now. Because Lightning makes everything speak the same language, bitcoin can easily work with all sorts of things, including USDT. And USDT joining the party? That’s going to seriously boost bitcoin into new uses, new markets, and challenges way bigger than anything the Lightning Network has seen before.

Personally, I’d always choose diving into the unknown over just chilling on the couch. All the exciting stuff is out there in the uncharted territory.

Given the choice, I’d rather dive head first into the unknown than spend the afternoon on the couch. All the cool stuff is in the unknown.

USDT on Lightning? It’s totally new ground. Definitely “interesting times.” So, let’s break down what it actually means for USDT to jump onto Lightning, and for Lightning to handle USDT—the good stuff, the potential problems, and the big questions we still have.

Lightning was first designed to make the bitcoin blockchain faster, so Bitcoin itself was supposed to be the only thing moving through it. But now, Taproot Assets is here, a new protocol that lets other assets (like stablecoins!) ride along on Lightning. It works by using hashed metadata, kind of piggybacking on the same system Bitcoin uses for payments.

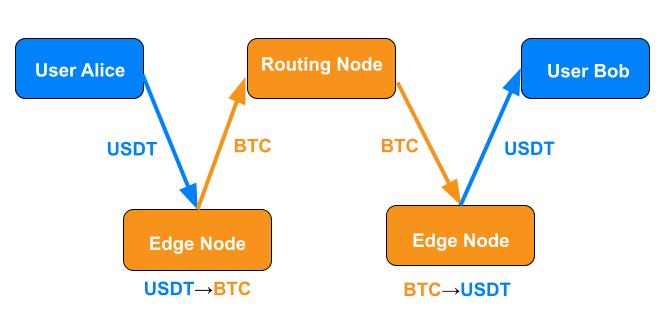

For anyone who gets how Lightning works, it’s pretty straightforward. The person getting paid makes an invoice that asks edge nodes (those nodes that connect regular users to the bigger network) for exchange rates between bitcoin and, in this case, USDT. Once the payer says “yes” to a rate from an edge node, they create a payment invoice and send it over. The person paying then sends the USDT to their edge node. That edge node does the conversion to bitcoin, makes it look like a regular Bitcoin payment, and it zips through the network’s routing nodes like normal. Finally, the edge node on the receiver’s side changes it back to USDT and hands it over. Done.

Taproot Assets takes advantage of Lightning and bitcoin’s flexibility. It means we can move new kinds of assets over the network, and bitcoin acts as the go-between, the universal currency in the middle. And here’s a cool bonus: because everything’s speaking “Lightning,” all those routing nodes in between? They only see Bitcoin moving around. Lightning tells them how to handle the BTC, and that’s all they need to know. Pretty awesome.

But there’s more to this than just the technical stuff. USDT is huge as a way to pay. Billions and billions of dollars worth of USDT changes hands daily in millions of transactions. Its daily trading amount is right up there with the Brazilian real and the Indian rupee! This is a really big deal. So, what does Lightning mean for USDT, and what does adding USDT mean for Lightning?

… for Bitcoin

Up until now, making bitcoin a part of everyday commerce has mostly been about getting as many people “orange pilled” as possible, growing the circular economy user by user. But maybe this approach is reaching its limits. The bitcoin circle has grown massively in the last decade or so, but it’s still got its boundaries, and we need to be thinking about reaching millions of people, all at once.

Now, with USDT and BTC working together natively on Lightning, things are getting more connected. When paying with Lightning, the person paying and person receiving can each choose to use BTC or USDT on their end—it doesn’t matter what the other person chooses. A customer can pay in BTC, and the business can get USDT. Or the other way around. Or both can use the same thing. It just works. Once both are on Lightning, they automatically become easily interchangeable. Everyone gets to pick: either bitcoin, with its user-driven, grassroots appeal, or USDT, with its price stability tied to the US dollar and Tether’s reserves.

Lightning, and bitcoin along with it, could gain millions of new users and billions in spending power. It’s a step up in what bitcoin can do. These new uses will be way more effective for bitcoin than just trying to “orange pill” everyone. And it could be a huge boost for Lightning too. Many of these new users might not even realize they’re using Lightning, it’s just so smooth and easy as the common language of the bitcoin economy. But those of us who’ve been around Lightning for a while? We get it. This is what we’ve been aiming for.

And since we just mentioned making USDT easier for Americans to access, USDT will also make it easier for them to use Lightning in general. US tax rules treat BTC like a stock, so every time you pay with it, it could be a tax event. But if US users can use Lightning with an asset that doesn’t trigger capital gains, they can enjoy all the benefits of Lightning without that tax headache.

…for Tether

Tether typically issues USDT on blockchains that are already popular and reliable. They’ve said they have no plans to launch their own blockchain. Right now, USDT is available on Algorand, Celo, Cosmos, Ethereum, EOS, Liquid Network, Solana, Tezos, Ton, and Tron. Notice how most of these are proof-of-stake (PoS) blockchains (except Liquid, which is federated). This means they’re all more centralized than bitcoin.

These blockchains have different pros and cons too. Ethereum is pretty decentralized for a PoS blockchain, but its transaction fees can be really high. Tron is cheaper, though. Maybe that’s why, according to some data, almost 7 times more regular USDT users choose Tron over Ethereum every month, and they send 8 times more money using Tron. But, Tron is known to be very centralized, which can be a weak point for USDT. If Tron had problems, Tether could lose around half of its total capacity across all blockchains. Ouch again. By allowing USDT to work over Lightning, which is naturally decentralized, Tether can reduce their reliance on those cheaper, but centralized, blockchains.

Also, Lightning could make USDT way more convenient to use in the US. US exchanges sometimes limit USDT transactions to specific blockchains. For instance, Coinbase says “Coinbase only supports USDT on the Ethereum blockchain (ERC-20). Don’t send USDT on any other blockchain to Coinbase.” Lightning gives big exchanges like Binance, Coinbase, and Kraken (which already support Lightning) a decentralized option for USDT payments they can offer to their customers.

The new US government has talked about bringing the stablecoin industry back home and regulating it, calling it their “first priority.” Basically, they’re going to be watching everything closely. As long as stablecoins like USDT are linked to the dollar, the ones who control and benefit from the dollar are going to want to control stablecoins too.

Regulators think they can improve even on freedom by regulating it. They can’t help themselves, it’s in their nature. But this also means that as USDT becomes more useful on Lightning, and Lightning becomes a better way to move USDT, we’re all going to get more attention from regulators. It’s hard to say exactly what they’ll do or how much they can do, but it’s probably not going to be fun. Regulation is always a drag.

One thing that’s likely to get regulatory attention is the edge nodes. Regular centralized exchanges are often subject to KYC/AML rules in many places. If these edge nodes are automatically swapping USDT and BTC and sending payments, they might look a lot like regular exchanges to regulators, who generally aren’t fans of decentralization. 🙄

What’s It Cost? What’s It Worth?

While Lightning definitely gives users and USDT some big advantages, it might not be the absolute best way for every single USDT payment. Lightning users are used to low fees. USDT users on centralized blockchains and exchanges are too. But adding another asset to Lightning changes the financial picture a bit, and everyone—routing nodes, users, especially edge nodes—will need to take that into account.

First off, edge nodes are doing the usual LSP stuff—keeping users connected, making sure there are enough channels and liquidity for payments to flow—plus they’re now doing asset conversions too. That conversion service is valuable and deserves to be paid for, and it also comes with risks (more on that below).

Second, USDT will probably increase the amount of transactions on Lightning quite a bit. This means LSPs and routing nodes will need to keep more funds available on the network to handle all those payments. They can’t use the same shortcuts as custodial exchanges, where they just update numbers in their internal records. The economics of managing liquidity still apply, but even more so now.

Will Lightning be able to compete with centralized blockchains like Tron for USDT payments? The answer is probably the same as for most questions about matching tech to uses: each option has its own strengths and weaknesses, making it better for certain situations than others. As usual, the market will sort it out. However, since this tech wasn’t specifically designed for this particular use, figuring out the right prices will be a process of trial and error, which takes time.

Free Call Options? Uh oh.

Edge nodes now face the risk of the “free-call-option problem.” It’s interesting enough to deserve its own discussion. This risk is new, and it comes up whenever you have two assets involved in a single Lightning payment.

Lightning payments have to be completed within a certain time to actually settle, or the invoice just expires automatically. That time limit is what the “T” stands for in HTLCs—hashed, time-locked contracts.

When edge nodes offer their exchange rates for a USDT↔BTC payment, they calculate their offers based on things like how much liquidity they have at the moment and the current market price. But users have a window of time—between accepting the edge node’s offer and the HTLC expiring—to finalize the payment. Prices can change in that time. If I start a USDT payment at one rate, I can wait and see if the rate gets better for me before I release the secret code (preimage) to settle it. If the rate moves against me, I can just not release the preimage. In that case, the edge node might have to close a channel to get their funds back, which is slow (and expensive). But if the rate moves in my favor, the edge node is stuck with the original, less favorable rate. Basically, if things go badly, I lose nothing. If things go well, I profit at the edge node’s expense.

Any payment on Lightning that involves different assets gives the user a call option. Regular financial companies deal with this risk when they sell call options by just including the risk in the price they charge. These options can get very expensive for edge nodes that aren’t prepared. Just ask Kilian and Michael at Boltz, who first brought this whole issue up and were kind enough to explain it for everyone in the community. The alternative is for edge nodes to factor the cost of this call option into their rates, just like those financial institutions do. Playing with time-sensitive price differences? That’s a good business if you can manage it.

And it’s not just users that edge nodes need to worry about. If a routing node messes up and doesn’t forward the preimage—whether on purpose or by accident—the edge node could still be on the hook. At least with routing nodes, maybe there could be some kind of reputation system to help choose reliable routes. But a reputation system for regular users might not work, since there will always be new users joining.

This free call option issue hasn’t been a problem for Lightning before now because the network has only dealt with one asset: bitcoin. If this free-option problem gets serious enough, we could see different Lightning Networks pop up—each for a single currency. One for bitcoin, one for USDT, maybe one for something else… If bitcoin gets left out of the mix, we lose the benefit of bitcoin and everything working together. We might even regret bringing USDT onto Lightning in the first place.

Bitcoin was always meant to shake things up. Disrupting the broken fiat system is the whole point, always has been. We’re here for the revolution. And we know that big changes and disruption are never going to be totally smooth.

But change is good, right? Progress is just a kind of change that people welcome. We welcome USDT on Lightning because we see the potential. It can mean progress for USDT users, for Lightning, and for bitcoin itself.

Like any change though, it’s going to take careful thinking, planning, sharp instincts, and fast reactions. You don’t go into uncharted territory without the right gear and skills. Anyone in the Lightning liquidity game is going to face some new challenges, but also has the chance to make some serious gains.

Tether could get a cheaper, decentralized way to distribute USDT and better access to the important US market. Lightning could get a huge boost of funds and users. Bitcoin will be able to work seamlessly with USDT. That’s why everyone’s excited.

But regulators are watching. And edge nodes will only offer those crucial conversion services if it’s profitable, not a losing game. So let’s approach this change the way we approach all new things in Lightning: by thinking hard, planning carefully, making our code strong, getting the market ready, and never forgetting our main goal—making the universal bitcoin economy a reality.