Whale Dump: 10,000 ETH Sell-off – Ethereum’s Exit?

Reason to trust

We adhere to a strict editorial policy, ensuring everything we publish is accurate, relevant, and unbiased.

Our content is created by experts in the field and undergoes thorough reviews to ensure top-notch quality.

We are committed to maintaining the highest standards when it comes to reporting and publishing news.

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

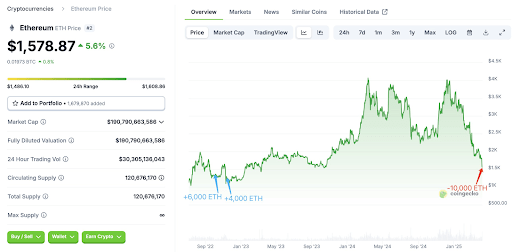

It looks like an Ethereum whale has decided to sell off their ETH stash after holding onto it for over two years—even through the recent bull market. This move to cash out after such a long hold could signal that it might be a smart time for others to consider selling their Ethereum too, especially with the possibility of prices dropping further in the weeks ahead.

Ethereum Whale Dumps 10,000 ETH After 900 Days

According to a recent post on X from on-chain analytics platform Lookonchain, an experienced Ethereum whale has finally thrown in the towel after holding for more than 900 days. They sold their entire 10,000 ETH, netting $15.71 million. This same whale had originally invested $12.95 million to purchase 10,000 ETH back in October and November of 2022, at an average price of $1,295 per coin.

Related Reading

Interestingly, this Ethereum whale didn’t budge and sell any of their ETH even when the price of Ethereum climbed past $4,000 not once, but twice in 2024. However, with the Ethereum price now dipping below $1,500, getting closer to their initial purchase price of $1,295, they decided to sell. In the end, they walked away with a $2.75 million profit, even though their profit was once as high as $27.6 million at the peak of the market.

This particular Ethereum whale isn’t alone in their decision to sell. As Bitcoinist previously reported, we’ve seen a wave of ETH whales dumping over 500,000 ETH in just 48 hours. This recent trend is largely due to the significant drop in Ethereum’s price, putting it at risk of even further declines. This broader downturn is part of a larger crypto market crash, which seems to be triggered by Donald Trump’s newly imposed tariffs.

Trump’s tariffs have escalated trade tensions with China, who have indicated they won’t back down, causing unease among investors. Because of this uncertainty, the price of Ethereum looks more likely to continue falling for now. This situation could explain why these major Ethereum holders are deciding to sell, aiming to minimize their potential losses.

Donald Trump’s World Liberty Financial Also Capitulating?

It appears that Donald Trump’s World Liberty Financial (WLFI), another significant Ethereum whale, might also be feeling the pressure and could be starting to offload their holdings. According to data from Arkham Intelligence shared by Lookonchain, a wallet possibly associated with WLFI sold 5,471 ETH for $8.01 million at a price of $1,465 each. This sale suggests a loss for this particular whale.

Related Reading

World Liberty Financial had previously invested heavily in Ethereum, purchasing 67,498 ETH for a whopping $210 million, averaging $3,259 per ETH. With the Ethereum price having plunged by over 50% since their purchase, the crypto firm is currently facing a substantial unrealized loss of $125 million.

Crypto analyst Ali Martinez is predicting further price drops for Ethereum in the near future. This forecast suggests that Ethereum whales like WLFI might see even greater unrealized losses on their ETH investments. Martinez has indicated that the $1,200 price range could be a potential bottom for Ethereum to stabilize.

As of writing this, the price of Ethereum is hovering around $1,400, marking a decrease of over 8% in the last 24 hours, based on data from CoinMarketCap.

Featured image from Unsplash, chart from Tradingview.com