XRP Premium Fuels Resilience, Holding $0.50

Market data reveals a surprising trend: XRP is demonstrating greater resilience than its past performance would suggest, even amidst the current choppy market conditions.

It’s worth noting that XRP, like many cryptocurrencies, is facing significant bearish pressure due to the wider market turmoil. Since February 2025, the crypto market has been navigating a rough patch, triggered by a bearish trend that has wiped out over $550 billion in market value.

XRP has also seen a significant drop, falling from a high of $3.4 in mid-January 2025 to the lower $2 range. However, even with this dip, analysts are pointing out that XRP has actually shown more strength than anticipated. To illustrate, while the overall crypto market cap has decreased by 17% so far this year, XRP has bucked the trend and is up by 2.72% in the same period.

XRP’s Curious Correlation with the RTY

Adding to this, market commentator Blockchain Backer recently highlighted the remarkable nature of this resilience. He suggested that XRP might be trading an astonishing 300% above where its price would typically be, based on past patterns. The analyst even described this unusual strength as “bizarre.”

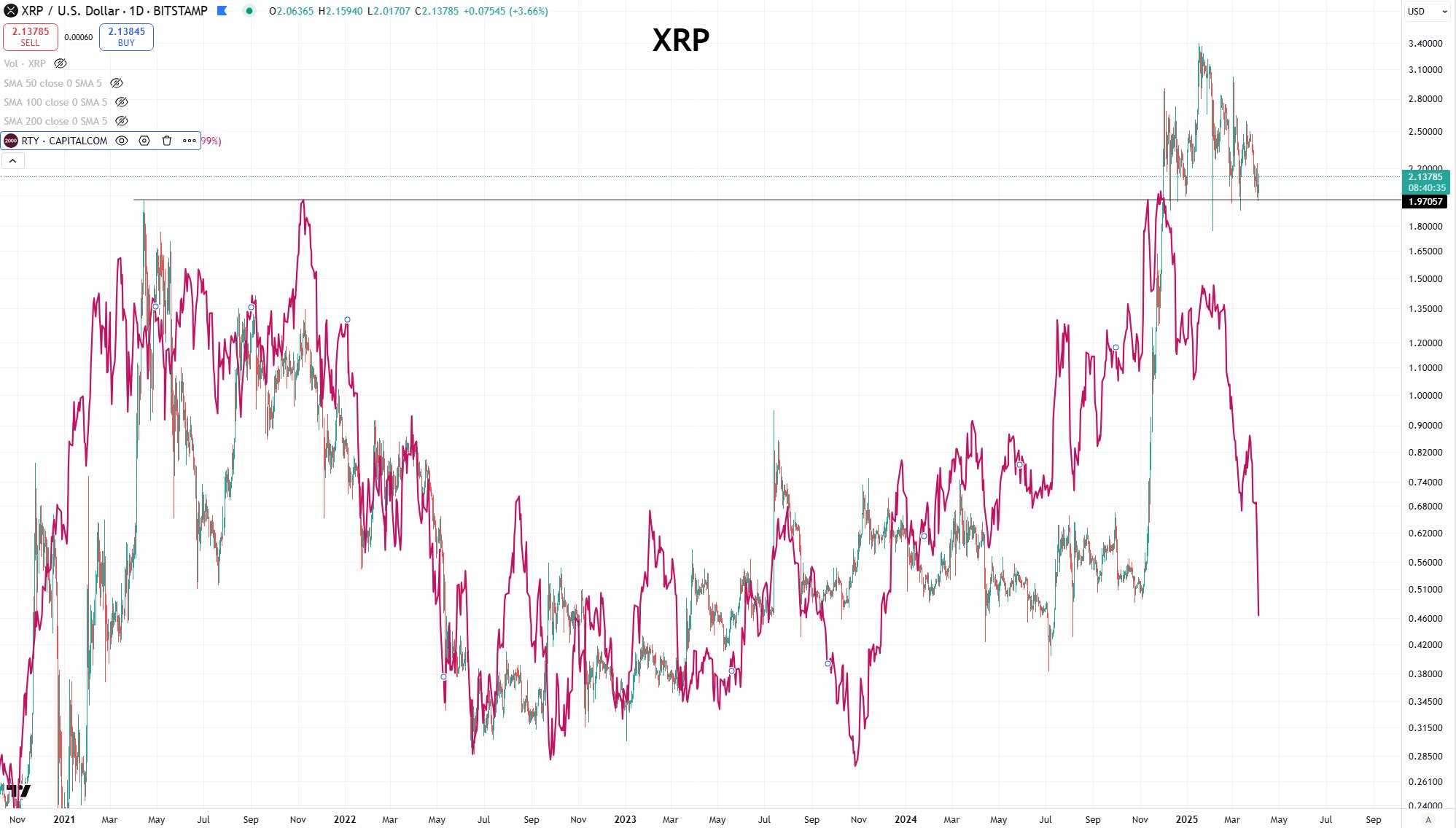

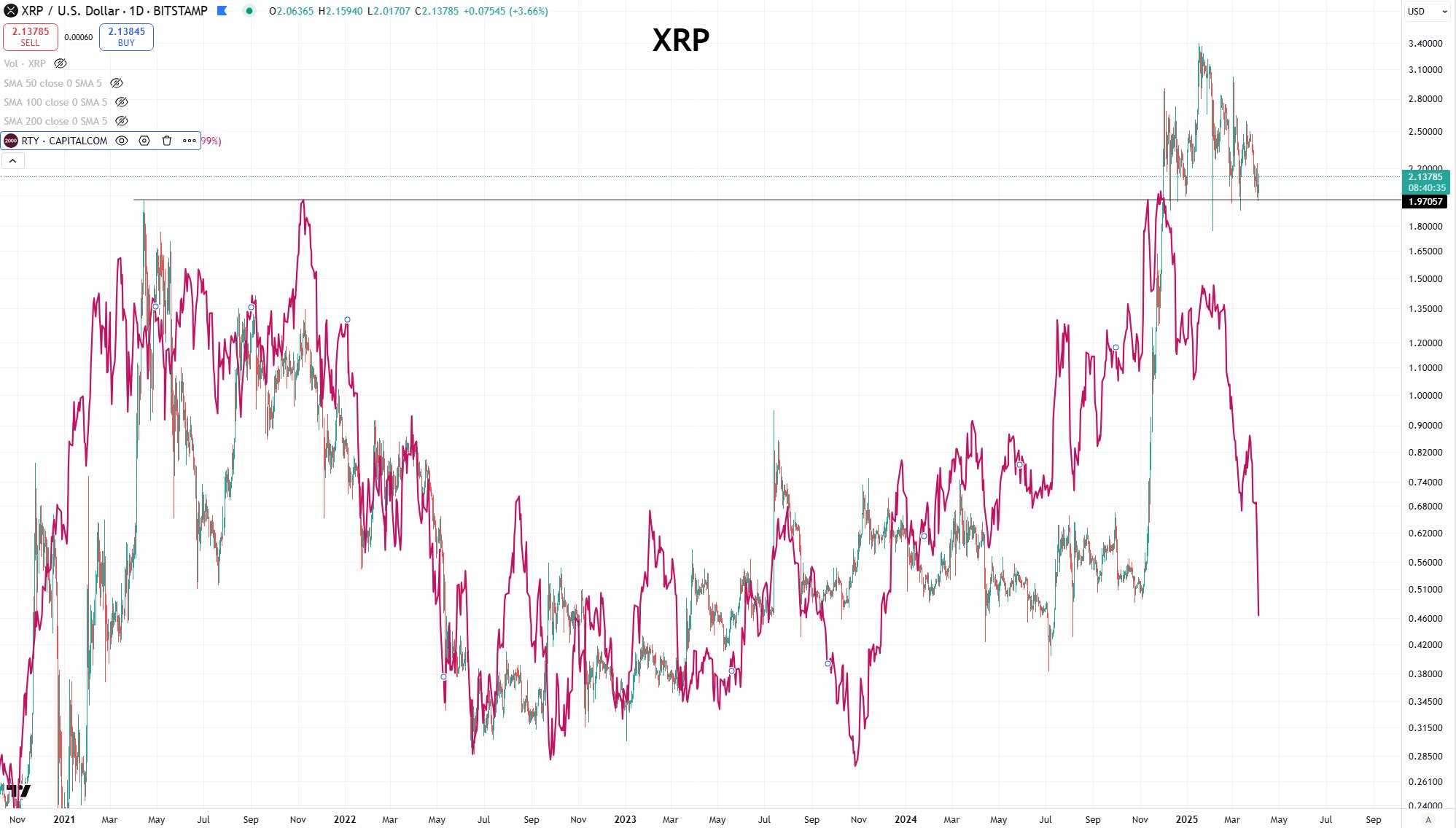

Blockchain Backer drew attention to this by comparing XRP’s historical performance to the U.S. Russell 2000 Index (RTY). For those unfamiliar, the RTY is a U.S. stock market index that tracks the performance of approximately 2,000 smaller companies by market capitalization.

According to his analysis, XRP and the Russell 2000 Index have historically moved in tandem with surprising accuracy, whether the broader market experienced gains or losses.

For example, during the COVID-19 pandemic’s initial phase, the RTY saw a brief upward trend from late 2019 to early 2020. However, after hitting resistance at a peak of $1,712 in January 2020, the index experienced a downturn that lasted until the end of the first quarter of 2020. Intriguingly, XRP mirrored this price movement, climbing to $0.34 by February 2020 before also falling.

This pattern repeated itself during the 2022 crypto bear market. As the RTY rebounded from the Q1 2020 crash, it surged from May 2020, peaking at $2,368 in March 2021, before eventually declining in early 2022. Similarly, XRP also experienced a surge, reaching a high of $1.96 in April 2021 before plummeting to $0.28 in 2022.

XRP’s Resilience Stands Out Now

Moreover, during the broad market recovery in late 2024, both XRP and the RTY saw significant rallies. However, now that bearish pressures have returned, a divergence has emerged. While the RTY has fallen by nearly 19% this year, XRP has demonstrated resilience, remaining up by 2.72% in the same period, even after a 29% drop in February.

Blockchain Backer points out that, for the first time, XRP has not mirrored the RTY’s decline during a market downturn. He suggests that if XRP were following its historical pattern, its price should currently be around $0.50. Given that XRP is currently trading at $2.13, this indicates that it’s trading at a 300% premium compared to its expected price based on this historical correlation.

John Bollinger, the creator of Bollinger Bands, also noted XRP’s resilience last month. However, with the market downturn still in play, it remains uncertain whether XRP will continue to deviate from this historical trend in the future. Meanwhile, analysts like Astekz are already anticipating further price drops if XRP falls below the $2 level.

Disclaimer: Please be advised that this content is for informational purposes only and should not be taken as financial advice. The opinions expressed here may be those of the author and not necessarily reflect the views of The Crypto Basic. We encourage readers to conduct their own thorough research before making any investment choices. The Crypto Basic cannot be held liable for any financial losses incurred.